Bitcoin Fear and Greed Index: Unpacking Crypto Fears

The Fear and Greed Index is a popular analytical tool used to gauge the prevailing sentiment among investors. By considering emotions and data from various sources, it provides insight into the overall mood of the crypto market. CScalp explores the Bitcoin fear and greed index and its impact on trading strategy.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding the Crypto Fear and Greed Index

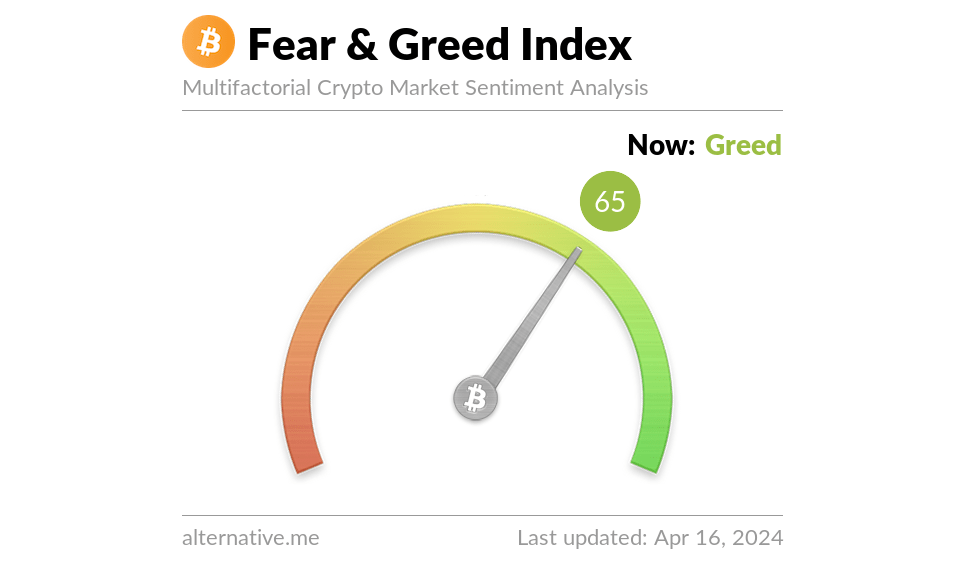

The underlying concept of the indicator is that emotions can drive the market. Extreme fear can signal that investors are too worried, potentially leading to a selling opportunity, whereas extreme greed could indicate that the market is due for a correction. The value operates on a scale from 0 to 100; lower values represent heavy fear, suggesting a bearish sentiment, while higher values indicate strong greed, pointing to a bullish sentiment.

To find the correct value on the scale, several types of data are combined:

- Volatility (25%): compared to the average values of the past 30 and 90 days.

- Market Momentum/Volume (25%): current volume and market momentum against the last 30 to 90-day average.

- Social Media (15%): analyzing the speed and volume of spread in crypto-related hashtags.

- Surveys (15%): periodic polls on investor sentiment.

- Dominance (10%): the supremacy of Bitcoin within the market, which might indicate shifts.

- Trends (10%): the number of searches on search engines, which can show the majority interest of the public in buying or selling crypto.

These data points are normalized and put into a formula that produces the index value reflecting the current market mood. This information assists you in understanding the prevailing emotions within the market, hence aiding in making informed investment decisions.

To take full advantage of Bitcoin trading and indicators, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

Factors Influencing the Indicators and Data Sources

Let’s take a closer look at the factors influencing the investor sentiment. Understanding these can help you gauge the current mood of the market.

Market Volatility

Volatility measures the frequency and magnitude of Bitcoin’s price movements. Sharper price fluctuations often lead to higher levels of fear, as they are associated with uncertainty.

- High volatility: May signal fear.

- Low volatility: Often correlates with greed or complacency.

Volume

Volume provides insight into the intensity of trading activity. Changes in volume can indicate shifts in investor sentiment.

- Increasing volume on price declines: May suggest growing fear.

- Increasing volume on price rises: This can point to increasing greed.

Social Media

The interaction rate and trending hashtags on platforms like Twitter can influence market sentiment.

- Google Trends data for Bitcoin-related searches

- Analysis of hashtag momentum and social media

Dominance

Bitcoin’s dominance is a metric showing its market capitalization relative to the entire crypto market.

- Rising dominance: This may imply investors are favoring Bitcoin as a “safe haven.”

- Falling dominance: This could indicate investors are confident in exploring altcoins.

To learn more about other factors that can influence the Bitcoin network, check out our article: “Bitcoin Hashrate Explained: Unraveling the Meaning of Hash.”

Surveys

Periodic surveys gather direct investor sentiment, adding a human element.

- Surveys assess diverse investor opinions.

- Results may be a reflection of prevailing market emotions.

Market Sentiment Analysis

Market mood often drives traders’ decisions to buy or sell assets. This section delves into how emotions influence trading, typical investor behaviors, and the tools used to gauge the mood of the market.

Emotional Component Embed in Trading

You might notice that the crypto markets are markedly emotional. When prices rise sharply, a sense of greed can pervade, leading to FOMO – Fear of Missing Out. Conversely, seeing your investments plummet may spur an irrational reaction to sell in an attempt to minimize losses, often referred to as panic selling. These emotions can result in extreme market sentiments – either fear or greed – which may not align with the underlying value of the assets.

Investor Behavior

As an investor, your behavior can significantly influence market trends. During times of greed, you may find yourself unwilling to liquidate profitable positions, hopeful for even greater gains. This can lead to an overheated market. In contrast, intense fear may cause you to sell your cryptocurrencies too quickly at a loss. Being aware of these tendencies can assist you in recognizing and resisting the impulse to make hasty, emotionally driven decisions.

Sentiment Indicators

Indicators are valuable tools that traders and market participants utilize to get a sense of the market’s mood. For cryptocurrencies, the Fear and Greed Indicator is particularly informative. A low score indicates a fearful market which might suggest a buying opportunity, while a high score points to a greedy market, which could signal overheating and a potential sell-off. Proper use of these indicators can help inform your trading strategies, tempering emotion with analysis.

Bitcoin’s Role in the Crypto Market

Bitcoin casts a significant shadow across the market. Its price movements and market dominance have enduring effects on the broader spectrum of cryptocurrencies.

Price Influence

Bitcoin’s price is a major indicator of the overall health of the crypto market. When Bitcoin’s price increases, it often leads to a bullish sentiment across the board, with many altcoins following suit. Conversely, a fall in its value can result in widespread caution, influencing traders to sell their assets. Such price movements can sometimes prompt accusations of Bitcoin price manipulation, where certain entities might hold enough sway to affect BTC market conditions.

Market Dominance

Bitcoin dominance refers to Bitcoin’s market capitalization relative to the rest of the crypto market. Historically, Bitcoin has maintained a high dominance index, reflecting its status as the flagship cryptocurrency. The term “dominance of Bitcoin” succinctly speaks to its influence; as Bitcoin wanes or waxes, so too does the confidence in altcoins.

Investment Strategies

Potential market sentiment shifts can influence your investment strategies. Understanding how to interpret the data in the context of buying opportunities and timing the market is crucial for your investment decisions.

Buying Opportunities

Extreme Fear may signify a buying opportunity. Historically, such moments have sometimes corresponded with market bottoms, as overly fearful sentiment can lead to an undervaluation of assets. However, proceed with caution; fear can also precede further declines. Evaluate additional market factors before considering a buy.

- Determine if the fear is a response to transient news or a more substantial issue.

- Look for signs of a potential correction after rapid declines.

Timing the Market

When the index shows Extreme Greed, the market may be due for a pullback as investors become overly optimistic and potentially disregard risks.

- Avoid FOMO (fear of missing out).

- Consider the context – bullish news might justify optimism, while a lack of it could hint at an overheated market.

- Buy when the trend is overly bearish and you believe a reversal is due.

- Conversely, consider when to sell or hold if you’re a long-term investor or swing trading during times of greed.

Remember, market indicators are tools to complement your investment strategy. They should not be the sole factor driving your decisions. Always conduct thorough research and consider your risk tolerance.

For an optimized trading experience, integrating CScalp with your preferred crypto trading exchange is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a professional trading platform, where efficiency and speed are paramount.

Critique and Analysis

The Fear and Greed Index uses the available data and strives to quantify the emotions and behaviors of investors. However, it comes with certain limitations and necessitates strategic nuance in its application.

Limitations and Criticisms

Critics argue that:

- Oversimplification: The metric consolidates diverse indicators, potentially masking the granularity of psychological factors and investment strategies.

- Rational vs. Irrational Reaction: Your rational decision-making may not always align with the crowd’s actions reflected in the index, which may track irrational overreactions arising from news or events, rather than fundamental analysis.

- Market Volatility: Fear and Greed levels often swing with market fluctuations, but do not necessarily predict long-term trends; your perspective may differ if focusing on security and investment potential beyond short-term market momentum.

Strategic Considerations

Incorporating the Fear and Greed Index into your strategy should involve:

- Balancing Emotion with Technicals: Your decisions should be tempered with technical indicators for a more holistic view.

- Counteracting Herd Mentality: When the index indicates fear or greed, it could be an opportunity to assess market overreactions and adjust your positions.

Remember, while emotional states such as fear and greed are inherent to trading, grounding your decisions in a mix of sentiment analysis, technical, and fundamental factors can offer a more secure investment approach amidst the inherent volatility of cryptocurrency markets.

Bitcoin Fear and Greed Index – Conclusion

The Fear and Greed Index consolidates a range of data, including market volatility, social media trends, and volume changes into a single, easily interpretable value on a scale from 0 to 100. A low score indicates “fear,” which may suggest a potential buying opportunity as prices could be at a low ebb. Conversely, a high score points to “greed,” signaling caution as an inflated market may be subject to a correction.

Key Takeaways:

- Sentiment Analysis: It gauges the emotions of the community, potentially allowing you to make more informed investment decisions.

- Market Indicators: Components like volume, social media, and momentum combine to inform the index.

- Value Interpretation: 0–49 (Fear) indicates potential buying opportunities as investors are likely cautious, 50–100 (Greed): indicates elevated prices suggest investor caution is advised.

The index does not predict market movements but provides insight into the current mood of crypto investors. Your strategy should account for both the psychological climate and the broader market context, ensuring you maintain a balanced perspective.

For a broader market context, check our article “Bitcoin or Gold: Bitcoin or Gold: Choosing Inflation Hedge.”

Furthermore, the CScalp team has created a free crypto screener. It allows tracking and analyzing the price dynamics of perpetual futures on Binance, Bybit, and OKX cryptocurrency exchanges. The screener simplifies the trader’s task of searching for volatile assets and helps monitor the current funding on crypto exchanges. Additionally, TradingView charts are integrated into the screener for each instrument in case you need to check a chart pattern or perform technical analysis.

Frequently Asked Questions: FAQs About Bitcoin Fear and Greed Index

What Determines the Levels of Fear and Greed in the Cryptocurrency Market?

Various factors such as volatility, market momentum, social media sentiment, surveys, and market dominance play a role in determining the levels of fear and greed in the cryptocurrency market. These indicators provide a temperature check of investor sentiment.

How Can the Fear and Greed Index Influence My Trading Decisions for Cryptocurrencies?

The Fear and Greed Index serves as a sentiment analysis tool. A high index value indicates market greed, which might signal a good time to sell, while a low value signals fear, which might indicate a buying opportunity. However, your trading decisions should also consider other fundamental and technical analyses.

Where Can I Find Historical Values on the Crypto Fear and Greed Index?

Historical data can typically be accessed through websites that track cryptocurrency market sentiments. They offer insights into past market emotions that may have influenced price movements.

How Does the Fear and Greed Index Differ Between Cryptocurrencies Like Bitcoin and Ethereum?

The Fear and Greed Index may react differently between cryptocurrencies such as Bitcoin and Ethereum due to varying market perceptions, use cases, and community reactions to news about each coin. Bitcoin sentiment, for instance, might have a greater impact given its larger market cap.

Can the Fear and Greed Index Predict Market Trends in the Crypto Space?

While the index provides a snapshot of current market sentiment, it is not a standalone predictor of future market trends. It should be used in conjunction with other tools and analyses to gauge potential market directions.

What Are the Implications of Extreme Fear or Greed Values on Cryptocurrency Investments?

Fear can lead to market sell-offs, potentially resulting in lower prices. Conversely, extreme greed might indicate an overheated market that could be due for a correction. Recognizing these extreme conditions can help manage your investment risks and opportunities.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT