What is Bitcoin Halving? Everything You Need to Know

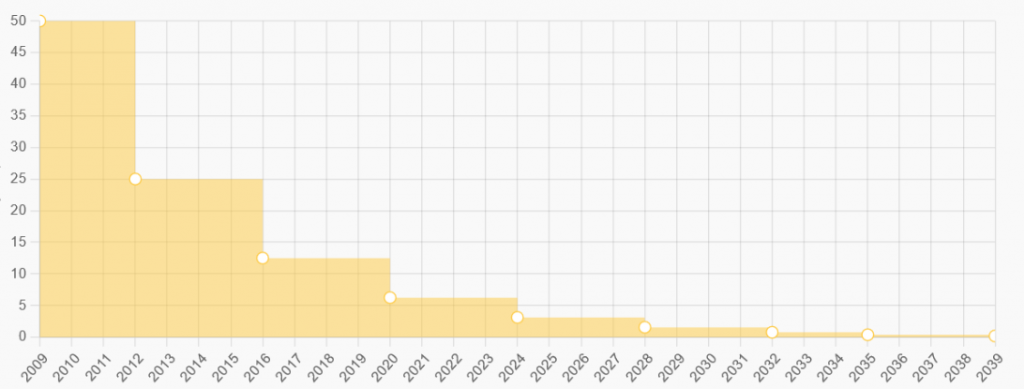

What is Bitcoin halving? It is an event that occurs approximately every four years (or every 210,000 blocks mined) in the Bitcoin network. It’s a fundamental part of Bitcoin’s monetary policy, built into its code by its creator, Satoshi Nakamoto, to control inflation and the supply of new bitcoins entering the market. CScalp explores BTC halving, historical examples of the first cryptocurrency’s halving, and market expectations after every halving event.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is BTC Halving?

Bitcoin halving is a mechanism that reduces the miners’ reward for a mined block in the Bitcoin network. Halving is programmed into the blockchain by its creator, Satoshi Nakamoto, to combat inflation.

The crypto community views halving as a powerful bullish stimulus affecting BTC quotes and the rest of the market. Meanwhile, halving is a transparent and predictable event, the date of which is known in advance to the community: for example, Bitcoin halving is programmed on April 2024.

To take full advantage of Bitcoin halving, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

How Does Bitcoin Halving Work?

To explain Bitcoin halving, let’s examine the basic principles of blockchain and mining. The blockchain is a chain of blocks, with each block containing a data package necessary for the network’s operation. The blockchain has no servers; miners are responsible for processing blocks and data using their power (“farms”).

The blockchain “lives” thanks to miners, who are rewarded for each processed block. The reward size is pre-programmed in the system and is reduced every four years. This reduction in reward is the process known as “halving.”

Halving is embedded in the blockchain’s source code: removing or changing these rules is impossible. Technically, Bitcoin’s halving is implemented as a cutoff, after which the block reward is reduced by half. Such a cutoff occurs once every 210,000 blocks. When the block is mined, the reward decreases. Miners receive less for subsequent blocks than for blocks before the cutoff.

Halving works not only in the BTC blockchain but also in other networks built on the Proof-of-Work principle. However, Bitcoin’s halving significantly impacts the market due to the cryptocurrency’s pioneering status and significant value.

Why Is Bitcoin Halving Important?

The primary objective of halving is to provide an economic safeguard for Bitcoin, ensuring its protection against inflation and preventing the premature mining of all BTC. This aligns with Satoshi Nakamoto’s vision to extend the mining of Bitcoin until approximately the year 2140.

Bitcoin Halvings as Protection From Inflation

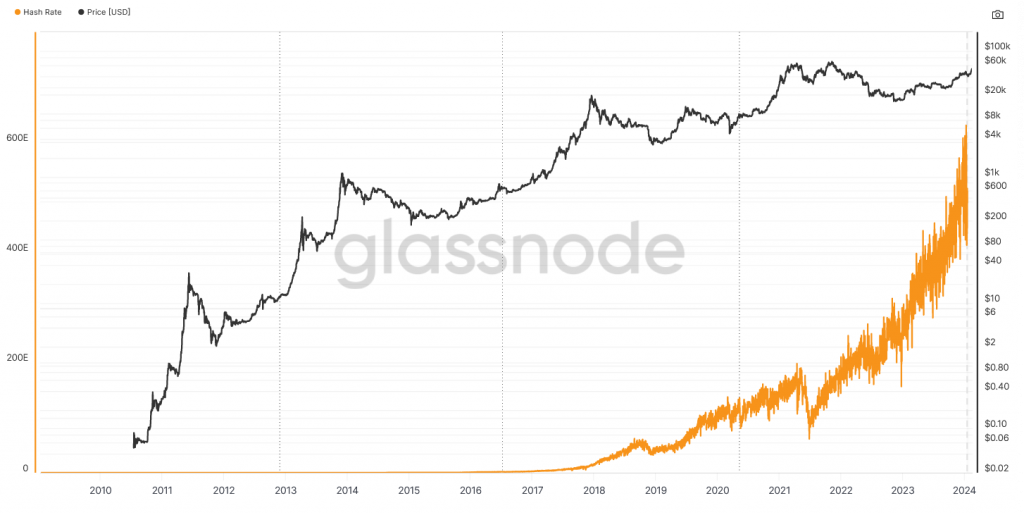

Thanks to halving, a sharp increase in hash rate (mining speeds) does not lead to hyperinflation and helps maintain BTC’s price. Inflation protection is based on a simple economic principle: if the supply is reduced while there is high market demand, the asset’s price will be higher because demand will outweigh supply.

To learn more about the Bitcoin hash rate, check out our article: “Bitcoin Hashrate Explained: Unravelling the Meaning of Hash”.

Unlike traditional money (fiat), which can be issued in unlimited quantities by governments, Bitcoin has a capped supply of no more than 21 million coins, preventing it from being “printed on demand.” The introduction of new coins into the market is regulated through mining.

Miners play a crucial role in maintaining the network’s functionality. They receive rewards for their contributions, which they can then sell on the market, acting as a decentralized version of a minting operation. However, these rewards are contingent on the miners’ ability to solve complex mathematical problems, requiring substantial computational resources and investment in mining equipment.

The halving mechanism is pivotal in this context. Without it, miners would continue to add more coins to the circulating supply. This unchecked increase in supply could lead to inflationary pressures within the Bitcoin ecosystem, potentially undermining its value. By halving the mining reward at predetermined intervals, Bitcoin ingeniously controls its supply, ensuring a gradual approach to the 21 million cap thus preserving the coin’s value over time.

How Bitcoin Halvings Affect Cryptocurrency Market

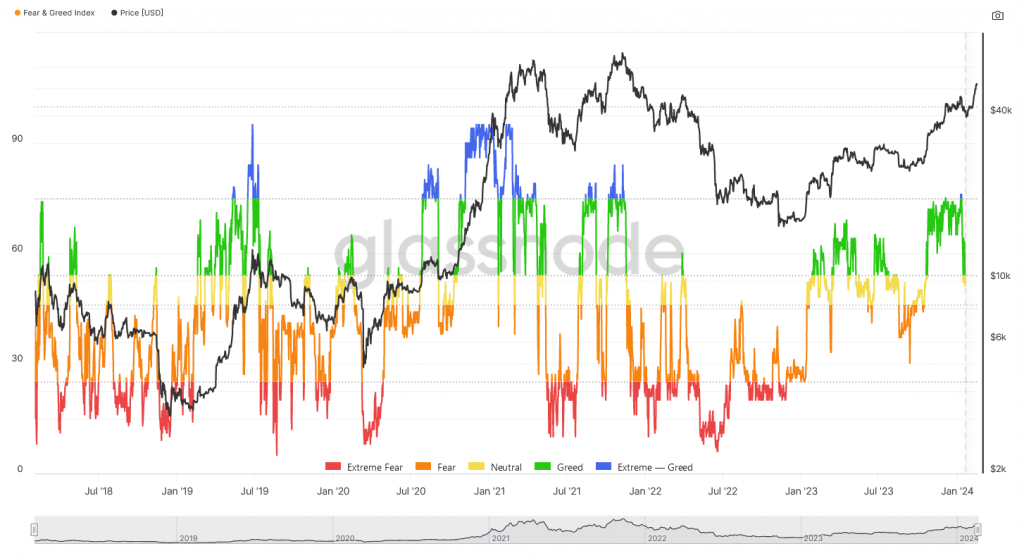

Historically, after halving, Bitcoin’s value has grown. Each past halving initiated a bullish market cycle and led to a new All-Time-High price.

Bitcoin is the “flagship” of the cryptocurrency industry; its quotes affect most altcoins. Therefore, a BTC bullish cycle “boosts” the entire market. At least, this was the case after the past three halvings.

How Halvings Affect Miners

At first glance, halving seems disadvantageous for miners – investments in equipment increase, mining difficulty rises, and revenue is halved.

However, the bullish market trend leads to the price increase. Miners hope that Bitcoin’s price rise will compensate for the “shortfall” in coin revenue from mining. In other words, the block reward is smaller, but its value in USD proportionally increases.

The mining business model implies that mined coins will be immediately sold on the market. Miners sell at “bottom” prices or at All-Time-High to cover costs. If, after the halving, the price increases and “pulls up” the average sale price to a level sufficient to cover expenses and projected profit, the miner will remain profitable. Otherwise, the miner will offer coins to the market at a higher price to recoup costs – this will also lead to a BTC price increase.

How Halvings Affect Trading

The community expects that after the halving, the crypto “winter” will end, and a stable bullish trend will begin. However, traders should not expect a rapid surge immediately after the halving.

After previous halvings, a certain pattern emerged in the market:

- Preliminary stage: The stage when bitcoin halving is “on the horizon.” BTC’s price may decrease as miners who are not profitable with the new block reward exit the market. These miners might sell their accumulated coins in significant volumes.

- Preparatory stage: Market excitement grows, related to the potential bullish trend. A “test rally” might occur: a mass purchase by traders wanting to profit from the possible boom.

- Accumulation stage: At this stage, some miners have sold coins, and some traders have bought them. Therefore, a price balance and “sideways” movement might occur.

- “Parabolic growth” phase: Rapid BTC growth, followed by altcoins. “Mass money” enters the market, initiating a “hype” period.

These stages are based on historical examples of BTC halving. Price growth in past cycles was not solely due to halving. For example, the 2016/17 market was supplemented by the first influx of mass money, the development of smart contracts, and ICOs. The 2020/21 cycle was made possible by media support, the development of stablecoins, and the arrival of investors seeking alternatives due to the instability of traditional assets during the pandemic.

First Bitcoin Halving Event and Historical Examples

When the Bitcoin blockchain was launched, the miner’s reward for a mined block was 50 BTC. The first halving and reward reduction occurred at block number 210,000. The block was mined on November 28, 2012. The reward was reduced to 25 BTC. By that time, BTC’s market price had grown from zero to $12.

The second halving happened four years later – on July 9, 2016, at block number 420,000. The reward was again halved – to 12.5 BTC. The market price was $651. After the second halving, a noticeable bullish trend emerged, continuing until January 2018, when BTC’s price approached $20,000. The media began discussing cryptocurrencies, the number of blockchain projects skyrocketed, and market “hegemons” like Binance emerged.

The third halving happened on May 11, 2020. The blockchain reached the block number 630,000. Miners’ rewards were reduced from 12.5 BTC to 6.25 BTC. In the following one and a half years, Bitcoin broke its record value and reached $69,044. Other market leaders like ETH – $4,878, DOGE – $0.731, LTC – $410 also set new records.

2024 Bitcoin Halving

The fourth Bitcoin halving is in April 2024. Potential market changes will not happen “in the blink of an eye.” The dynamics in the following months will be more important.

The halving will occur at the block number 840,000. The reward for a mined block will be reduced from 6.25 BTC to 3.125 BTC. The next halving is expected in March 2028, at block 1,050,000. The reward will decrease from 3.125 BTC to 1.5625 BTC.

The largest corporate “holder” of BTC – Microstrategy – has already increased its portfolio to 190,000 BTC (approximately $9.5 billion). According to the company’s chairman, Michael Saylor, Bitcoin’s growth potential in the months following the 2024 halving is up to $100,000.

Growth is also expected by Bitfinex exchange analysts. According to the report, only 11% of current BTC holders are at a cumulative loss, so a massive sell-off and pullback are not expected if the price rises above $52,000. Additional growth drivers, according to Bitfinex experts, include the emergence of new Bitcoin ETFs, the growth of existing funds, and the expansion of institutional money inflow.

According to Galaxy Digital, the total hash rate in the BTC network will drop by about 20%. Losses of 90-110 EH are expected. The decrease will occur because – with a block reward of 3.125 BTC – mining will become unprofitable for some miners, who will “detach” from the overall hash rate. The remaining miners will update some equipment (about 20% of global capacity). The BTC mining market will likely become strictly corporate, closed to private miners.

What Is Bitcoin Halving – Conclusion

The time has come to prepare for significant market changes. For traders, this is an opportunity window: after the halving, the market will likely show growth – from BTC to lesser-known and new tokens. However, despite statistics and expert forecasts, halving does not guarantee that we will see new price records for Bitcoin and other cryptocurrencies.

With an overwhelming number of crypto assets available, it can be challenging to determine which are the top cryptocurrency choices for day traders. The CScalp free crypto screener simplifies this process by providing real-time data on new cryptocurrencies and their potential for day trading. By identifying the best crypto to day trade, traders can profit from short-term price movements.

Frequently Asked Questions: FAQs About Bitcoin Halving

What Is Bitcoin Halving?

Bitcoin halving is an event that reduces the reward for mining a Bitcoin block by half. It’s programmed into the Bitcoin network to occur every 210,000 blocks, or approximately every four years, as a measure to control inflation and extend the mining life cycle of Bitcoin until around 2140.

Why Was Halving Introduced Into the Bitcoin Protocol?

Halving was introduced by Satoshi Nakamoto, the creator of Bitcoin, as a mechanism to fight inflation within the Bitcoin ecosystem. By reducing the miners’ rewards over time, halving ensures that Bitcoin’s supply grows at a decreasing rate, mimicking the extraction of precious resources like gold.

How Does Halving Influence the Bitcoin Price?

While halving reduces the rate at which new bitcoins are created, it can lead to increased prices if demand remains strong. This is because the reduced flow of new coins can create supply scarcity, which, combined with strong demand, can drive up prices.

What Is the Maximum Number of Bitcoin That Can Be Mined?

The maximum supply of Bitcoin is capped at 21 million coins. This finite supply is a key feature that differentiates Bitcoin from traditional fiat currencies, which can be printed in unlimited quantities by central authorities.

How Does Bitcoin’s Halving Differ From Traditional Fiat Currency Systems?

Unlike fiat currencies, which can be issued in unlimited quantities, Bitcoin has a fixed supply and a predetermined issuance schedule. Halving ensures that the creation of new bitcoins slows down over time, whereas fiat currencies can experience inflation or deflation based on government and central bank policies.

What Impact Does Bitcoin Halving Have on Bitcoin Miners?

Halving impacts miners by reducing their earnings per block mined by half, which can affect their profitability. This may lead to a consolidation in the mining industry, where only the most efficient miners can continue to operate profitably.

What Happens When All 21 Million Bitcoins Are Mined?

Once all 21 million bitcoins have been mined, miners will no longer receive block rewards. They will, however, continue to earn transaction fees as incentives to validate transactions and secure the network.

Can Bitcoin Halving Lead to Hyperinflation in the Bitcoin Network?

On the contrary, halving is designed to prevent inflation in the Bitcoin network. By decreasing the rate at which new bitcoins are introduced, halving helps maintain Bitcoin’s purchasing power over time, unlike fiat currencies, which can lose value due to excessive supply growth.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT