How Binance Liquidation Works on the Futures Market

When you trade on Binance Futures with leverage, you’ll find that it can significantly boost your potential profits. However, it’s crucial to understand that it also comes with increased risks. In this guide, we’ll dive into the concept of Binance liquidation, how it works, and most importantly, how you can correctly calculate your liquidation price to safeguard your positions.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Binance Liquidation

Liquidation is the situation where Binance forcibly closes your losing position if you’re unable to maintain the required margin. In simple terms, if your trade goes against the market, and you don’t have enough funds to cover the margin, Binance will step in and close your position.

Let’s talk about leverage. When you trade futures, you don’t have to put up the entire value of the contract. Instead, you deposit a fraction known as collateral. If things don’t go your way, and let’s say the price drops while you’re holding a long position, your collateral, which is your own money, gets used up first. When your collateral is entirely gone, that’s when liquidation occurs. Binance essentially cuts your position, and you lose the money you put up as collateral.

Let’s look at a simple example of Binance liquidation:

Imagine you have 100 USDT in your account. You want to open a long position worth 1,000 USDT, so you use 10x leverage. Here, 900 USDT gets added to your total position size, and 100 USDT comes from your pocket. If the contract’s price falls by 10%, the value of your position drops to 900 USDT. In this scenario, your 100 USDT acts as collateral and gets “burned,” resulting in liquidation.

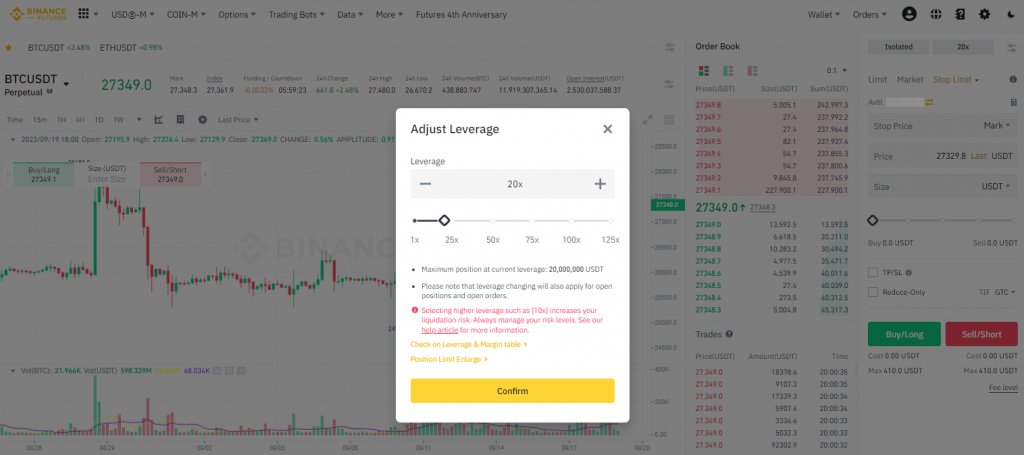

It’s important to note that liquidation is closely tied to your chosen leverage level. The higher the leverage, the greater the risk of liquidation. For example, if you’re trading with 100x leverage in a long position, Binance will liquidate your position if the contract price falls by just 1% from your entry price. Since 1% represents your collateral, it’ll be used up quite quickly. In comparison, with 10x leverage, liquidation only happens if the price falls by 10%.

How to Calculate Your Binance Futures Liquidation Price?

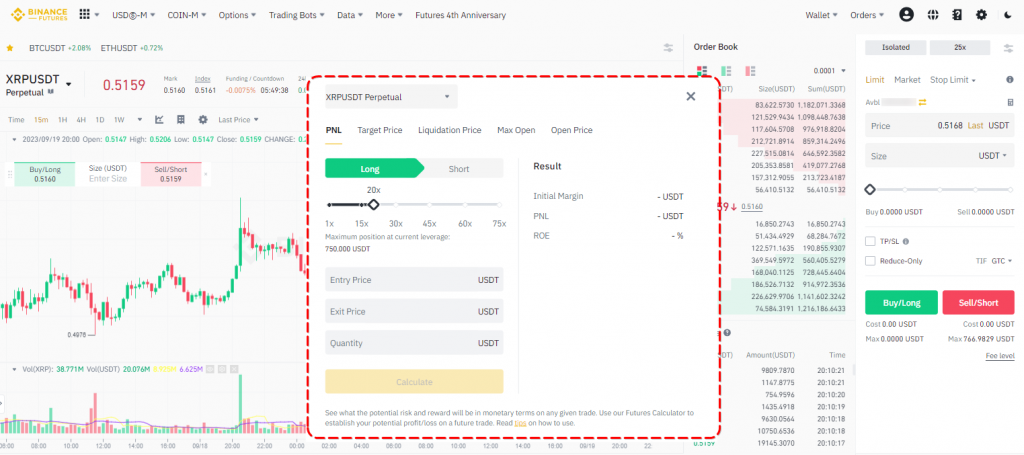

You don’t need to memorize complex formulas to calculate your liquidation price. In practice, you can relate your chosen leverage to the change in the futures price since you entered the position.

For example, let’s say you’re using 10x leverage. This means that 1/10 of the position is yours, and the rest is leveraged funds. Binance will liquidate your position as soon as your 10% share is used up. Therefore, liquidation will occur with a price drop of 10% from your entry price.

Suppose you open a long position on BTCUSDT at $30,000 with 10x leverage. Binance will liquidate your position if the price drops to $27,000 ($30,000 – $3,000 = $27,000). With 5x leverage, your share is 1/5, or 20%. This means a permissible drawdown of 20%. With 3x leverage, it’s 33%, and so on.

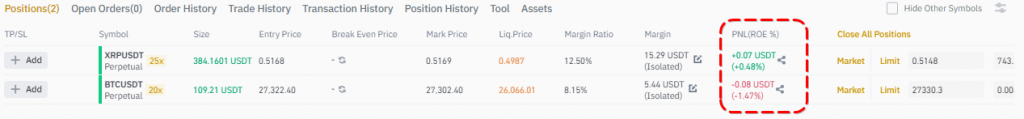

An even simpler method is to keep an eye on the PnL (Profit and Loss) indicator. PnL is displayed next to the futures ticker under the “Positions” section, right below the chart. If your PnL is positive, your position is making a profit. If it’s negative, it means the price is moving against you, and you’re losing your collateral. In case the PnL reaches “-100%,” it signifies that you’ve lost your collateral, and your position is liquidated.

Binance Futures’ interface also includes a handy liquidation calculator widget. To use it, simply click on the calculator icon in the order placement block.

Understanding Binance Liquidation Fees

When liquidation occurs on Binance Futures, the exchange charges you a fee, which typically ranges from 1% to 1.5%. The fee amount depends on the specific futures contract and is deducted from your futures account. It’s calculated based on the margin you deposited.

For instance, if you used your own 100 USDT to open a position with 100x leverage, and the trade didn’t go your way, resulting in liquidation, the fee would be 1.5% and calculated from the 100 USDT you deposited. This means Binance would deduct 1.5 USDT from your account (1.5% of 100 USDT).

How to Protect Your Position Against Liquidation on Binance Futures

Binance Futures won’t send you notifications if your position is going against you. The exchange sends a notification only after liquidation has already happened. When liquidation occurs, your open position disappears from the “Positions” section, and your funds aren’t returned.

So, how can you protect your position from liquidation? Keep a close eye on the futures price and the PnL indicator. If you notice a significant drawdown, you can manually close the position at a loss while retaining a portion of your funds invested as collateral.

Stop-Loss Is Your Greatest Ally against Binance Liquidation

Automating your exit from a position is another option, and you can do this with a Stop-Loss order. Place the order below your entry price but above the liquidation price. For example, if there’s a potential drawdown of 10% before liquidation, you can set the Stop-Loss at 5% or 3%.

Choose Well the Margin You Are Going to Use

Consider the type of margin you use. Isolated margin is safer because, in case of losses, the exchange will use the collateral specifically allocated for that position. With cross margin, the exchange may deduct funds from your free balance in your futures account, potentially leading to even larger losses.

Given the volatility of the cryptocurrency market, price swings of 5-10% in a day are common. If you’re relatively new to trading, it’s advisable to avoid using high leverage (10x and higher) for your trades, especially during times of increased volatility, as positions with higher leverage are more susceptible to liquidation.

Mastering Binance Futures While Safeguarding Your Leverage Investments

In your journey through the world of Binance Futures, you’ve explored the potential of leverage and learned to navigate the waters of liquidation. Armed with the knowledge of how leverage amplifies profits and risks, and how liquidation can impact your investments, you’re better prepared than ever to make good decisions.

Remember, it is as important to know how to calculate the Binance liquidation price as it is to know how to calculate Binance profit on the Futures market. Read our article and join our Discord channel, where more experienced traders will help you with your questions and provide trading ideas. With these tools at your disposal, you can mitigate the risks and trade with confidence.

As you continue your trading journey on Binance Futures, always prioritize risk management. Keep an eye on market trends, employ Stop-Loss orders, and be ready to adapt when needed. With the right strategies and a keen eye for detail, you can leverage the power of Binance Futures to build a successful trading strategy.

Related Article: How to add money to Binance Futures

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT