How to Make Money Online for Beginners Through Crypto Trading: A Step-by-Step Guide

Cryptocurrency trading is a great way to earn online. With the increasing popularity of digital currencies like Bitcoin and Ethereum, it presents abundant opportunities for remote work, accessible to anyone with an Internet connection and a willingness to learn. CScalp explores how to make money online for beginners in crypto trading, the potential for fast earnings, popular strategies, and more.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Understanding Cryptocurrency Basics

Before diving into how to make money online for beginners in crypto trading, it’s important to highlight the basic concepts of cryptocurrencies, how they operate, and the potential of day trading.

What Is Cryptocurrency?

A cryptocurrency is a digital or virtual currency that employs cryptography for security and operates on a decentralized network, typically a blockchain.

Unlike traditional currencies, crypto transactions occur directly between peers without the intermediation of a central authority like a bank. The first and most well-known cryptocurrency is Bitcoin (BTC), but there are thousands of others, including Ethereum (ETH), known for its smart contract functionality.

Freepik

How Cryptocurrencies Work

Cryptocurrencies work on a technology called blockchain, which is a distributed ledger recording all transactions across a network of computers. This ensures that each digital asset, or “coin,” has a unique identity and ownership history.

Day Trading as a Way to Make Money

Day trading cryptocurrencies involves buying and selling digital assets within the same trading day. Profiting from short-term price movements requires knowledge of market patterns, strategies, and trading software.

As you embark on day trading, you’ll need to understand the concepts of order books, trading pairs, and learn to interpret technical analysis charts to make informed decisions and manage your cash flow effectively.

To take full advantage of day trading, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to your preferred exchange and place orders with one click, as well as automatically manage your risks.

Tools to Reach Fast Crypto Profits

To succeed in cryptocurrency trading, you have to leverage the right tools and platforms. These tools can help you make informed decisions, execute trades efficiently, and maximize your profit potential. Here are some important tools to consider:

- Cryptocurrency Exchanges: Choose cryptocurrency exchanges that offer a wide range of trading pairs, competitive fees, and robust security features. Exchanges like Binance, Bybit, HTX, or OKX provide user-friendly interfaces and advanced trading functionalities to help you capitalize on market opportunities in the finance sector.

- Trading Terminals: Utilize trading terminals or platforms like CScalp to access real-time market data, advanced charting tools, and technical analysis indicators. CScalp, specifically designed for intraday trading, offers professional trading tools and a supportive community to help you succeed.

- Trading Journals: Trading Diary created by CScalp allows you to automatically record your trades and evaluate performance. Review your past trades to identify success patterns or mistakes, ensuring continuous improvement in your trading tactics.

- Wallets: Safeguard your digital assets by storing them in secure cryptocurrency wallets. While hardware wallets like Ledger Nano S or Trezor offer offline storage and enhanced security features, software wallets like MetaMask or Trust Wallet provide convenient access to your assets.

- Crypto Screeners: The CScalp team has created a free crypto screener. It allows tracking and analyzing the price dynamics of perpetual futures on Binance, Bybit, and OKX cryptocurrency exchanges. The screener simplifies the trader’s task of searching for volatile assets and helps monitor the current funding on crypto exchanges. Additionally, TradingView charts are integrated into the screener for each instrument in case you need to check a chart pattern or perform technical analysis.

- Cryptocurrency News Aggregators: Stay informed about the latest news, market trends, and developments in the cryptocurrency space with news aggregators like CoinDesk, CoinTelegraph, or CryptoSlate. CScalp’s community also provides valuable insights and updates to help you stay ahead of market movements and separate facts from truth.

- Educational Resources: Invest in your knowledge and skills by accessing educational resources and learning materials about cryptocurrency trading and investment. Platforms like Udemy or Coursera offer paid online courses, tutorials, and articles covering topics such as technical analysis, fundamental analysis, and risk management strategies. If you’re looking for free tutorials, CScalp offers courses and YouTube videos to help traders of all experience levels.

Setting up for Crypto Trading

Embarking on the journey of crypto trading starts with establishing a foundation to trade efficiently and securely. Carefully select your trading platform, ensure your assets are secure in a dedicated wallet, and optimize your trading process by connecting to a functional terminal.

Choose a Crypto Exchange

Your first step is selecting a crypto exchange that supports direct integration with the CScalp trading terminal.

- Compatibility: Check the exchange’s documentation or user support to confirm that it integrates with CScalp. Some popular exchanges include Binance, Bybit, OKX, and HTX.

- Available Trading Pairs: Look for a variety of trading pairs to have flexibility in your trading choices.

Create an Account on the Crypto Exchange’s Website

After selecting an exchange, you have to create an account on the exchange’s platform.

Security: Ensure your account has robust security measures. Activate two-factor authentication (2FA) and use strong, unique passwords.

Connect Crypto Exchange to the CScalp Trading Terminal

Connect your chosen crypto exchange to the CScalp trading terminal to facilitate swift trade execution and real-time market analysis.

- API Integration: You’ll generate an API key on your exchange and input it into CScalp to establish the connection.

- Security Measures: Grant necessary permissions to the API for trading activities and review the security tips provided by both the exchange and the CScalp terminal.

CScalp and Bybit connection process

Developing Trading Knowledge

To excel at crypto trading, you must grasp the basics of technical and fundamental analysis and familiarize yourself with various trading strategies. Building this foundation of knowledge can help you make informed decisions in the volatile world of cryptocurrency.

One key way to develop more trading knowledge and refine your approach is through interacting with other traders. Join our vibrant community of traders on the CScalp Discord server and begin absorbing knowledge from more experienced traders.

What is Technical Analysis?

Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements. You rely on charts and statistical tools to identify patterns, trends, and potential entry and exit points for trades.

Two key concepts you should know are:

- Support and Resistance: Support is a price level where a downtrend can be expected to pause due to a concentration of demand. Resistance is the opposite, acting as a ceiling where price hikes tend to stall.

- Indicators and Oscillators: Examples include the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), which help determine momentum and possible market direction.

What is Fundamental Analysis?

Fundamental analysis involves evaluating a cryptocurrency’s intrinsic value by examining related economic, financial, and other qualitative and quantitative factors.

Unlike technical analysis, which looks at price action, fundamental analysis considers:

- Project Longevity: The development team, technology, and community support behind a cryptocurrency can be indicative of its long-term viability.

- Market News and Events: Significant events such as regulatory updates or technological advancements can have profound impacts on a cryptocurrency’s price.

Learning Crypto Trading Strategies

A thorough understanding of trading strategies is crucial to navigating the crypto market. Each strategy varies in risk level and time commitment. A few approaches include:

- Day Trading: Taking advantage of intraday price movements by entering and exiting positions within the same trading day.

- Scalping: Profiting from small price gaps created by order flows or spreads. Platforms like the CScalp blog offer resources to hone this fast-paced strategy.

- Swing Trading: Capturing trends that play out over days or weeks, allowing for potentially higher gains than day trading.

Learn more about how to make money online for beginners with crypto trading strategy on CScalp’s YouTube channel.

Risk Management in Crypto Trading

To make money with crypto trading as a beginner, you need to understand and apply solid risk management strategies. The volatility of the market, the composition of your portfolio, and your personal risk tolerance will all play crucial roles in your trading success.

Understand Volatility

Cryptocurrency markets are highly volatile, with prices fluctuating widely and rapidly. Volatility reflects the degree of variation of a trading price series over time.

High volatility in cryptocurrencies can result from factors like limited liquidity, market news, and regulatory risk. To manage this risk effectively:

- Monitor market trends, news, and analyses regularly to stay informed

- Implement tools like Stop-Loss orders to automatically sell your crypto at a pre-set price to minimize losses

- Recognize and prepare for the possibility of sudden market movements causing substantial changes in your portfolio’s value

Diversify Your Portfolio

Diversification involves spreading your investment across various assets to reduce exposure to any single risk or volatility. In crypto trading, this may involve holding or trading a variety of different cryptocurrencies. Portfolio diversification can mitigate risk by:

- Balancing high-risk, high-reward cryptocurrencies with more established, stable ones.

- Investing in different categories of digital assets, such as coins and tokens, which can react differently to market events.

The Role of Risk in Crypto Trading

Risk in crypto trading is the potential financial loss that comes with investment decisions.

Effective risk management is critical in navigating the turbulent waters of cryptocurrency markets. To manage risk, you should:

- Assess your risk tolerance to understand how much volatility you can comfortably endure.

- Use risk management techniques such as setting a cap on the percentage of your capital you are willing to risk on a single trade, commonly between 1-2%.

- Stay updated on security practices to protect your investments from theft and hacking.

If you are preoccupied with risk management when trading, try utilizing the automatic Stop-Loss feature on the CScalp trading platform to protect your investments.

How to Execute Your First Trade

When you decide to make money online through cryptocurrency trading, understanding how to execute your first trade is essential. This includes navigating an order book, capitalizing on market fluctuations, and being aware of fees and expenses.

How to Use an Order Book

An order book is a list displaying all buy and sell orders for a specific currency pair, organized by price level. To interpret an order book, learn about these concepts:

- Bid: The highest price buyers are willing to pay.

- Ask (or Offer): The lowest price sellers are willing to accept.

- Spread: The difference between the bid and ask price.

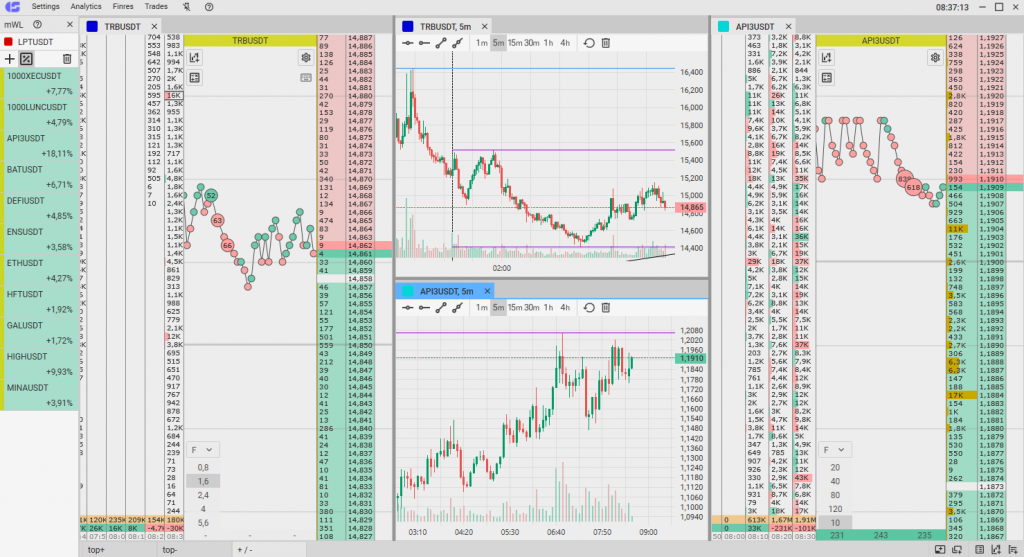

The order book is where you will place orders in CScalp. Identify where sellers’ orders are (in the red zone) and buyers’ (in the green). Place limit or market orders by clicking on the desired price.

Learn more about how to make your first trade in CSCalp.

CScalp professional trading terminal interface

Make Fast Money with Crypto Having a Wide Portfolio: Strategies for Swift Portfolio Growth in Crypto Markets

To make quick profits with crypto, day trading is the best option. However, having a diverse portfolio can also boost your digital asset’s growth. Spreading your investments and strategically approaching your trades, you’re aiming to seize the volatility and potential opportunities within the crypto space. Below, you’ll find several strategies crafted for swift portfolio growth in crypto markets:

- ICO Investments: Dive into Initial Coin Offerings (ICOs) of promising projects. Early-stage projects with solid fundamentals and innovative concepts can lead to rapid portfolio growth as they succeed post-launch.

- Staking Rewards: Earn additional tokens while supporting network security by staking your cryptocurrencies in networks that offer staking rewards. Opt for networks with high staking rewards and potential token appreciation to accelerate your portfolio growth.

- Arbitrage Trading: Capitalize on price differences across exchanges or trading pairs to yield quick profits. Buy low on one platform and sell high on another to exploit price inefficiencies and grow your portfolio.

- Yield Farming: Generate substantial returns by providing liquidity to various DeFi platforms. Earn trading fees, interest, or governance tokens to rapidly increase your crypto holdings through yield farming protocols.

- Identifying Emerging Trends: Stay ahead of the curve by investing in projects that pioneer new solutions or disrupt traditional industries. Rapid portfolio growth can be achieved as adoption increases for these emerging trends.

Airdrops: Accumulate free tokens by actively participating in airdrops of promising projects. Engage in crypto communities and stay updated on airdrop opportunities for swift accumulation of assets.

Alternative Ways to Make Money Fast with Crypto: Beyond Trading and Investing

Cryptocurrency mining involves validating and adding transactions to a blockchain network, typically in exchange for newly minted coins or transaction fees. While it requires initial investment in mining hardware and electricity costs, it can be a lucrative way to earn crypto over time. Here are some alternative ways to make money with crypto:

- Participating in Staking Pools: Joining staking pools allows individuals to combine their resources to increase their chances of validating transactions and earning staking rewards. This method provides a passive income stream without the need for specialized mining equipment.

- Participating in Initial DEX Offerings (IDO): Similar to ICOs, IDOs allow investors to purchase tokens of new projects at an early stage. These tokens are typically offered on decentralized exchanges (DEXs), providing an opportunity to profit from projects with high growth potential.

- Providing Liquidity to Automated Market Makers (AMMs): By supplying liquidity to decentralized exchanges or liquidity pools, investors can earn trading fees and rewards in the form of liquidity provider (LP) tokens. This strategy involves pairing two assets and contributing them to a liquidity pool to facilitate trading.

- Participating in Yield Aggregators: Yield aggregators automatically allocate funds to various DeFi protocols to maximize returns. Users deposit their assets into these platforms, which then distribute them across multiple protocols to earn interest, rewards, and trading fees.

- Trading Non-Fungible Tokens (NFTs): NFTs are unique digital assets representing ownership of digital art, collectibles, or other items. Buying and selling NFTs on platforms like OpenSea or Rarible can yield quick profits, especially during periods of high demand for certain digital collectibles.

- Crypto Freelancing: Offer your skills and services in exchange for cryptocurrency payments. Platforms like Cryptogrind and Bitwage allow freelancers to find gigs and receive payments in various cryptocurrencies, providing an alternative way to earn crypto online.

- Becoming a Liquidity Provider for Synthetic Assets: Synthetic asset platforms allow users to mint and trade synthetic assets that track the value of real-world assets like stocks, commodities, or fiat currencies. By providing liquidity to these platforms, users can earn rewards in the form of trading fees and incentives.

- Participating in Airdrops and Bounty Programs: Keep an eye out for airdrops and bounty programs offered by new blockchain projects. By completing tasks, such as social media promotion or bug reporting, participants can earn free tokens or rewards from these projects

- Crypto Affiliate Marketing: Promote crypto products, services, or exchanges through affiliate marketing programs. By driving traffic or referrals to these platforms, affiliates can earn commissions or rewards based on the actions of referred users.

How to Make Money Online for Beginners – Conclusion

Making money online with Bitcoin for beginners encompasses a spectrum of strategies that range from rapid day trading to the patient approach of long-term holding. Crypto trading with professional platforms like CScalp offers a gateway to the dynamic world of digital currencies, where understanding market trends, leveraging technical analysis, and utilizing the right tools is paramount.

Stay informed, stay adaptable, and utilize platforms and communities that bolster your trading acumen, like CScalp, to turn the volatile landscape of cryptocurrency into a land of potential profits and opportunities.

Related article: How to Make Money in An Hour with Crypto Trading: Proven Way to Make Money in an Hour

Frequently Asked Questions: FAQs About How to Make Money Online For Beginners

Making money online, particularly through cryptocurrencies, can feel like stepping into uncharted territory for beginners. To help you navigate this exciting landscape with confidence, we’ve compiled answers to some frequently asked questions that often arise as you begin exploring the possibilities of earning money online with cryptocurrencies.

What Are Some Factors to Consider for Beginners to Make Money in Cryptocurrency?

Here are some key factors to consider:

- Basic Trading Concepts: Before diving headfirst into trading, take the time to familiarize yourself with fundamental trading concepts such as order books, trading pairs, and order types.

- Technical Analysis: Technical analysis involves studying historical market data, primarily focusing on price and volume, to forecast future price movements. By analyzing charts and utilizing various technical indicators and tools, beginners can identify patterns and trends in the market, helping them make informed trading decisions. Learning how to interpret candlestick patterns, support and resistance levels, and momentum indicators can significantly enhance your trading strategies.

- Risk Management: Effective risk management is essential for any trader, especially beginners. Establishing risk management techniques, such as setting Stop-Loss orders and determining your risk tolerance, can help mitigate potential losses and protect your capital. It’s essential to never risk more than you can afford to lose and to always have a clear exit strategy in place before entering any trade.

- Continuous Learning: The cryptocurrency market is dynamic and constantly evolving, making continuous learning a vital aspect of your trading journey. Stay updated on market trends, news, and developments within the crypto space through reputable sources, community forums, and educational resources. By staying informed and adaptable, you can better navigate the ever-changing landscape of cryptocurrency trading.

Which Platforms Are Recommended for Beginners to Start Crypto Trading?

Look for crypto exchanges or brokerage platforms renowned for their simplicity and robust security measures. Platforms like CScalp can be particularly beneficial, offering intuitive interfaces tailored for beginners and professionals, along with comprehensive educational resources to guide you through your initial steps. Ensuring the platform provides educational materials, reliable security features, and a straightforward interface can significantly ease the learning curve and enhance your trading experience as you embark on your crypto journey.

Is It Possible to Earn a Steady Income From Trading Cryptocurrency?

Yes, it is possible to earn a steady income from trading cryptocurrency. It’s important to acknowledge the inherent volatility of the market. Cryptocurrency prices can fluctuate wildly, posing significant risks to traders. Day trading, a method where positions are opened and closed within the same day, is one approach adopted by traders seeking to capitalize on short-term price movements. However, achieving consistency in income requires a deep understanding of market dynamics, risk management strategies, and disciplined trading practices. Success in cryptocurrency trading often involves continuous learning, adaptability to market conditions, and the ability to mitigate risks.

What Are the Potential Risks and Rewards of Trading Crypto as a Beginner?

As a beginner in crypto trading, you have to understand both the potential risks and rewards associated with this endeavor. The potential rewards can be enticing, with the opportunity for high returns due to the market’s inherent volatility. Cryptocurrency markets can experience rapid price fluctuations, presenting opportunities for traders to profit from these movements.

However, it’s equally important to recognize the substantial risks involved. Cryptocurrency prices can indeed fluctuate wildly, leading to significant losses if not managed properly. The volatility of the market, coupled with factors such as regulatory changes, market sentiment, and technological developments, can amplify these risks.

It’s crucial to approach crypto trading with caution and to implement robust risk management strategies. This may include diversifying your portfolio, setting Stop-Loss orders to limit potential losses, conducting thorough research before making investment decisions, and staying informed about market trends and developments. By understanding and mitigating these risks, beginners can navigate the crypto markets more effectively and increase their chances of success over time.

How Much Initial Investment Is Typically Needed for Beginners to Start Making Profits in Crypto Trading?

For beginners looking to start making profits in crypto trading, it’s possible to begin with a relatively small investment. We suggest you start learning to trade through CScalp with a minimum deposit of $10. As you gain experience and confidence, increase your working volume accordingly.

Can Beginners Learn to Generate Regular Returns From Cryptocurrency Trading, and How?

As a beginner, you can learn to generate regular returns from cryptocurrency trading by following a few key steps. Firstly, dedicate yourself to learning. Gain a thorough understanding of the cryptocurrency market, including fundamental concepts and trading strategies. Secondly, apply prudent trading strategies. Start by familiarizing yourself with risk management techniques, such as setting stop losses to limit potential losses. Additionally, begin with small trades to gain valuable experience without risking significant capital. As you gain confidence and experience, gradually increase the complexity of your trading strategies and the size of your trades. Consistent learning, practice, and adaptability are key to generating regular returns with cryptocurrency trading.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT