How to Calculate Binance Profit on the Futures Market

Binance Futures is a complex derivative instrument, and it can be challenging for beginners to calculate potential profits accurately. And opening a position without the correct profit calculation can be risky. In this article, we will discuss how to calculate Binance profit.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Profit and Loss in Futures Trading

In the futures market, we calculate the outcome of a trade similarly to Spot trading when opening a long position without leverage (formally, with 1x leverage). However, when leverage is involved in the trade, the calculations become more complicated.

Before getting into the calculations, you need to understand the “essence” of futures trading with leverage. In simple terms, leverage is a financial lever that allows you to operate with a larger sum than what is in your account. Your funds and leverage “combine” for the trade.

For example, to buy one ETHUSD contract, you need to have $1,000 in your account. You are ready to invest $100, while the remaining $900 can be added through leverage. This means you have 10% of this position, and the leverage is 90%. Your contribution to the trade is called margin.

In the example, we provided 1/10 of the total investment, and leverage added 9/10, which means we used 10x leverage. The leverage size is the number that shows how many times our investment will be multiplied. Therefore, with 100x leverage, we provide 1/100 of the total position size, and with 50x leverage, it’s 1/50.

To determine profit, you need to take the total outcome of the trade and “extract” the trader’s share – 1/10 with 10x leverage, 1/25 with 25x leverage, and so on.

Let’s assume the price of ETHUSD has risen from $1,000 to $2,000. The trade has yielded a 100% return on the invested funds. We receive 10% of the total profit, proportionate to our “contribution,” which amounts to $100 out of the total $1,000 earned.

If ETHUSD had fallen in price, we would have lost our own $100, proportionate to the price drop. In an open position at $1,000, we “own” $100. Futures trading is designed so that the trader is responsible for the accumulated losses. Therefore, if the position at $1,000 “shrinks” due to a drop in the contract price, our collateral is burned until it is fully depleted.

In such a case, the exchange will liquidate our position – forcibly close it. Learn more about how Binance liquidation works on the Futures market.

How to calculate PnL (Profit and Loss)?

PnL is a formula that shows the losses or gains from buying and selling cryptocurrencies. It’s the difference between the entry price of the position and the current price at which the position can be closed, or between the opening and closing prices of the position.

If calculations use the opening price and the current price, this PnL is called unrealized. Possible profits/losses are not realized. You can find this type of PnL in the trade history.

If the opening and closing prices of the position are used in calculations, the PnL is realized. When Binance automatically calculates the realized PnL, it takes into account the commission paid by the trader for closing the position.

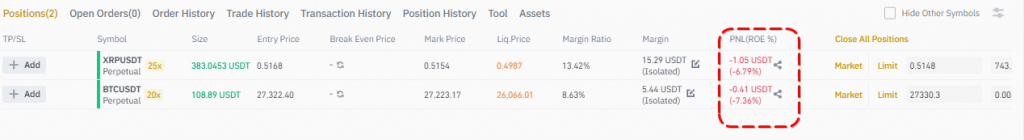

Unrealized PnL does not consider commissions and is calculated “on the go” based on the entry point and the price if we were to exit the position at the time of calculation. You can usually find this type of PnL in the current open positions statistics on Binance Futures. Typically, when traders talk about PnL, they mean unrealized PnL.

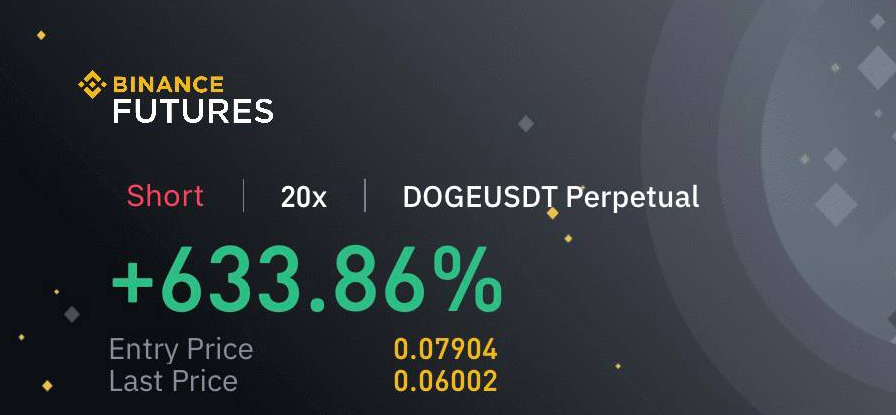

The PnL calculation formula depends on the direction of the trade

- For long positions: PnL = (Current price – Opening position price) x Number of contracts in the position

- For short positions: PnL = (Opening position price – Current price) x Number of contracts in the position

If the resulting PnL is positive, the position is profitable. If negative, the position is incurring a loss.

To calculate margin (the trader’s share in the trade), you need to divide PnL by the leverage used. In our example with ETHUSD, the profit from the trade (PnL) divided by the used leverage (10x) equals $1,000 / 10x = $100. $100 is the initial margin of the trader.

It is not necessary to manually calculate the PnL. It is displayed in the “Positions” table below the futures chart in the Binance trading interface. PnL for closed trades can be found on the “Trade History” tab.

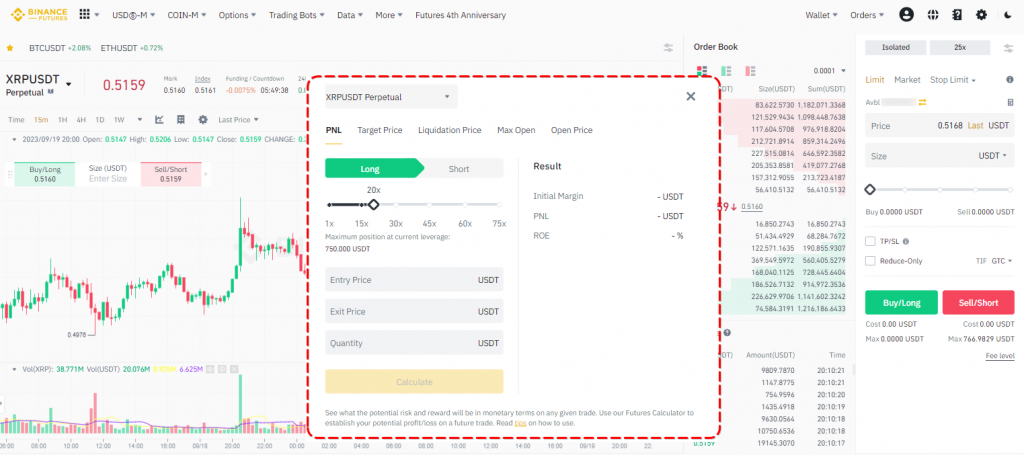

How to Use the Binance Futures Calculator

Binance provides a special tool for calculating the results of futures positions. To open the calculator, click on the respective icon in the order entry window.

In the upper part of the calculator, you will find a dropdown list of available contracts. For example, let’s choose ETHUSDT. Just below, select PnL as we plan to calculate the trade’s result. Next, choose the direction of the trade – “Long” or “Short.”

Below that, there’s a slider for selecting leverage. In our hypothetical trade, we’re using 40x leverage. Under the slider, there are three fields where you enter the entry price, the potential exit price, and the number of contracts in the position. After entering the data, click “Calculate.”

Let’s assume we plan to enter a long position on ETHUSDT at $1,000 and exit at $2,000, trading one contract. The calculator shows that to open a similar position, we need to deposit 25 USDT. When the position is closed, we will earn $1,000, which is a 4,000% return on equity (ROE).

You can also use the calculator to review the entry and exit prices of previously closed trades. In that case, you’ll need to manually account for Binance’s fees. Additionally, you can calculate the parameters of open positions to gauge at what price level you need to “close out” to achieve the desired profit.

Binance Profit – Successful Futures Trading

By mastering the art of Binance profit calculation and risk management on the Futures market, you can make more informed trading decisions and potentially increase your chances of success. Remember that while futures trading can offer substantial rewards, it also carries inherent risks. Therefore, it’s essential to continually educate yourself, stay updated on market trends, and practice prudent trading strategies to maximize your Binance profit potential on Binance Futures.

Join our Discord community, where other traders who have embraced the power of CScalp can help you learn more about using this cutting-edge day trading software. Also, on YouTube’s CScalp TV, you can find tutorials, trading strategies, and live streams that will help you harness the full potential of this extraordinary free tool.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT