“DEX vs CEX. Decentralized and Centralized Crypto Exchanges Comparison”

Cryptocurrency exchanges can be divided into two groups: Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs). Both are widely used in the cryptocurrency space, each in its own way. In this article, we’re going to cover the main similarities and differences between DEXs and CEXs.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

Centralized exchanges (CEX)

A centralized exchange is run by a central entity. This entity can be either real or virtual. In a CEX, all of the platform’s decision-making is concentrated in one place, and is out of the reach of the platform’s users.

This type of exchange holds their users’ funds in custody and dictates the rules of using the platform. Users of centralized exchanges face a tradeoff: no agency over their funds and no say in the direction of the platform in exchange for the safety of their funds and the overall convenience the platform offers.

The most prominent centralized exchanges include Binance, ByBit, Kraken, Huobi, OKX, Phemex, KuCoin, Bitfinex, Bitstamp, and many more. Most of the exchanges listed above are present in the CScalp trading terminal.

Compliance & Regulation

Centralized exchanges offer custody and protection of user funds. For that, they need to be officially registered as enterprises. Being officially registered implies being compliant and following legislation. So, CEXs have to be compliant and follow all major regulations of the legislations they operate in.

That said, the exact degree and manner of compliance will vary by legislation. For example, Coinbase is registered in the US and has to satisfy every request of the SEC. Binance, in turn, is registered in the Cayman Islands, which allows it to be more flexible in the way it complies and choose its own way and degree to which it implements restrictions.

Custody of user funds

Once a user deposits funds on a centralized exchange, these funds are no longer the user’s. They are now held by the exchange and managed on the behalf of the user. In case there’s a data breach and the funds are compromised, the exchange will be held accountable. At best, it will have to repay the user the full amount of the funds compromised.

At worst, if the platform doesn’t have enough funds to repay its users, it will have to be held accountable otherwise – through court and regulatory pressure. Thus, the law becomes the middleman ensuring that the user’s funds are safe, or can at least be recovered if need be.

Bank Integration & Fiat support

Compliance opens up a lot of integration potential for centralized exchanges. As CEXs integrate into the banking system, there’s a lot of fiat support on most major centralized exchanges. Many of them allow users to deposit, trade, and withdraw fiat money, while some support only one or two of these operation types.

KYC

Another major tradeoff on centralized exchanges is KYC identity verification. Users have to submit their IDs and/or other personal data to be able to access the full functionality of an exchange. Some of the major exchanges, such as Binance, require you to do KYC before you can use the platform. Others, like Phemex and KuCoin, have more loose KYC policies, allowing you to use the key features of the exchange without submitting you details. They only require KYC to get advanced trading capabilities. Even if you don’t do KYC yet, in most cases you’ll have to submit your phone number and/or email address, which all but elimitanes anonymity when using CEXs. On the whole, KYC is pretty much synonymous with centralized exchanges.

P2P markets

Centralized exchanges are becoming less of one-trick ponies and more of full-on crypto hubs offering much beyond mere cryptocurrency swapping. Most regulated crypto exchanges offer P2P marketplaces where users of one exchange can trade directly with each other. P2P can be used for arbitrage trading, or as a means of quickly depositing and withdrawing funds.

The convenience of P2P markets on CEXs is multiplied by the number of payment methods supported. Most major centralized exchanges are built so that virtually anyone with any amount of fiat on any bank card or digital wallet can jump in and quickly deposit their funds on (or withdraw them from) a CEX using P2P.

Blockchain support & transaction record

Centralized crypto exchanges, first and foremost, allow people to trade cryptocurrencies. For that, they naturally need to support blockchain tech. However, they can only keep track of cryptocurrency deposits and withdrawals. As soon as a user deposits their funds on a CEX, these funds will be kept in the exchange’s vault. All the deals made on that exchange will not be registered on the blockchain, because they’re not actually blockchain transactions.

Volume traded

As of this writing, centralized exchanges are industry standard. The overwhelming majority of crypto in circulation is traded via CEXs. These days, cryptocurrency trading is almost synonymous with names like Binance, ByBit, KuCoin, Huobi Global, etc. One major reason for that is the huge volumes traded on those exchanges.

What allows CEXs to have almost overwhelming volumes is described in the previous point – it’s the transaction record model. As no internal deals end up being registered on the blockchain, this leaves the servers of an exchange have a lot of free bandwidth that they can use to ensure split-second deal execution without hindrance. This makes CEXs a go-to for just about all professional traders worldwide, scalpers included.

Fees

Centralized exchanges charge fees arbitrarily. Most of them use a tiered Maker/Taker model. The tiers depend on the user’s KYC level, volume traded, native exchange’s tokens held, and other things. Deposit and withdrawal fees depend on the method selected: cryptocurrency transfers a charged accodring to the selected network, while fiat deposts and withdrawals are charged separately. Most times, depositing and withdrawing fiat is very expensive on CEXs 2-5% on average, although it does vary and may even be as low as 0% on some services.

Decentralized exchanges (DEX)

The goal of a Decentralized Exchange is to allow users to quickly swap their cryptocurrency for other tokens on-chain. For that reason, many DEXs are often called “Swaps”.

The first DEX of its kind was Ethereum-based Uniswap. Launched in 2017, it remains one of the key DEXs to this day.

No regulation

Decentralized exchanges (DEX) are Decentralized Finance (DeFi) exchange platforms that run on a blockchain network. Like all other DeFi products, they exist on the Web 3.0. DEXs do not have a single governing body. Instead, they’re run automatically by smart contracts or semi-automatically – by a joint effort of smart contracts, the developers, and the community.

Smart Contracts

Like any other DApps, Decentralized exchanges are fueled by smart contracts. Smart contracts are blockchain algorithms that execute automatically if a particular set of contritions is met. For example, if account A sends 1000 USDT to account B between 16:00 and 17:00 this Monday, account B sends 0.05 BTC to account A at 21:00 of the same day.

Smart contracts serve as an automated replacement for human workers and can potentially eliminate human error. They allow to quickly and automatically carry out operations that otherwise take a lot of effort man-hours. Potentially, this amounts to a more fluid user experience and more efficient trading. However, the bottleneck so far is the volumes. Besides, smart contracts can fall prey to hacks, in which case there’ll be no one to hold accountable.

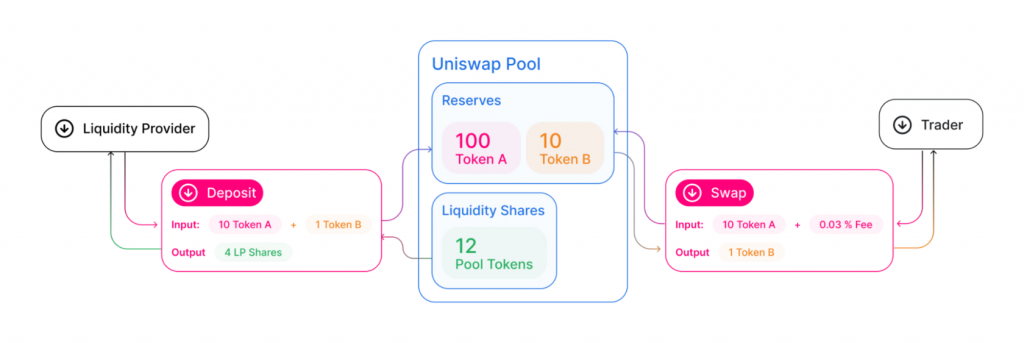

Liquidity Pools & Liquidity Mining

Automated Market Makers draw their liquidity from a dedicated pool of crypto assets, known as the “liquidity pool”. When a trader wants to buy or sell a crypto on an AMM type of DEX, they submit their cryptos to the smart contract. The contract requests an equivalent amount of the requested token from the liquidity pool, automatically swaps the submitted crypto and returns the newly swapped coins to the user.

On decentralized exchanges, anyone can add funds to the pool and thus become a liquidity provider. This is done by staking, i.e. locking up an equivalent amount of two different cryptos on the smart contract for a specific time period. The staked cryptos will serve as liquidity on the exchange, allowing other traders to use the pool for their swaps. Liquidity providers get a cut of the exchange’s transaction fees and other monetary rewards for their trust.

While their funds are locked, liquidity providers get LP tokens – tokenized obligations by the exchange to repay them at the end of their staking term. LP tokens can be traded or staked further just like any other crypto asset.

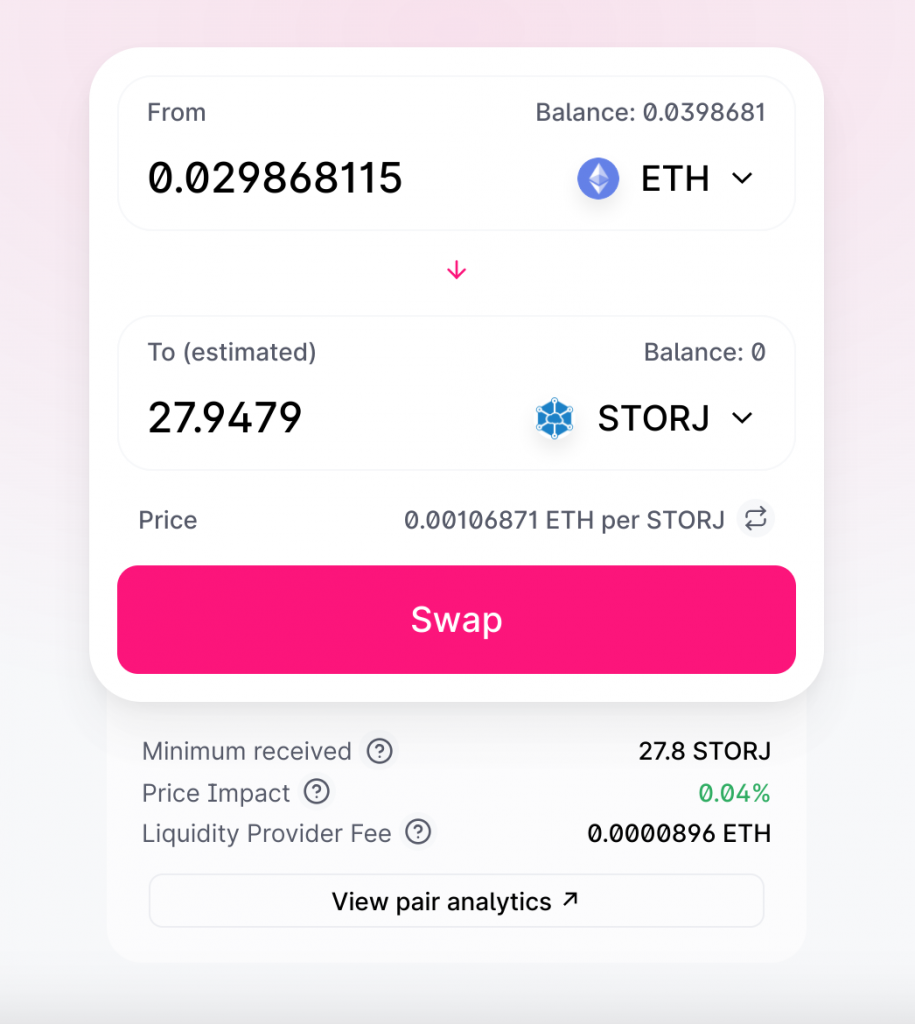

Order Book vs. AMM

Broadly speaking, there are two types of DEXs. They can be either order book-based, or AMMs (short for Automated Market Maker), or some sort of hybrid of the two. The first DEX in history was Uniswap, which also gave birth to the AMM genome. Such a DEX offers a simple, widget-like interface allowing you to quickly swap your crypto for another.

The most prominent examples of AMM-based DEXs include Uniswap on Ethereum, PancakeSwap and SushiSwap on Binance Smart Chain (BSC), Saber and Raydium on the Solana network, QuickSwap on Polygon, and Pangolin on Avalanche. This kind of exchange is not exactly fit for ‘traditional’ types of cryptocurrency trading, like swing trading, day trading, or scalping. The reason, among other things, is the lack of analysis tools. These DEXs serve more like auxiliary exchange widgets; they can be easily integrated into other decentralized apps (DApps) that may require their users to use specific crypto coins. So their goal is to serve as a tool of convenience.

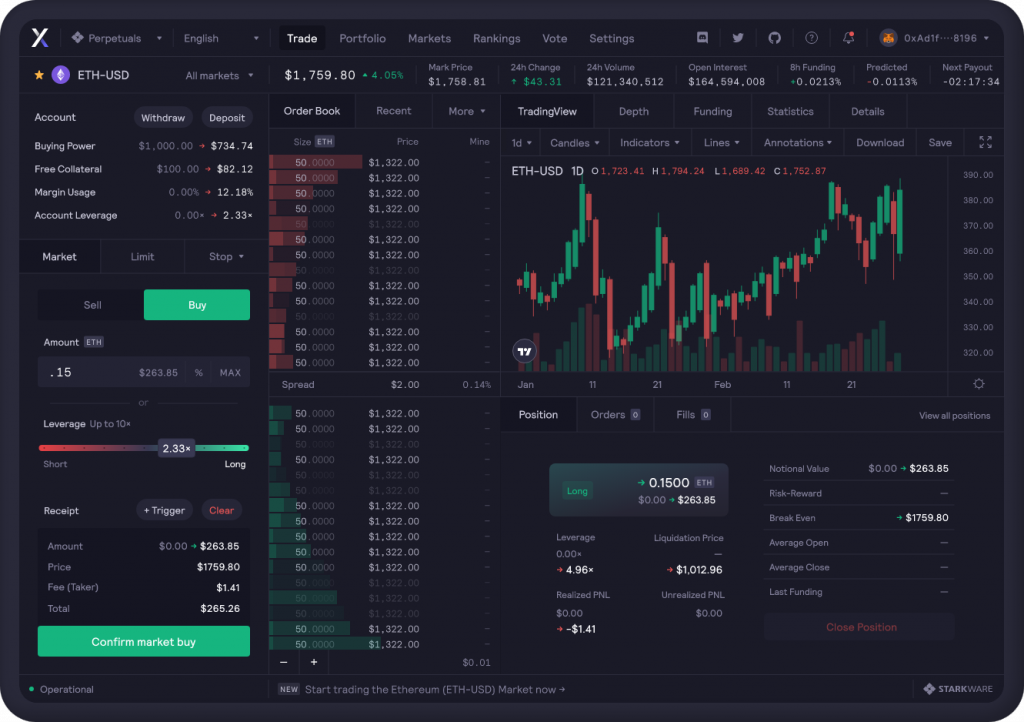

An order book type of DEX offers roughly the same trading toolkit as a centralized exchange. These include an order book, a price chart (candlestick and other types), a depth-of-market chart, different order types (Limit/Market/Stop-Loss etc.), leverage, and so on. This type of DEX aims to cater to the more discerning trader who seeks to do technical analysis and trade professionally without having to leave the DeFi field. By definition, this kind DEX runs on a blockchain, draws liquidity from the protocol, and is fueled by its governance token.

The most widely used order book DEXs are dYdX and IDEX on Ethereum, Serum DEX on the Solana blockchain, and Dexalot on Avalanche. dYdX is the only decentralized exchange supported in the CScalp terminal so far.

Liquidity and volume traded

Decentralized exchanges offer lower liquidity compared to their centralized counterparts. The reason is that blockchain transactions take a relatively long time to execute and. This puts off many users who are after speed and liquidity, resulting in overall lower volumes circulating in the DeFi segment. Also, the absence of fiat support makes DEXs inapproachable for many traders who are used to dealing with banks.

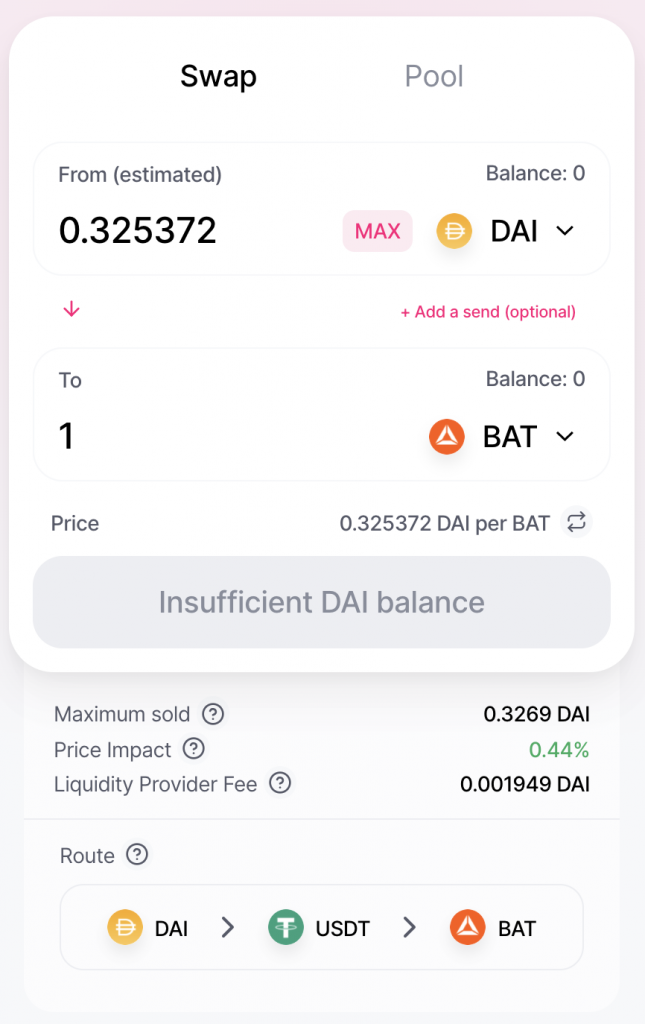

DEX Aggregators

To sole the liquidity problem of modern DEXs, liquidity aggregators are used. These are protocols that allow the assets to make more than one move along the conversion route, finding an optimal way across the connected liquidity pools.

For example, a user submits $1000 in DAI to swap for the equivalent in BAT, but there’s not enough BAT in the DAI/BAT liquidity pool. However, there is enough BAT in the USDT/BAT pool. To that end, a more complex route is built: the DAI is first swapped for USDT in the auxiliary pool, then the USDT for BAT in the main pool, and then the BAT gets returned to the user. Liquidity aggregators allow transactions to find complex routes like that across liquidity pools, protocols, and even different networks. Naturally, the longer the route, the longer the swap will take, and the more it will cost to the user.

The most popular DEX aggregators include 1inch, Rango, ParaSwap, OpenOcean, Orion Protocol, and Matcha.

Slippage & Impermanent loss

The two main downsides of swapping cryptos on DEXs are impermanent loss and slippage. Impermanent loss is the potential of losing out on the value of the staked cryptos. For example, a user stakes their ETH and USDT for 6 months, after which ETH sees a sharp drop in price. If the market stays at that level, the user’s funds at the end of the staking terms will be worth less than in the beginning. Thankfully, many DEXes and other DApps offer tools to predict and mitigate impermanent losses.

Slippage is the difference in price that occurs after the users has placed their order. If, after submitting a buy order, the price of the going sharply goes up, the user may end up buying it at a higher price. And vice versa – for sell orders, slippage may come out to a lower selling price. Most decent DEXs offer tools to manage your slippage tolerance before making a trade.

Governance model

The governance model on decentralized exchanges is called DAO, short for “Decentralized Autonomous Organization”. It implies governance by a virtual entity made up of the accounts and wallets of the platform’s users. Every change and development in the project’s lifecycle is first publically proposed within the DAO, then voted on with the platform’s own governance token. If the proposal gains enough votes, it becomes a task for the developers. The weight of each vote is proportional to the amount of tokens locked for it.

Community governance is something that’s simply not present in the centralized world – this makes decentralized exchanges especially attractive to users to want to have a say in the direction on the platform they’re using.

No fiat support

As decentralized exchanges have no integration into the banking system, they don’t support operations with fiat currencies. This puts a wall between DEXs and broader audiences – unlike on centralized exchanges, where you can swap fiat for crypto in an instant, DEXs require you to take multiple steps to convert your funds first. The closest you get to trading fiat is using stablecoins – crypto tokens whose price is pegged to that of another asset. The vast majority of stablecoins are pegged to the American Dollar. The most popular ones include USDT, USDC, DAI, and BUSD.

Self-custody

Decentralized exchanges don’t hold any of their users’ funds. To use a DEX, one must connect their crypto wallet to the exchange’s interface. This way, the platform will gain access to the wallet and will be able to transact with the user’s approval, but the funds always remain in the user’s account and their security are entirely the user’s concern.

This puts users at a fork: to assume full responsibility for their funds and any potential losses, or submit their data to centralized platforms in exchange for their custody services.

Transaction record

Every deal made on a DEX is a blockchain transaction. Therefore, it gets registered on the blockchain and can be easily tracked. The downside is that this clogs up the bandwidth, taking away from the potential liquidity and trading volumes. To that end, various blockchain solutions are used, including layer-2 solutions (Immutable X, Polygon, Polkadot), sidechains and parachains of different kinds. DEX creators are hard at work trying to solve the problem of bandwidth, but at this point, it’s still a problem to solve.

Fees

When trading on a decentralized exchange, a user trades directly with another user via a smart contract. When trading, they only pay commission per transaction. The size of the commission is dynamic and depends on the load on the blockchain network. Between the traders there are no intermediaries to charge them additional fees. Therefore, in theory, the commission on decentralized exchanges should be less than on centralized ones. In practice, with a high load on the blockchain network, the commission level can be absurdly high. Thus, in September 2020, after the rapid growth in the popularity of DeFi and the increase in the load on the Ethereum network, the commission per transaction on Uniswap exceeded $45.

Fake cryptos

As decentralized exchanges gain popularity, there’s an increasing danger of accidentally buying a worthless dud of a real coin. The DeFi ecosystem allows anyone to create their own tokens in minutes and get them listed on decentralized exchanges fairly easily. When trading a new crypto asset on a DEX, it pays to study the CoinGecko/CoinMarketCap profile of the coin first to make sure it’s the real deal.

Conclusion

On the one hand, decentralized exchanges are safer and more reliable than traditional ones. On the other hand, they provide fewer features and are not nearly as user-friendly. Decentralized exchanges are unlikely to become a full-fledged analogue of centralized ones due to number of factors described above. However, this does not take away the prospects for their development, since they are focused on other tasks than traditional exchanges.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT