CScalp explains the basics of short-term trading, the different strategies to choose from, and the pros and cons of each method. We will also show how to trade crypto short-term and highlight common mistakes to avoid.

Basics of Short-Term Cryptocurrency Trading

Short-term trading involves buying and selling digital assets within a relatively short period, ranging from minutes to a few days. Unlike long-term trading, which focuses on holding assets over a longer period for gradual profits, short-term trading aims to capitalize on short-term price fluctuations for quick gains.

To engage in short-term trading, it is crucial to understand the fundamental principles of this approach. One essential aspect is technical analysis, which involves studying historical price data, patterns, and indicators to identify potential entry and exit points.

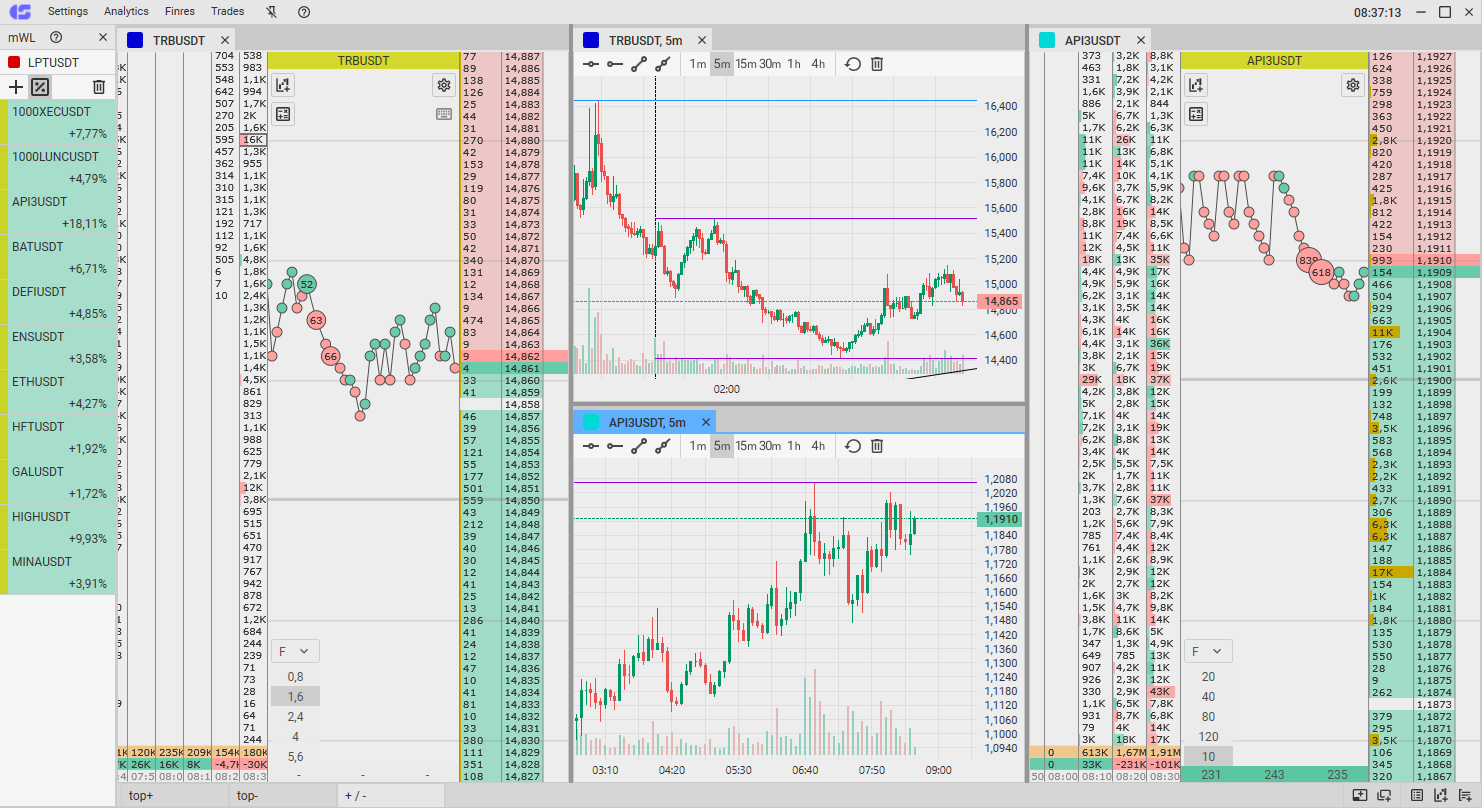

Technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can provide insights into market trends and potential buying or selling opportunities. By interpreting these indicators, traders can make informed decisions based on price movements and market momentum.

Furthermore, it is important to stay updated on relevant news and developments in the crypto market. News regarding regulatory changes, partnerships, or technological advancements can significantly impact the value of cryptocurrencies. Traders should regularly monitor reputable sources to stay informed and adjust their strategies accordingly.

Risk management is another critical aspect of short-term trading. Due to the inherent volatility of cryptocurrencies, it is vital to set strict Stop-Loss orders to limit potential losses. Traders should also determine their risk tolerance and allocate capital accordingly, ensuring they do not overexpose themselves to high-risk trades.

Choosing the Right Strategy to Trade Cryptocurrency

When it comes to short-term trading, selecting the appropriate strategy is crucial for maximizing potential profits while managing risks.

- Scalping: Scalping is a short-term trading strategy that focuses on taking advantage of small price movements within a short timeframe. Scalpers aim to make numerous trades with small profits per trade. This strategy requires quick decision-making, technical analysis proficiency, and diligent risk management.

- Day Trading: Intraday trading involves capturing medium-sized price movements within a single trading day. Day traders aim to close all their positions before the market closes to avoid overnight risks. To excel in day trading, you'll need strong technical analysis skills, as well as the ability to adapt to volatile market conditions.

- Swing Trading: Swing trading targets larger price movements over a medium-term timeframe, ranging from a few days to several weeks or even months. Swing traders hold positions for longer periods compared to scalpers and day traders. Proficiency in technical and fundamental analysis and the ability to manage long-term risks are essential for swing trading success.

Remember, there's no one-size-fits-all strategy for short-term trading. Your choice should align with your risk tolerance, time availability for analysis, and your experience level in trading cryptocurrencies.

The Pros and Cons of Different Short-Term Trading Strategies

There are several methods that traders employ to capitalize on price fluctuations. Each method has its own advantages and disadvantages, and it's important to understand them before deciding which one suits your trading style. Here are the pros and cons of different short-term trading methods:

Scalping Pros

- Quick Profits: Scalping involves making many trades over the course of a day, with each trade seeking small profits. This can accumulate to a significant total by the end of the day.

- Less Exposure to Market Risk: Since positions are held for a very short period, the exposure to market risks like major news events or overnight price changes is minimized.

- High Liquidity: Scalping usually occurs in high-liquid markets, which allows for faster execution of trades at desirable prices.

Scalping Cons

- High Stress and Time-Consuming: Scalping requires constant market monitoring, quick decision-making, and immediate action, making it a high-pressure and time-intensive trading method.

- Transaction Costs: Frequent trading can lead to higher transaction costs, which can eat into profits.

- Requires Significant Discipline: Scalping requires strict adherence to exit strategies to avoid large losses on individual trades.

Day Trading Pros

- No Overnight Risk: Day traders close all positions before the market closes, which protects them from overnight market volatility.

- Potential for Quick Returns: Day trading can yield quick returns, as traders take advantage of intraday price movements.

- More Opportunities: Since day trading involves taking multiple trades in a day, it provides more opportunities to profit from short-term price movements.

Day Trading Cons

- Time-Consuming: It requires a significant amount of time and attention during trading hours.

- High Stress: Constant monitoring of market fluctuations can be stressful.

- Risk of Significant Losses: Day trading can be risky, as traders have to make quick decisions, which may not always be accurate.

Swing Trading Pros

- Less Time-Consuming: Swing trading involves holding positions for several days to weeks, requiring less constant market monitoring compared to day trading or scalping.

- Potential for Larger Gains: By holding positions for a longer period, swing traders can capitalize on larger market movements.

- Flexibility: Swing trading is more flexible and can be easier for those with a full-time job or other commitments.

Swing Trading Cons

- Overnight Risk: Holding positions for several days exposes traders to overnight and weekend market risks.

- Requires Patience: Profits are realized over a longer period, requiring patience and a longer-term view of the market.

- Less Frequent Trading Opportunities: Swing trading provides fewer trading opportunities compared to day trading, which may limit potential profits.

Each strategy requires a different set of skills and mindset, making it important for traders to assess their own capabilities and preferences before diving into one of them

Step-by-Step Guide to Start Trading

After you have chosen your trading strategy, it is time to create your trading environment. Below is a detailed guide that will walk you through the essential steps to begin your trading journey, especially if you're keen to learn how to trade cryptocurrency. We'll cover everything from selecting a trading platform to understanding the associated risks.

1. Sign Up With an Exchange

Cryptocurrency exchanges act as intermediaries between you and the markets. Select an exchange with a strong reputation, transparent fee structure, and robust customer support. It is also important that an exchange of your choice is compatible with professional trading platforms like CScalp.

For an optimized trading experience, integrating CScalp with your preferred crypto trading exchange is a game-changer. This integration not only simplifies your trading processes but also enriches your market analysis capabilities. The connection between CScalp and various exchanges through API keys enables you to enjoy a centralized trading platform, where efficiency and speed are paramount.

2. Open a Trading Account

To start trading, you will have to open an account. This typically involves providing personal information and completing a KYC verification process. Ensure that your exchange is compliant with relevant regulations to safeguard your funds and personal data.

3. Fund Your Account

After you've signed up with a crypto broker and opened your account, you will need to fund it. This usually involves transferring fiat currency or cryptocurrencies into your trading account. Make sure to understand the deposit methods, fees, and processing times associated with funding your account.

4. Choose a Professional Trading Platform

Trading platforms are your gateway to the markets. Look for platforms that offer a user-friendly interface and a wide range of tools and resources. This will help you make informed decisions and manage your trades efficiently.

To take full advantage of short-term trading, try the professional trading platform CScalp by leaving your email in the form above. With the free terminal, you will be able to connect to an exchange and place orders with one click, automatically set Stop-Loss and Take-Profit targets, as well as manage your risks.

7. Start Trading

With your account funded and a firm grasp of the trading platform, you're ready to start trading. Begin with small trades to understand the market dynamics and gradually increase your exposure as you gain more experience and confidence.

8. Continuous Learning and Adaptation

The crypto market is constantly evolving, and successful traders never stop learning. Stay updated with market trends, continuously refine your strategies, and be prepared to adapt to changing market conditions.

9. Risk Management

Always be mindful of the risks involved in trading cryptocurrencies. Use Stop-Loss orders to protect your capital and never invest more than you can afford to lose. Don’t forget to be aware of the emotional aspect of trading.

By following this detailed guide, you will have a strong foundation to start your trading journey. Remember, trading involves significant risk, and it's important to approach it with caution, education, and a clear strategy.

Common Mistakes to Avoid in Day Trading

There are several common mistakes that traders should be aware of and avoid. By understanding these mistakes, you can improve your trading strategy and increase your chances of success.

Lack of Research and Analysis

One of the biggest mistakes that traders make is jumping into short-term trading without conducting proper research and analysis. Without a solid understanding of the market and right tools as the CScalp’s free crypto screener, you may make decisions based on speculation or rumors, which can lead to poor trading outcomes.

Ignoring Risk Management

Risk management is a crucial aspect of any trading strategy, especially in the volatile world of cryptocurrencies. Many traders make the mistake of not setting Stop-Loss orders or using proper risk management techniques. As a result, they expose themselves to significant losses if the market moves against them. It is essential to set realistic profit targets and implement risk management strategies to protect your capital.

Remember that CScalp has implemented an automatic Stop-Loss feature that you can use to protect your assets.

Overtrading and Lack of Patience

Overtrading is a prevalent mistake among short-term traders. Trying to take advantage of every market opportunity can lead to exhaustion and poor decision-making. It is crucial to be patient and wait for high-probability trading setups.

Emotional Trading

Emotions often influence trading decisions, and it is important to control them when engaging in short-term trading. Fear of missing out (FOMO) or panic selling during market downturns can lead to poor outcomes. Developing a disciplined approach and sticking to your trading plan can help mitigate emotional biases.

How to Trade Crypto Short-Term – Conclusion

Short-term crypto trading offers an exciting opportunity to capitalize on the frequent price movements within the crypto market. However, it requires a mix of astute market analysis, disciplined strategy implementation, and effective use of trading tools. Whether you opt for scalping, day trading, or swing trading, each method comes with its unique set of challenges and rewards.

To excel in this arena, choose the best crypto exchange and trading platform that aligns with your strategy. Platforms like CScalp provide an intuitive interface and advanced features like one-click trading and automatic Stop-Loss/Take-Profit settings, which are crucial for rapid decision-making and risk management. Remember, the key to success lies in continuous learning, adapting to market changes, and maintaining a balanced approach towards risk and reward.