Wedge Pattern Trading: How to Spot and Capitalize on Market Trends

CScalp presents a comprehensive guide to wedge pattern trading. We will focus on the practical aspects of identifying and leveraging rising and falling wedge patterns in candlestick trading. Aimed at enhancing market trend analysis, it offers traders the knowledge to navigate and profit in the crypto market with precision and confidence.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Wedge Pattern Trading: Mastering Market Trends

At the core of technical analysis in trading is the concept of chart patterns, with wedge patterns being used by traders on a daily basis. A good understanding of them can provide concrete insight into market sentiment and potential trend changes, making them a valuable tool for traders.

Consult our blog to learn about other candlestick patterns, such as “Flag Pattern Trading Strategies for Crypto Traders.”

A wedge pattern forms when price movements consolidate, resulting in a narrowing of the range between support and resistance levels. There are two types of wedge patterns: rising wedges and falling wedges. Let’s explore their particularities and what they indicate.

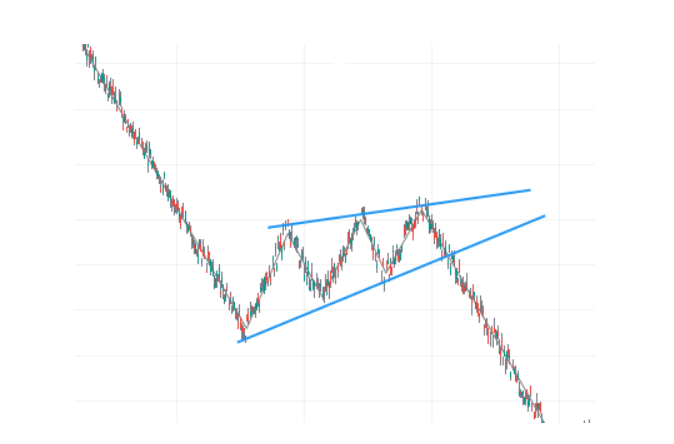

What Is a Rising Wedge Pattern?

A rising wedge pattern is typically identified in an uptrend and is characterized by a narrowing price range between converging upward-sloping support and resistance lines. This pattern often signals a bearish reversal, indicating that an uptrend may be losing momentum.

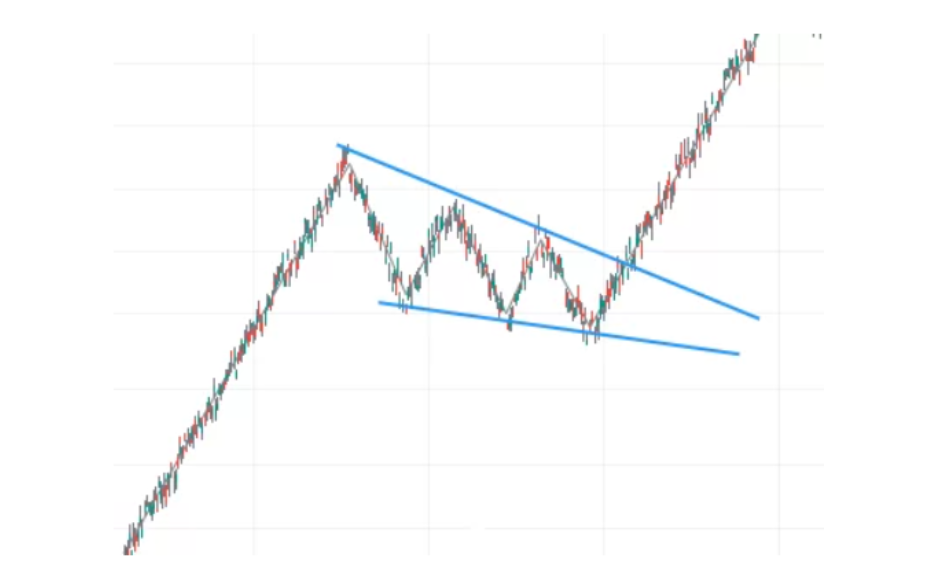

What Is a Falling Wedge Pattern?

Falling wedges occur in downtrends and are identified by downward-sloping support and resistance lines converging. This pattern suggests a bullish reversal, implying that a downtrend may be nearing its end.

How to Identify Wedge Patterns

When identifying wedge patterns, it is advisable to use technical indicators and analysis techniques to confirm your decisions.

Key Indicators for Spotting Rising and Falling Wedges

To effectively spot these patterns, traders must pay close attention to certain technical indicators.

- Trend Lines: The most fundamental aspect of identifying wedge patterns is the drawing of trend lines. These lines connect the highs and lows of price movements, forming a converging pattern in the case of wedges.

- Volume Analysis: Volume plays a crucial role in confirming wedge patterns. Typically, the volume should decrease as the pattern develops, indicating a reduction in market interest at current price levels. A breakout from the wedge pattern, especially on higher volume, can serve as a strong confirmation signal.

- Moving Averages: Utilizing moving averages, like the 50-day or 200-day moving average, can help traders understand the broader market trend. When a wedge pattern forms in proximity to these averages, it can provide additional context to the pattern’s significance.

- Relative Strength Index (RSI): The RSI can be useful in identifying potential reversals. In a rising wedge, if the RSI starts showing divergence (i.e., the price is making higher highs, but the RSI is making lower highs), it could indicate weakening momentum.

- Fibonacci Retracement Levels: These levels can be used to anticipate potential reversal points within the wedge pattern. Traders often look for price reactions near key Fibonacci levels like 38.2%, 50%, and 61.8%.

Chart Analysis Techniques for Wedge Patterns

In addition to the key indicators, specific chart analysis techniques can enhance the identification and interpretation of wedge patterns, especially in the fast-paced crypto markets.

- Candlestick Analysis: Observing candlestick patterns within the wedge can provide early signs of a breakout. Reversal candlestick patterns, such as doji, hammer, or engulfing patterns, at the boundary of the wedge can be significant.

- Breakout Confirmation: A breakout occurs when the price moves outside the converging trend lines. It’s crucial to wait for a candlestick to close outside the wedge pattern for confirmation. False breakouts are common, so confirmation with other indicators is recommended.

- Backtesting the Pattern: Utilizing historical data to backtest how wedge patterns have performed in the past can give traders insight into their reliability and potential outcomes.

Wedge Patterns Trading Strategies

Now that we know how to interpret wedge patterns, let’s consider how to strategize to our advantage.

Capitalizing on Rising Wedges

When trading rising wedges, the strategy usually involves preparing for a potential bearish reversal. Traders might consider taking short positions or exiting long positions as the pattern nears completion. The key is to wait for a confirmation signal, such as a breakout below the lower trend line.

Making the Most of Falling Wedge Opportunities

In the case of falling wedges, traders should anticipate a bullish reversal. This might involve entering long positions or closing short positions. The confirmation of a falling wedge is typically a breakout above the upper trend line, often accompanied by increased trading volume.

Risk Management Strategies

Below, we will explore various strategies to manage these risks.

- Stop-Loss Orders: One of the most effective risk management tools is the use of stop-loss orders. Setting a Stop-Loss just outside the wedge pattern (above for rising wedges, below for falling wedges) can help limit potential losses if the market moves against the expected direction.

- Position Sizing: Managing the size of trades is crucial. Investing only a portion of the total trading capital in a single trade helps in mitigating risks. The size should be determined based on the individual’s risk tolerance and the overall market conditions.

- External Market Factors: Cryptocurrency markets can be heavily influenced by external factors like regulatory news, technological advancements, or macroeconomic factors. Staying informed about these can help traders anticipate sudden market shifts that might affect their positions.

- Emotional Discipline: Emotional discipline is crucial, especially in a market as volatile as cryptocurrency. Avoiding panic selling during a false breakout or greed-driven decisions is essential. Sticking to a predefined trading plan can help maintain this discipline.

Another factor to consider is the existence of false market signals, especially if you are a less experienced trader. For that reason, we recommend you check out our recent article, “Bear Traps in Trading: How to Identify and Overcome Them,” where we delve into all the things you need to know about them.

Using Wedge Patterns to Your Advantage

Wedge pattern trading is a nuanced and powerful tool in your arsenal, especially when combined with the advanced functionalities of the CScalp free professional platform. By mastering the art of identifying and capitalizing on these patterns, traders can significantly enhance their market analysis and trading strategies. However, it’s important to remember the importance of thorough analysis, risk management, and continuous learning to navigate the complexities of financial markets.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT