Active Trading Strategies: Start Online Trading in the Crypto Market

Success in active trading hinges on the ability to quickly recognize and respond to volatile crypto market trends and fluctuations. To actively trade, you’ll use professional software like CScalp, as well as technical analysis, which involves examining chart patterns and employing indicators. Depending on your style, you might engage in day trading, scalping, or swing trading. Let’s delve deeper into the world of active trading strategies.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Active Trading Fundamentals

Active trading involves taking advantage of the volatile nature of the market to secure profits and manage risk.

Understanding Active Trading in Crypto Markets

Active trading in cryptocurrencies is, by definition, an approach to gaining returns through buying and selling digital assets, such as Bitcoin, Ethereum, and other altcoins, over short periods. Your strategy should be based on exploiting short-term fluctuations in the market, to turn a profit from these movements, rather than hold the assets long-term.

Comparison with Passive Investing

Active Trading:

- Objective: Achieve substantial gains through frequent trades.

- Approach: Vigilant market monitoring and quick response to price changes.

- Timeframe: Seconds to days; positions are not typically held long-term.

Passive Investing:

- Objective: Steady growth aligned with market trends over an extended period.

- Approach: Investors buy and hold strategy, minimal trading activities.

- Timeframe: Months to years; the focus is on the intrinsic value of assets.

While passive investing requires less active management and generally involves fewer transactions, active trading demands a more hands-on approach, as you aim for potentially higher short-term gains from the highly volatile cryptocurrency market.

Learn more: How to Become an Active Trader: Become a Day Trader and Reach Market Success

Essential Tools to Actively Trade Cryptocurrencies

These are some of the most important active trading tools:

- A 64-bit PC: Essential for efficiently running complex trading and analysis software (not all the programs will work on a 32-bit PC or Mac).

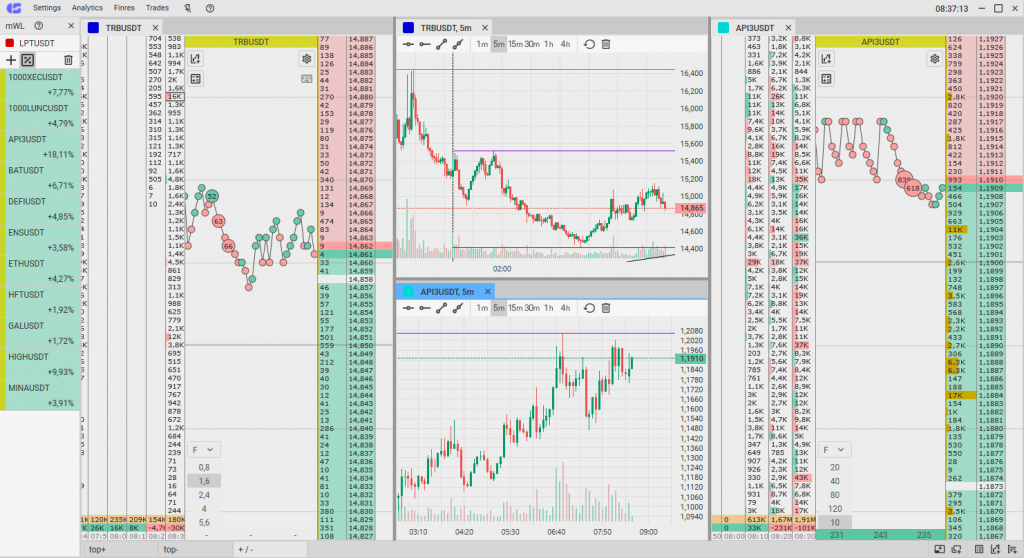

- Trading terminal like CScalp: This free professional platform by a fintech company offers direct access to markets with advanced tools – including charting – for active traders.

- Second monitor: Increases efficiency by allowing simultaneous monitoring of multiple charts, order books, and analysis tools.

- Real-time market data: Critical for staying updated with the fast-moving cryptocurrency markets.

- Free Crypto Screener by CScalp: A valuable tool for identifying trading opportunities in the crypto market.

Skills Active Traders Must Have

To be successful in active trading, you should develop a specific set of skills:

- Technical Analysis: Interpreting charts and identifying patterns to predict future price movements, as well as entry and exit points for trades.

- Risk Management: Establishing Stop-Loss orders and risking a small percentage of your deposit on single trades.

- Knowledge of Market Trends: Staying updated with the latest cryptocurrency and finance news can give you insights into market sentiment and potential price shifts.

- Discipline: Have a trading plan and stick to it, even when emotions are high, to avoid impulsive decisions that could lead to losses.

Understanding the tools at your disposal, such as technical indicators and trading platforms, is also vital. By utilizing these skills and tools, you can navigate the cryptocurrency market’s complexities and work towards achieving short-term profits while managing your risk exposure.

Key Active Trading Strategies

Active trading in the cryptocurrency market involves various strategies to exploit short-term price movements. Remember that you can use CScalp free professional day trading software to implement any of these strategies and enhance your experience in the crypto market.

Scalping

Scalp trading is a strategy designed to profit from small price changes, with traders making numerous trades in a day or trading session. The focus here is on incremental gains, often using derivatives. Liquidity and volatility of the cryptocurrency are crucial factors for scalpers.

Day Trading

Day trading is an active trading strategy where you buy and sell cryptocurrencies within the same trading day. A day trader does not hold positions overnight, aiming to profit from short-term price movements. You’ll rely on technical analysis to identify quick entry and exit points. Fast decision-making as well as constant statistics and market monitoring with the latest technology are essential in this strategy.

Swing Trading

Swing trading involves holding positions for several days or weeks to profit from expected ‘swings’ in market prices. Unlike day trading, you’re not looking to make a return in a single day, but rather to catch a potential trend. Swing traders must understand market sentiment and be able to perform both technical and fundamental analysis to forecast price movements effectively.

Position Trading

Position trading is a long-term strategy compared to the others. Here, you take a position in a cryptocurrency that you expect to appreciate over time. Your decisions might be based on long-term trend following and fundamental analysis, and you’ll likely look past short-term market fluctuations. Proactive risk management, including setting Stop-Loss orders and diversifying your portfolio (for example, trading stocks, CFDs, commodities, etc.), is important to protect from volatile swings.

CScalp supports these strategies by offering a free terminal with no account minimums or usage fees. The platform’s innovative approach, catering to both novice and experienced traders, makes it a valuable tool in the high-risk, high-reward world of cryptocurrency active trading.

CScalp Professional Trading Software

Even more importantly, CScalp fosters a collaborative trading environment, featuring a Trading Diary and a Discord community, where traders can share insights, learn from experiences, and engage in real-time discussions. Community support is a significant advantage, especially for those new to trading.

If you’re interested in joining an active community of traders, exploring new strategies, finding free trading signals, and enhancing your trading skills, consider joining CScalp’s Discord server. It’s a space where knowledge meets experience, and traders of all levels can benefit from shared wisdom and support.

Analytical Tools and Indicators

Active trading in the cryptocurrency market relies on understanding and utilizing various analytical tools and indicators to make informed decisions.

Technical Analysis Basics

Technical analysis in cryptocurrency trading involves the study of past market data, primarily price and trading volume, to forecast future price movements. The core assumption is that all known information is already reflected in the price and that prices move in trends. You’ll find that charts are a fundamental tool in technical analysis, as they provide a visual representation of price action over time, helping you identify trends, patterns, and potential levels of support and resistance.

Japanese Candlestick Chart Patterns and Indicators

Within technical analysis, chart patterns and indicators are crucial for anticipating possible price movements. For cryptocurrencies, certain patterns are of particular interest:

- Trend lines: Straight lines drawn on charts to highlight the prevailing market direction.

- Triangles: These can be symmetric, ascending, or descending, and often lead to a breakout.

- Head and Shoulders: Suggests a reversal of a current trend.

- Cup and Handle: Indicates bullish continuation.

Indicators such as moving averages (simple and exponential), Bollinger Bands, Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) are also applied. These technical indicators help you grasp underlying trends, momentum, and volatility in the cryptocurrency markets.

Volume and Price Movements

Volume plays a pivotal role in confirming trends and chart patterns in cryptocurrencies. A price movement accompanied by high volume is generally seen as a stronger, more relevant movement than one with low volume. For instance, a breakout above a resistance level on heavy volume is more credible than one with scant volume because it suggests a more substantial shift in market sentiment.

- Bullish signs: An increase in volume during an upward price trend.

- Bearish signs: An increase in volume during a downward price trend.

Analyzing price movements along with volume can give you a better understanding of where the market could be heading. Combined, these tools can help refine your trading strategy and increase your confidence when entering or exiting trades.

Risk and Money Management in Active Trading

In active cryptocurrency trading, effectively managing your risk and judiciously allocating capital are paramount to sustaining your trading career. Utilizing leverage can offer amplified results, but must be approached with caution to prevent significant losses.

Freepik

Managing Trading Risk

Your approach to risk management should be systematic; it is imperative to define your risk tolerance and stick to it. Utilize Stop-Loss orders to automatically exit positions at a predetermined price, thus minimizing potential losses. Similarly, limit orders can be employed to realize profits at your target levels, ensuring you don’t give back gains due to market volatility. Here’s how to integrate these tools for optimal profit and loss management:

- Stop-Loss Orders: Set these below key support levels to limit downside exposure.

- Limit Orders: Place these at calculated resistance points to capture profits.

Remember that CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

Capital Allocation

Allocating your capital carefully is crucial for long-term survival in the volatile crypto markets. Determine the percentage of your total capital that you can risk on a single trade — commonly, traders do not risk more than 1-2% of their capital on one position. Here is a simple breakdown of capital management:

- Total Capital: The sum of funds you have available for trading.

- Risk per Trade: Maintain it at 1-2% of your total capital.

- Diversification: Spread your capital across different assets (stock trading, crude, hedge funds, etc.) to mitigate risk.

Using Leverage Wisely

Leverage, when used wisely, can magnify your gains in cryptocurrency trading. However, leverage can also magnify losses, and the use of margin increases the risks substantially. Adhere to disciplined leverage use by:

- Start with lower leverage: We suggest you not surpass the x5 leverage while learning.

- Keeping a close eye on market movements: Remember that cryptocurrency prices can fluctuate rapidly.

Manage trading risk with trading discipline, allocate capital conservatively, and use low leverage with a well-informed strategy to navigate the cryptocurrency markets effectively.

Market Mechanics and Operations

Understanding the nuances of operations and market mechanics is vital. It will help you navigate the digital currency trading landscape.

Open an Active Trading Account

To begin active trading in cryptocurrencies, you need to open an account with a reliable online broker or trading platform that specializes in digital currencies. Look for online institutions that offer robust security measures, a straightforward interface, and real-time access to market data. It is also important to select a centralized or decentralised exchange that is compatible with the CScalp free trading terminal.

Before choosing, ensure it is reputable and, ideally, regulated by a financial authority. This online trading account will be your gateway to actively trade cryptocurrencies like Bitcoin, Ethereum, and other altcoins.

We suggest you try out these top cryptocurrency exchanges:

- Binance

- Bybit

- OKX

- HTX

Connect Your Preferred Exchange to CScalp

For an optimized trading experience, integrating CScalp with your preferred crypto trading exchange is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a professional trading platform, where efficiency and speed are paramount.

Learn how to connect CScalp to cryptocurrency exchanges.

Learn How to Place Orders and Start Trading

Learning how to execute limit and market orders through CScalp is crucial. Timing plays a key role due to rapid price movements driven by market conditions and market news. That is why, in the free professional terminal, it is possible to place an order with one click.

Learn how to make your first trade with CScalp.

Framework for Developing Active Trading Strategies

Developing a robust strategy is a cornerstone of success. It can significantly enhance your profit potential and trading decisions.

There are several notable examples where active trading strategies in the cryptocurrency market have led to significant profits. One such instance involves the reaction of Bitcoin’s price to news events.

For example, Bitcoin experienced a substantial price increase of around $9,000 within 24 hours following Elon Musk company Tesla’s announcement to invest 1.5 billion USD in Bitcoin on February 20, 2020. This dramatic surge, often referred to as the ‘Tesla Candle,’ is a prime example of how news and information can heavily influence the cryptocurrency market and create profitable trading opportunities.

It’s important to remember that cryptocurrency trading is highly volatile and risky, and while some strategies can lead to profits, they can also result in significant losses. Therefore, proper financial risk management and a well-thought-out trading plan are essential to succeed in this market.

Creating a Personalized Active Trading Plan

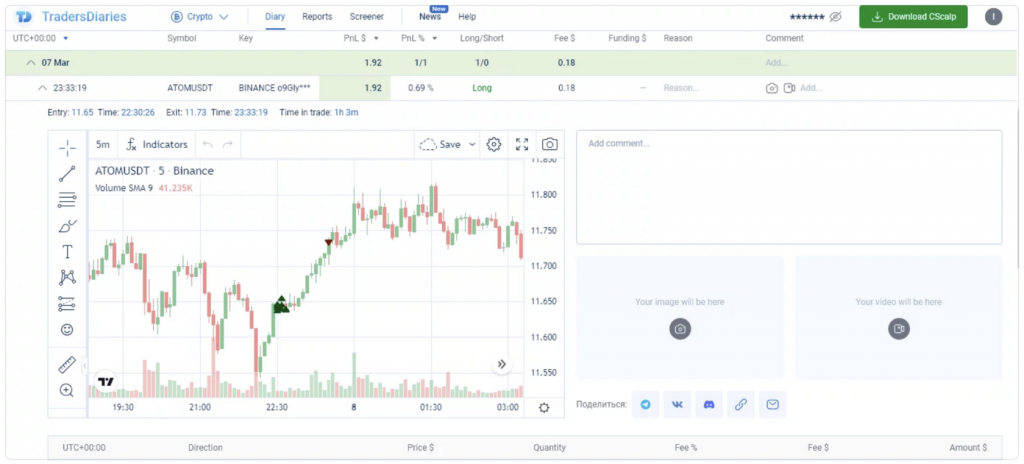

Your personalized trading plan is the bedrock of your trading activities. To start, determine your investment goals and risk tolerance. These aspects will dictate the aggressiveness of your strategies and the cryptocurrencies you choose to trade. Entry and exit points must be defined, leveraging technical analysis to identify the optimal timing. Remember, your plan should be unique to your situation and adjustable as your experience grows. We also recommend you keep track of your performance in the market by utilizing CScalp’s free Trading Diary.

Free Trading Diary by CScalp

FAQs: Frequently Asked Questions About Active Trading

In this section, you’ll find answers to the questions most relevant to active traders.

What Are the Most Effective Active Trading Strategies?

The most effective strategies for active trading in the cryptocurrency market involve scalping and day trading, where you capitalize on daily price movements, and swing trading, where you take advantage of multi-day price trends.

What Are Some Reputable Books to Learn About Active Trading?

To deepen your understanding of active trading in the cryptocurrency realm, consider reading “Scalping is Fun! 1-4: The Complete Series” book by Heikin Ashi Trader and “The Electronic Day Trader: Successful Strategies for On-line Trading” book by Marc Friedfertig, George West and George Piecznik.

Which Mobile Applications Are Recommended for Active Traders?

For active cryptocurrency trading, mobile versions of cryptocurrency exchanges like Binance, Bybit or OKX can be used. Professional traders use trading terminals like CScalp on their PC and use mobile apps of crypto exchanges as backup tools to close their positions.

How Does Active Trading Differ From Passive Investing Strategies?

Active trading in cryptocurrencies involves attempting to outperform the market through frequent trades and market timing, whereas passive investing involves holding cryptocurrencies long-term, regardless of short-term market fluctuations.

What Are the Potential Earnings from Active Trading?

Earnings from active trading in cryptocurrencies can vary widely based on market conditions, your skill in predicting market movements, and your risk management. There’s potential for high returns, but also a risk of significant losses.

What Does an Active Order Imply in the Context of Trading?

An active order in the context of cryptocurrency trading refers to a directive you’ve placed to buy or sell a cryptocurrency that has yet to be executed. These orders are contingent on the market reaching your specified price.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT