dYdX exchange: beginner’s friendly guide

dYdX is a decentralized exchange (DEX) for trading cryptocurrency derivatives, implemented on the second layer protocol (Layer 2). The platform allows you to trade futures, including perpetual, and is characterized by high transaction speed, low fees, as well as bonuses for owners of the local management token dYdX.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

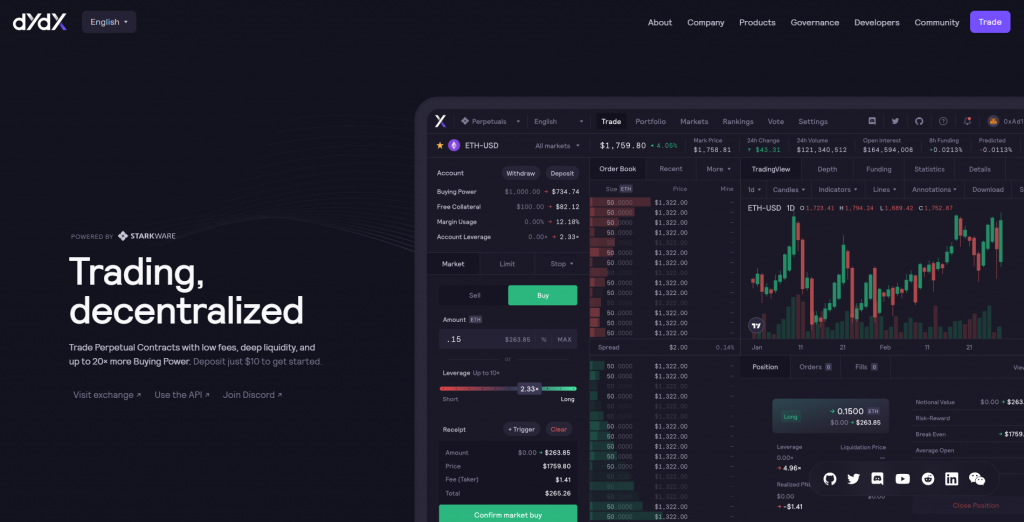

dYdX: About

dYdX was launched in 2019 and is considered the leader in decentralized margin trading due to its combination of cutting-edge technology and affordability. The platform is supported by the largest business angels and investment funds, such as Andreessen Horowitz, a16zcrypto, Paradigm, Polychain, and others.

dYdX homepage

The exchange is completely decentralized and does not have a dedicated trade management node; all transactions take place directly between users through smart contracts. The platform is managed according to the principle of DAO (Decentralized Autonomous Organization) through its own utility token dYdX. Also, trading on dYdX is completely anonymous and secure thanks to the zero-knowledge proofs system.

dYdX is based on the StarkEx layer 2 protocol, which allows transactions to be carried out instantly and without gas fees. Traders pay for gas only during registration and wallet connection; When making transactions, you do not need to pay for gas.

The platform fee is 0.05% from each transaction. Also, since January 2022, dYdX has been running a reduced fee program. Users may receive fee discounts based on trading volumes and/or account balance.

On dYdX you can trade with cross margin meaning in several markets of perpetual contracts at once through one margin account. This simplifies the trading process, especially when working with multiple pairs.

The platform is available in 5 languages.

How it works

To get started, you need to transfer funds from the Ethereum network to StarkEx.

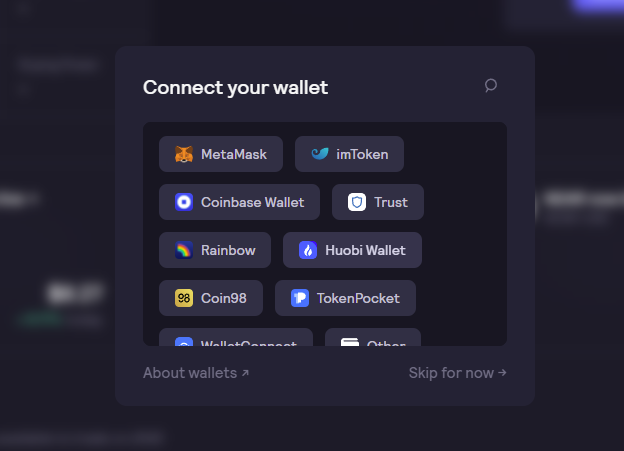

Go to the dYdX official website and click “Connect Wallet” in the top right corner. A pop-up window will appear asking you to connect to your Ethereum wallet. MetaMask, Ledger, Wallet Connect, imToken, and others are supported.

Wallet connection

On dYdX, you cannot connect a wallet that does not have funds and transaction history. Before connecting, make sure that your wallet is topped up and has an activity history.

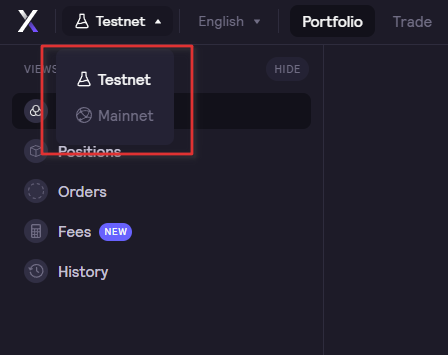

Those who wish to try out the platform toolkit without attachments can do it in testnet. To do this, switch to the testnet in the upper left corner.

Testnet and mainnet switchers

After that, in the crypto wallet settings, you also need to switch to the Ropsten Test Network.

After connecting the wallet, a pop-up window will offer to generate a Stark key. It helps identify the user account and enables secure interaction between layers 1 and 2.

The Stark key is not backed up and is stored directly in the browser. Click “Generate Stark Key” to create a signing request, then sign the transaction (no gas fees).

Now you need to accept the legal terms. Click “I agree” to continue. Please note that dYdX restricts access to US users.

After that, you can enter your account name and specify an email address, but this is optional. Click “Create an account” to continue without entering any details. A window will appear asking you to authorize a crypto wallet, which you need to confirm. Now you have access to the dYdX trading terminal.

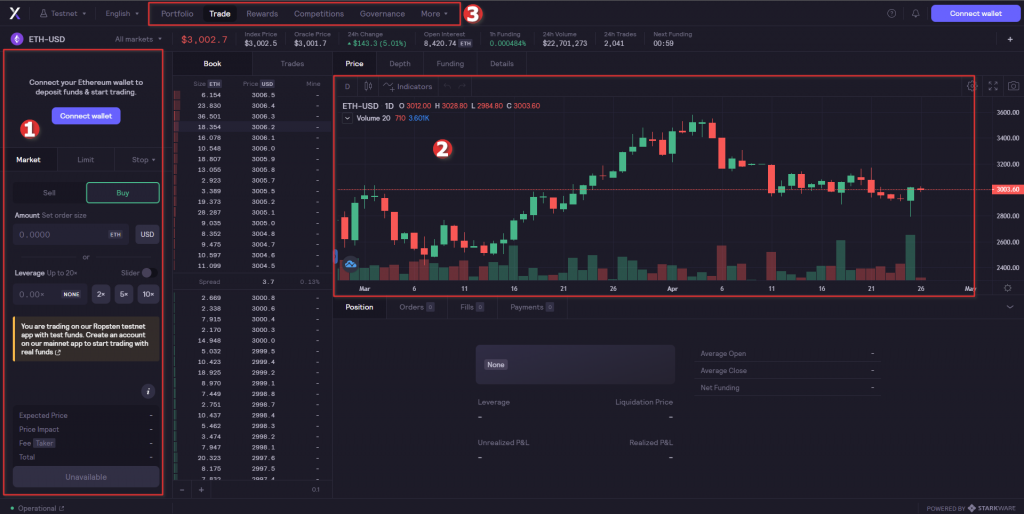

dYdX trading interface

To trade on the main network, you need to deposit USD-C from the Ethereum network to your dYdX account. At the time of writing, the minimum entry threshold is $10 USD-C. With a smaller number, trading on the exchange will not be available.

When depositing USD-C into a dYdX account, spending must be allowed in the wallet. To approve the transaction, you must pay the gas fee in ETH. Then enter the amount of USD-C you wish to trade. This transaction also requires a gas fee.

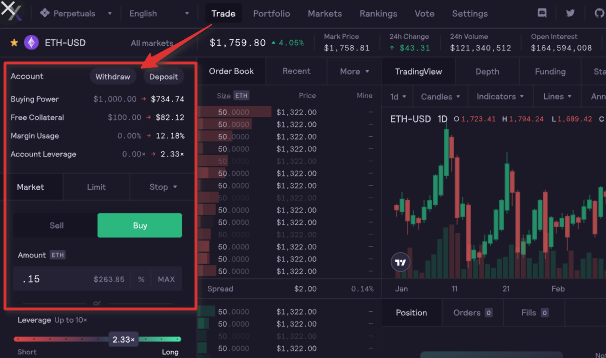

Trading terminal

Once confirmed, the deposited USD-C will appear in your account and you will be presented with a trading window.

The trading screen is divided into three sections:

1. Account details and order placement panel

2. Price chart and selected market details

3. Menu

In the top menu, you can select a network, language, view portfolio details and download transaction history in CSV format.

In the upper right corner there is a quick access panel to the wallet, as well as notifications and a help button (?), where you can read tutorial articles and contact the live support chat.

dYdX trading

To start trading, go to the “Trade” tab and select the pair you want to work with.

Trading pair selection

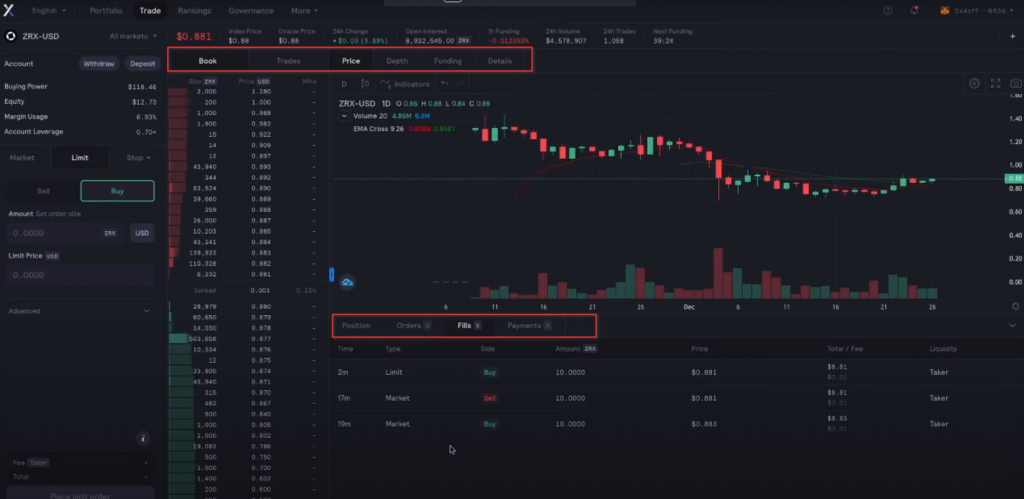

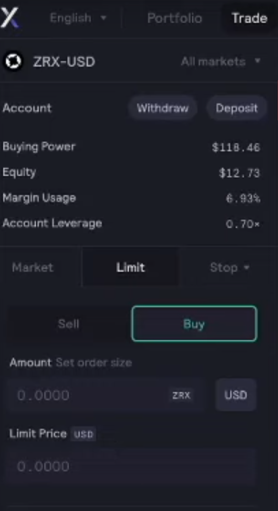

This will open a window with price and market data, as well as a summary of your balance and a menu for placing orders. You can switch between the selected market and all available pairs using the “All Markets” button in the top left menu.

Trading menu

The screen of the selected coin contains price statistics with summaries of transactions, price changes, depth, funding, and other parameters. In the “Details” tab there is a description of the coin and links to its official resources.

At the bottom of the page you will find information about your activity in this market: open positions, orders, execution, and payments.

Account details

The account summary is divided into the following tabs:

- Buying power: total available purchasing power to boost your position. This parameter will change depending on the selected market, as well as the leverage available in each pair.

- Equity: the total value of your account (initially, these are the funds deposited into the account).

- Margin usage: percentage of the total margin used by open positions.

- Account leverage: your account’s leverage based on all of your open positions. Because your account is cross-margined, each position you open has its own leverage, which also affects your account’s overall leverage.

Here you can quickly deposit and withdraw funds through the appropriate buttons. The dYdX exchange supports two types of withdrawals from Level 2. Fast withdrawals are subject to a small fee, but no gas charges are required and funds are sent instantly. With a slow withdrawal, no commission is charged, but two stages are required, which takes much more time, and the user will have to pay the gas costs on his own.

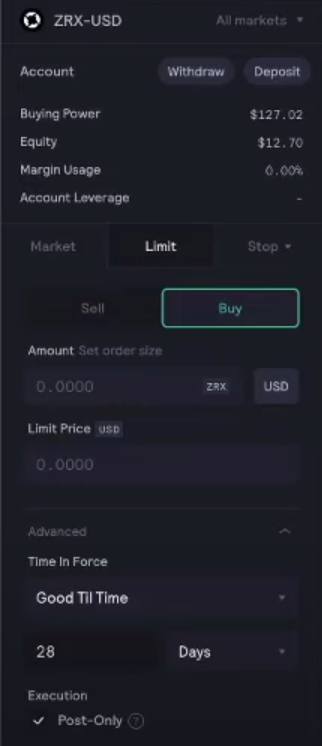

Types of orders

dYdX allows you to trade with up to 25x leverage. For Bitcoin and Ethereum, it is reduced to 20x.

To avoid significant losses, dYdX will liquidate your position after a certain threshold. Before entering a trade, the platform automatically calculates the liquidation price of the position.

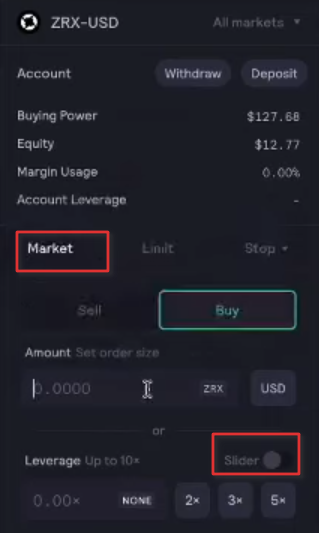

Market Order: To place a market order, click “Market” and select the trade direction. Then enter the amount and leverage value.

Leverage slider in a market order

When placing a market order, you can set the leverage using the slider. In this case, all indicators in the balance sheet will be automatically recalculated in real time. The liquidation price is displayed at the bottom right of the page.

In the lower left corner are the details of the expected transaction. If all the data is entered correctly, click “Buy/Sell market” and it will be added to your portfolio. If you change your mind and want to place a different type of order, click “Clear” in the same window.

To close a position, you can create a limit order that will sell tokens at a specified price under certain conditions.

When filling a limit order, the platform will automatically enter the same leverage that was used in the previous buy order.

Limit order

When placing a limit order, you can specify an expiration date, or choose between the “Fill or cancel” and “Immediate or cancel” algorithms. Also, to avoid layering of several orders, you can mark the order as “post-only”.

Because the trade is only executed if the price crosses the limit price, the position remains open until then. You can also exit an open position at any time by manually clicking “Close Position” at the bottom of the “Trade” tab.

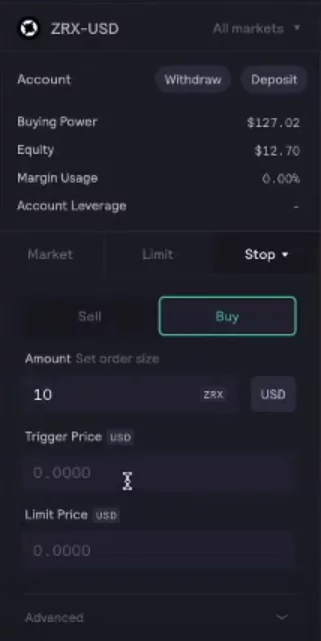

dYdX also allows you to place stop-loss orders to minimize capital loss due to market volatility. If the price of an asset falls, the position will be closed before the platform can liquidate it.

Stop orders

To place a short position, select Stop from the left menu. Select an order type and set the trigger and limit prices if needed.

dYdX: other

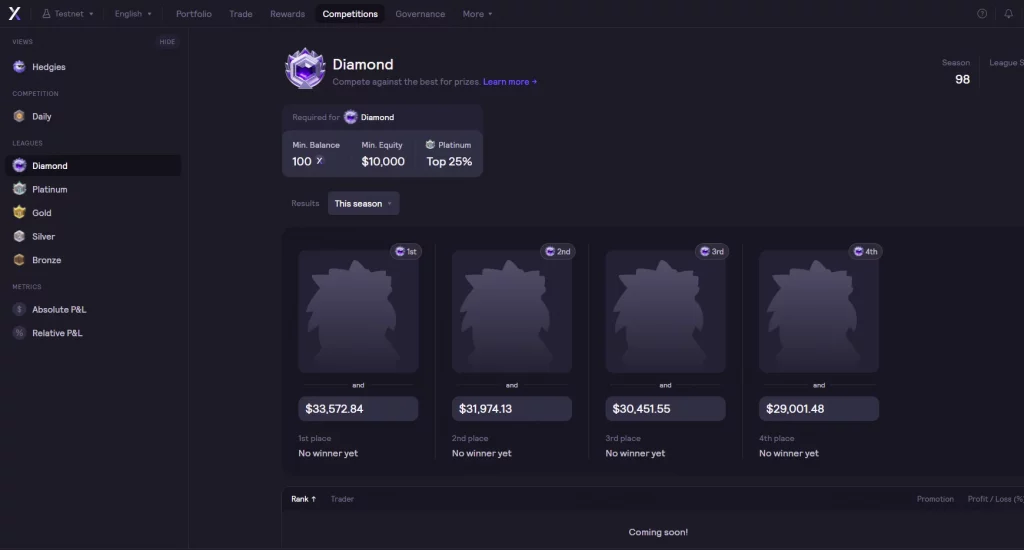

On the platform, you can also join “Competitions” (tab in the top menu). In Leagues, users are encouraged to move up the ranks, competing with other traders and winning cash prizes.

Competitions page

Also, winners in different categories can win unique avatars from the Hedgies series, presented in the form of NFT tokens.

NFT-avatars Hedgies

Under the “Management” tab, you can go to a separate community management site where you can stake the dYdX coin in different pools (as well as offer your own), and participate in voting and other activities related to the platform.

Conclusion

Derivatives trading is considered risky and is not recommended for beginners. However, for those looking to trade perpetual futures, the dYdX exchange might be the best place to start. With high liquidity, a large number of supported assets, and low fees thanks to StarkWare technology, dYdX is a serious competitor to the most famous centralized exchanges.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT