WHAT IS SCALPING

Scalping is a type of intraday trading in the stock, Forex, or crypto markets. Scalping is considered one of the most complex types of trading because it requires not only fast and decision-making but also increased psychological resilience and long, hard hours during the working day.

Nevertheless, scalping is a very popular trading strategy, especially among newbies. The reason is that the results can often be seen instantly. However, it should be noted that scalping may provide the desirable result only when trading high-volatility currency pairs with low spreads.

It should also be noted that scalping didn’t use to be around because all the deals had to be done manually. However, a manual scalper is now an ‘endangered species’ as this strategy was automated long ago and evolved into HFT – high-frequency algorithmic trading. The only difference between the two is that HFT trades are executed and held for milliseconds. Manual trading at such speeds is simply impossible – that is why scalpers now make all trades using a dedicated trading terminal.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

KEY TAKEAWAYS:

- Scalping is an effective trading strategy, but it can only be efficient in a volatile market such as cryptocurrency. The inherent volatility of the cryptocurrency market makes it ideal for scalping, as traders can use small price movements to make big gains. Conversely, scalping equities, options, and Forex markets on average can’t be considered efficient due to the low volatility of those markets.

- The most suitable cryptocurrency for scalping is Bitcoin because of its decentralized nature. This cryptocurrency is not vulnerable to hacking and its price does not fluctuate depending on news or developer announcements.

- Scalpers must have adequate risk management strategies so as to minimize risks. To engage in scalping, it takes to develop a certain strategy and test it a dozen times with a small deposit or a demo account. Also, a scalper should realise that there is no room for gambling here – scalping must be treated responsibly, like a day job. In addition, it should be understood that this strategy, just like any other, may bring you big gains as well as big losses.

- The biggest upside of scalping is that it brings fast results. On the whole, scalping is fairly easy to understand and apply. It does not rely heavily on complicated indicators or fundamental analysis. Applying this strategy in practice, you can soon find yourself trading with ease. The downside of scalping is that it takes long hours in front of the screen and a lot of manual deals may get exhausting. Also, the scalper should focus all their attention on trading – it doesn’t forgive distractions.

- The scalper’s main tool is the trading terminal, which is superior to trading via a default exchange interface by just about every measure.

- If a trader has quick reflexes and can stay focused for as long as they have multiple trades open, then scalping is perfect for them.

What Is Scalping in Crypto Trading?

There are many different strategies for trading cryptocurrency. One of them is scalping, which involves making a large number of trades within a day. The point of scalping is to make small trades in large numbers – that is, dozens of quick trades throughout the day, each of which is supposed to make a few pips of profit.

The scalping strategy is based on insignificant stock price changes during the day and frequent market entries and exits during the trading session. The period of position holding lasts from fractions of a second to several minutes. That is why scalpers tend to follow short-term (one-minute, five-minute) or tick (with a timeframe of less than a minute) charts that reflect instantaneous changes in quotes.

Note: every scalper should set a maximum loss (drawdown) before the start of the trading day. If a trader exceeds the drawdown they should stop trading for that day.

It’s worth noting that you may read somewhere on the Web that professional scalpers often use trading bots. Roughly speaking, this approach has nothing to do with real scalping. Scalping is a type of manual trading where all trades are executed by hand within one session. The scalper’s main tool is the trading terminal – it helps the trader to analyze order books, market trading history, charts and diagrams, – in a complex way.

The profitability of scalping depends on many factors: the size of the deposit, the level of take profit and stop loss orders, and, ultimately, on the trader’s. But, most importantly, scalping requires extensive periods of focus and maximum attention from the trader.

Scalping vs Day Trading (Intraday Trading)

What is the difference between scalping and day trading?

The main difference is that when scalping, traders focus on proportionally short timeframes. The vast majority of scalpers use short timeframes – up to 2 minutes. The average time frame is generally less than 5 minutes.

Scalping is real-time trading, where the trader needs to constantly apply technical analysis and also analyse the order book.

Day traders also use smaller timeframes. For example, these traders cannot use the four-hour chart because each bar on the chart corresponds to a four-hour time period. There are only six periods that long in a day, so it wouldn’t make sense to rely on those in day trading – only for general trend analysis. In addition, day trading does not require you to analyse the crypto market, and a deal normally lasts much longer than in scalping.

Scalping vs Swing Trading

What is the difference between scalping and swing trading?

Scalping and swing trading are two of the most popular short-term trading strategies used by traders.

Scalping involves making multiple trades in a day, while positions are held for very short periods of time – sometimes only for a few seconds. As a rule, scalpers only use technical analysis in their trades.

Swing-trading implies a medium-term time frame of transactions, often from several days to several weeks. Swing traders often combine fundamental analysis tools with technical analysis to help themselves in making decisions.

Scalping vs Position Trading

What is the difference between scalping and position trading?

The main difference between the two strategies is the duration of an open trade.

Position traders have an average order execution time of one to five days. The fastest trades are closed within a few hours of opening them, and the longest deals may take two to three weeks to close.

As for scalping, the average deal lasts from a couple of dozen minutes to a couple of hours. The shortest deals can even be closed even in less than one minute. The longest trades can last till the end of the day.

Why is Cryptocurrency best for Scalping?

The crypto market is best for scalping because of its high volatility, which enables scalpers to capitalize on minute price movements to generate quick profits on a series of trades. This highly volatile nature comes with short-term bursts of volatility which scalpers take advantage of through leverage, consistency, and speed.

In addition, the crypto industry is a fairly young economic sector. Cryptocurrency continues to move in accumulation zones, so it is easy to learn technical analysis and practice scalping strategies on it.

Which Crypto is the best for Scalping?

Your choice of asset depends on your strategy and your willingness to take risks. The best cryptocurrencies for scalping are liquid coins with large trading volumes.

Bitcoin is a time-tested coin. Its price is more stable than that of other cryptocurrencies, so the probability of a significant capital loss is lower.

Altcoins are better suited for aggressive trading. Their price fluctuates much more drastically and more frequently, increasing both potential income and loss.

Top Platforms to Scalp Crypto

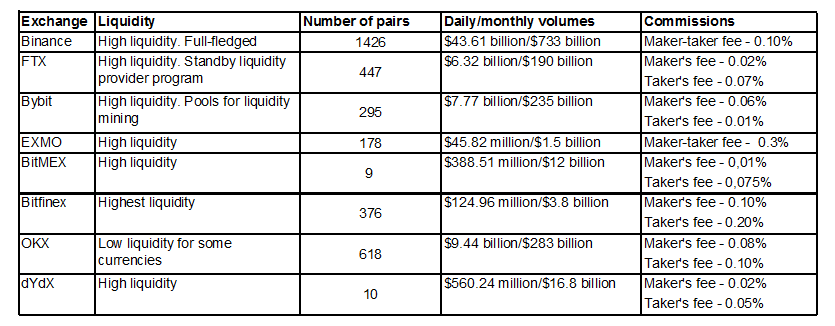

Binance

Binance’s interface

Binance is the world’s leading centralized cryptocurrency trading platform, founded in 2017 by Changpeng Zhao.

Liquidity: Binance has high liquidity. The exchange has a full-fledged program for liquidity providers on the Spot market – Spot Liquidity Provider Program.

Number of pairs: 1426 trading pairs.

Daily/monthly volumes: $43.61 billion/$733 billion.

Deposit/withdrawal: Deposits and withdrawals are available through the web version or in the mobile app. When depositing BTC, USDT, and ETH, there is no deposit fee. Withdrawal fees will depend on the cryptocurrency you withdraw and the choice of network. There is a minimum amount for each withdrawal request. If the amount is too low, you will not be able to make a withdrawal.

Trading Trading fees: The maker-taker fee on spot trading for regular users is 0.1%. In July 2022, Binance announced zero commission for BTC spot pairs and for ETH/BUSD more information about fees in this article.

Click on the “BINANCE 20% Discount” button, click on the link and open the account. Register a new e-mail account which is not used for Binance earlier.

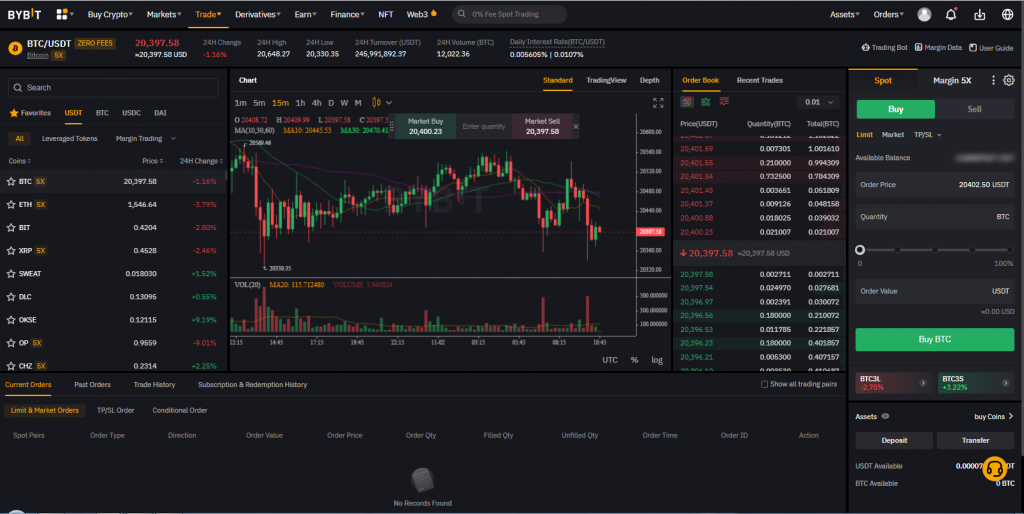

ByBit

Bybit’s interface

ByBit, a crypto exchange headquartered in Singapore, began operations in 2018 and is focused on cryptocurrency derivatives. Currently, users of the exchange have access to a spot market, ways to earn passive income, an NFT marketplace, a P2P platform, and more.

Liquidity: ByBit has high liquidity. In 2022, Bybit announced the launch of liquidity mining pools. Liquidity mining supports up to 3x leverage and allows exchange customers to earn up to 30% APY.

Number of pairs: 296 trading pairs.

Daily/monthly volumes: $7.77 billion/$235 billion.

Deposits & withdrawals: You can deposit and withdraw funds to Bybit through the website or the app. There is a daily withdrawal limit: a maximum of 100 BTC or 10,000 ETH. ByBit does not charge any fees for deposits and withdrawals – you only need to pay network fees.

Trading fees: 0.06% taker, 0.01% maker.

To get up to $4,000 first deposit bonus and a 10% discount on trading fees on Bybit, click on the “Sign up on Bybit” button below proceed with the sign-up. Once done, you will get a 10% discount on ByBit trading fees.

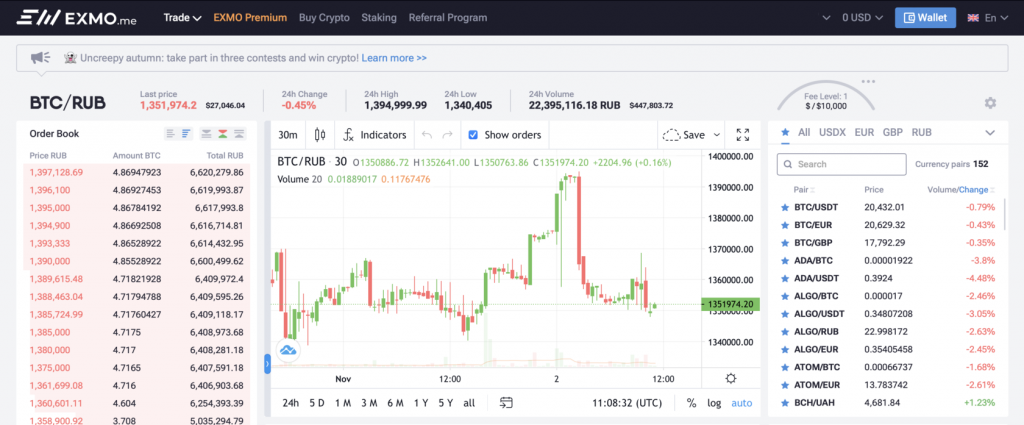

EXMO

The largest cryptocurrency and fiat trading platform, popular in Eastern Europe. In addition to cryptocurrencies, the exchange works with U.S. dollars, euros, hryvnias, zloty and other national currencies and allows you to use VISA/Mastercard to deposit and withdraw money.

Liquidity: High liquidity. EXMO draws and combines liquidity from leading trading platforms to make large deals with various assets with minimal market impact.

Number of pairs: 178 trading pairs.

Daily/monthly volumes: $45.82 million/$1.5 billion.

Deposits & withdrawals: EXMO does not charge any fees for depositing and withdrawing crypto. However, you still have to pay network fees. The minimum withdrawal limit is 0.002 BTC.

Trading fees: EXMO trading fees are 0.3% maker and 0.3% taker.

Interface of EXMO

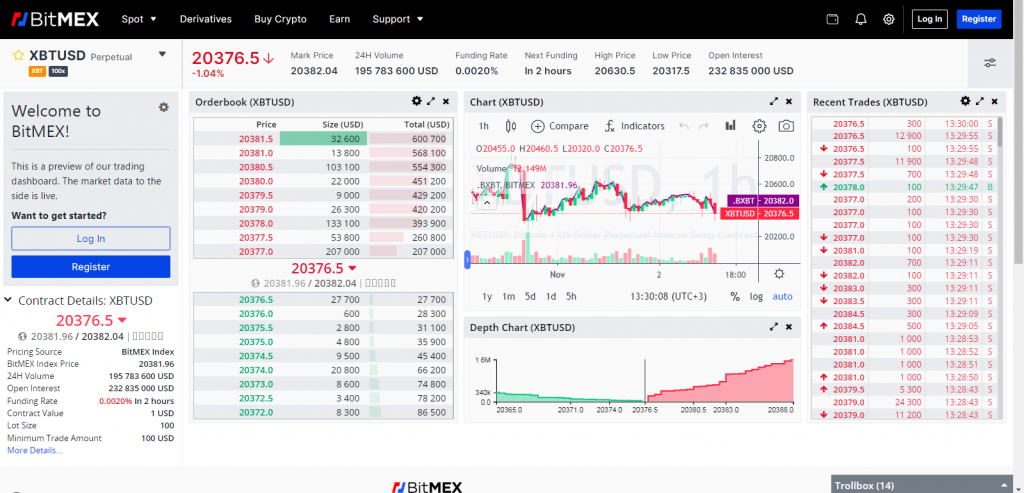

BitMEX

BitMEX is a popular P2P trading platform offering a lot of opportunities for profitable cryptocurrency trading, including leveraged trading. There is a testnet version for beginners and those who want to understand how to trade on BitMEX.

Liquidity: The exchange has one of the highest liquidity for Bitcoin perpetual futures contracts in the market.

Number of pairs: 9 trading pairs.

Daily/monthly volumes: $388.51 million/$12 billion.

Deposits & withdrawals: Funds can be withdrawn via the site or the mobile app. Deposits and withdrawals are made only in BTC. BitMEX does not charge anything for deposits and withdrawals. There are no limits for BTC withdrawals.

Trading fees: BitMEX trading fees are 0,075% taker and 0,01% maker.

Bitmex’s interface

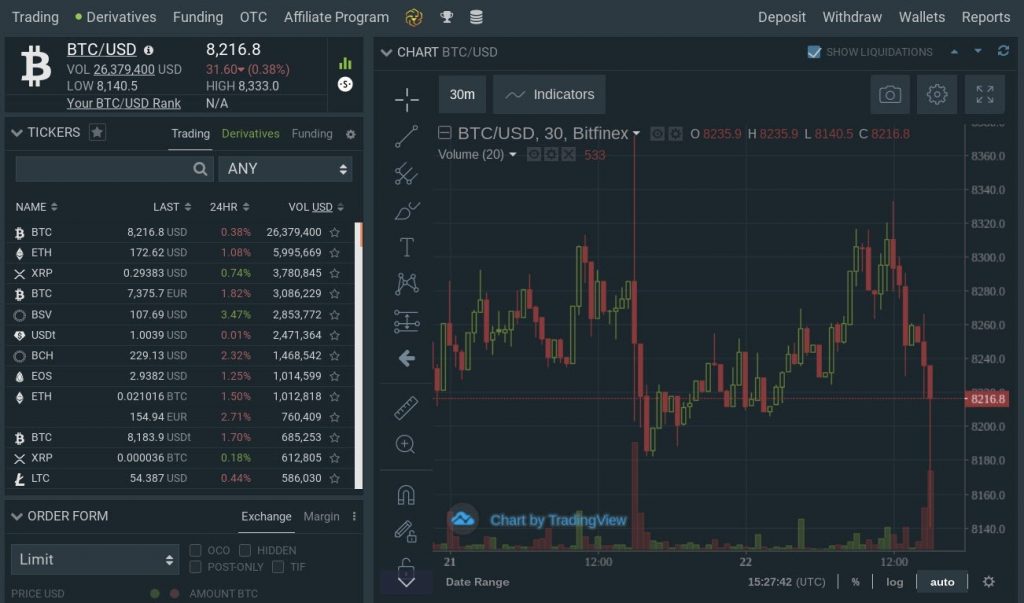

Bitfinex

Bitfinex.com is a large cryptocurrency exchange that has been extremely popular among online traders since 2014. Thanks to its advanced trading tools, the exchange is ideal for experienced traders. Bitfinex has the ability to trade with leverage and credit funds.

Liquidity: This exchange has the highest liquidity in the market.

Number of pairs: 376 trading pairs.

Daily/monthly volumes: $124.96 million/$3.8 billion.

Deposits & withdrawals: traders on Bitfinex do not pay any fees when making deposits in cryptocurrency. Withdrawal fees differ for each token and depend on the network load, transfer methods, and other factors. The minimum amount to withdraw cryptocurrency is the equivalent of $5.

Trading fees: Most traders are subject to either a 0.10% maker’s fee or a 0.20% taker’s more information here.

Bitfinex’s interface

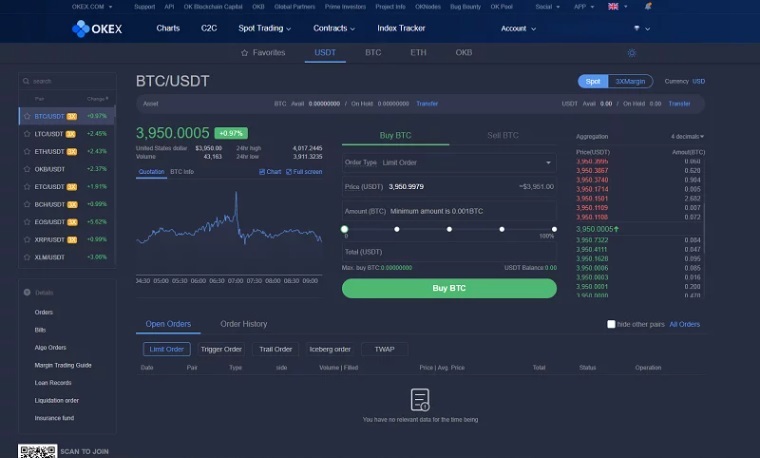

OKX

OKX is one of the best crypto exchanges as it supports advanced trading in over 200 countries worldwide. OKX features over 100 currency pairs for Tether, Bitcoin and Ethereum, making it one of the best crypto exchanges for international users.

Liquidity: Low liquidity for some currencies.

Number of pairs: 618 trading pairs.

Daily/monthly volumes: $9.44 billion/$283 billion.

Deposits & withdrawals: OKX users don’t pay for crypto deposits, but must pay a withdrawal fee of 0.0005 BTC for Bitcoins, 0.01 for ETH and 0.15 for Ripple. There is a minimum amount for each withdrawal request. For new/unconfirmed accounts the limit is 10 BTC/day, and for KYC passed accounts – 500 BTC/day.

Trading fees: OKX charges a trading fee of 0.10% for takers and 0.08% for makers.

Interface of OKX

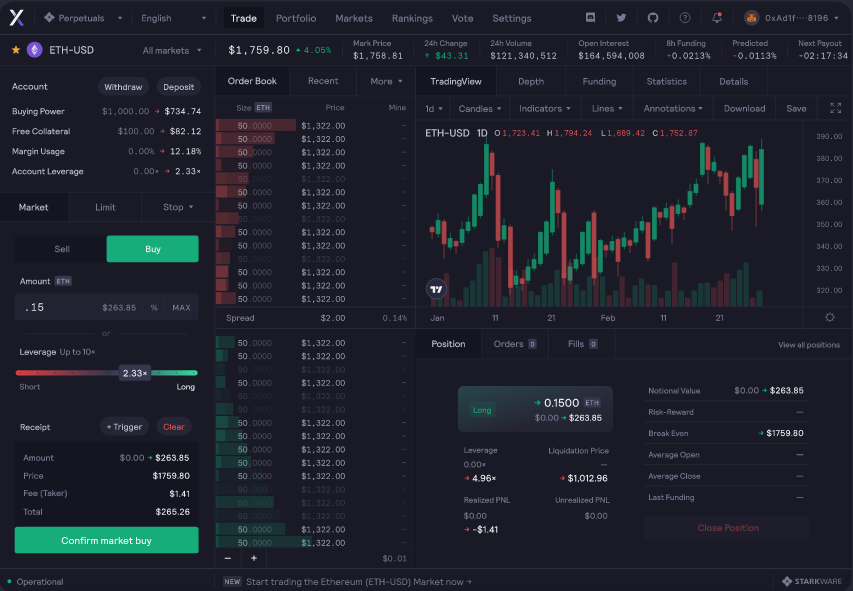

dYdX

dYdX is one of the leading decentralized crypto exchanges focused on trading perpetual contracts. It operates on the Ethereum blockchain. dYdX allows you to trade with up to 25x leverage.

Liquidity: High liquidity.

Number of pairs: 10 trading pairs.

Daily/monthly volumes: $560.24 million/$16.8 billion.

Deposits & withdrawals: There are no deposit or withdrawal fees on dYdX. Traders only have to pay network fees.

Trading fees: On dYdX, the takers are charged a fee of 0.05%, and the makers are charged 0.02%.

Interface of dYdX

Scalping Strategies

As a rule, scalpers don’t do fundamental analysis; instead, they rely on identifying short-term support and resistance levels. Traders analyze cryptocurrency price charts and order books, and conduct a technical analysis to understand where the price is going.

Also, when coming up with a strategy, one must remember that the goal of scalping is to make as much profit as possible in a short amount of time. This means that the key point is the entry and exit points. You should enter a trade at the beginning of a trend and exit when the trend is starting to show weakness.

There are two basic scalping strategies:

Breakdown trading

Trades on the breakdown of a level are a more reliable entry into the market.

What is a breakout level? Suppose that there’s a level that has been holding the price back for a while. Then the price goes out of it, i.e. breaks through it – signifying that the market intends to continue moving in the direction of the breakdown. The scalper needs to determine the breakout level and its potential strength, and then open a trade.

Trading on a rebound

The main point of this strategy is that you open positions as soon as the price bounces off the key levels, and close it according to indicator signals. With this strategy, the first thing a trader must do is to identify the downtrend. If there is one, build a trend line and wait for the signal (price rebound from the line). As soon as the price touches the line – open a sell position.

To trade successfully, it is crucial for a scalper to identify what phase the market is in right now: a breakout, a rebound or a false breakout. A false breakout occurs when the price moves above a level but does not have enough momentum to consolidate, and then slides back below the said level. Roughly speaking, this situation is a manifestation of ‘herd mentality’ in the market – when traders buy the tops and sell the bottoms. The main indicator of such a breakout is a small trading volume. In such cases, the candles have relatively small bodies, and the price is fixed in a very narrow price range. This means that the breakout momentum is very weak and the chart is likely to return into the previous channel.

Scalping Indicators

Indicators are special analytical tools that help chart analysis and facilitate decision-making in trading.

To understand what indicators to use for scalping, you need to know that indicators are divided into two types: trend indicators and oscillators. The former show the general direction of a dominating trend and the latter indicate overbought/oversold prices in a certain average range. There are also indicators based on volume data and other specific indicators.

Trend indicators

The most common trend indicator is the Moving Average (MA). It shows the average price of an asset over a specified time period. It is displayed on the chart in the form of a curve. Moving averages usually have a number in the name (MA50, MA200, etc.). The number stands for the number of the selected time periods (i.e. individual candlesticks), over which the price is being averaged. MA is used for the convenience of price analysis: it helps a trader ignore daily price fluctuations.

Oscillators

An oscillator in technical analysis is a mathematical manifestation of the speed of the price movement in time; it’s expressed in the form of a sine wave on the chart. This indicator defines the probability of a turnaround. The main goal of the oscillator is to find the turning point as well as to identify the overbought areas – the areas where there is only demand or only supply.

A special kind of oscillator called Stochastic is good for scalping because it includes the prices of highs and lows. Within a single candle, these prices can be very different from the closing prices. It’s worth noting that both trend indicators and oscillators in scalping are best used with faster parameters than in longer-term trading.

Note: the indicators in scalping do not show the entry points – they only help you determine the ranges where entry or exit signals may appear.

What is a Scalping Bot?

A scalping bot is a computer program that buys and sells digital assets, either according to the algorithm of the program itself or with the participation of the trader. All bots use different signals, algorithms, patterns and settings defined by the scalper. Their main purpose is to automate the trading process and help to reduce the time for market analysis and signal filtering.

However, despite the convenience of scalping bots, they have significant disadvantages over manual trading. First, bots never think and cannot adjust themselves on the fly. Therefore, a bot cannot guarantee a profit or even a zero loss. The market is always in flux, and every bot, however profitable at first, becomes obsolete after a while.

Trading bots can also have security risks. Since many bots trade through APIs, these channels can be vulnerable. Double-check your permissions and IP addresses in your API management windows before connecting a bot to your terminal.

Also, scalping bots have no human instincts – therefore, they’ll never recognize a ‘chance’ to enter a profitable deal, however obvious that chance may seem. Trading bots are not able to take risks and usually bring small, albeit steady, profits.

Crypto Scalping Software

Benefits of trading through a terminal

- A terminal allows you to minimize transaction time and adjust the chart layout to the task at hand.

- Traders have full and immediate control over their trades.

- Terminals work in real-time, meaning that traders get the most up-to-date prices.

- A trading terminal combines a technical analysis platform with a client transaction management module. The trader can do various kinds of technical research with the selected instruments.

- Some terminals broadcast news from the most reputable news agencies.

- The trader can infinitely customize the layout of charting and trading tools, choosing from advanced timeframes, color codes, and other parameters.

- Trading terminals allow you to analyse your portfolio from different angles, coming up with a 3-dimensional picture of your profits and losses.

- Data is presented in a user-friendly way with clear and readable charts and diagrams.

- Multiple exchanges and assets available in one window.

- Support for many platforms and operating systems.

- An extensive set of order types, including trailing stops and so on.

- Trading terminals combine the best features of bots and exchanges: a simple interface, affordable prices, and, of course, automated trading.

Scalping crypto with the CScalp terminal

The CScalp terminal is ideal for professional scalping and day trading. It supports multiple markets, including stocks, ForEX, and crypto. Scalping crypto with CScalp is easy because traders can switch between exchanges without needing to cycle through tabs.

With CScalp, scalpers can easily operate multiple accounts and subaccounts of a cryptocurrency exchange and switch between them effortlessly. The also offers market analysis, charting, and drawing tools for a better understanding of the market in real-time.

CScalp features include:

- Order book – this allows traders to trade multiple instruments at once while placing limit orders in one click.

- Clusters – allow traders to stay up to date with market dynamics.

- Statistics – direct access to trading history while also maintaining control over profit and loss without affecting other trading activities.

- Market trades history – this shows market orders in real-time, enabling traders to be informed about all the trades made in by other players.

- Risk management – Stop-loss and Take-profit orders are available for better risk management.

- Charts – customizable and moveable charts enable traders to observe price dynamics with ease and convenience.

CScalp is only available on Windows x64; there is no mobile version available.

How to Scalp Crypto. PRO’s Rules

How to calculate risks. Money management in scalping

The CScalp terminal is ideal for professional scalping and day trading. It supports multiple markets, including stocks, ForEX, and crypto. Scalping crypto with CScalp is easy because traders can switch between exchanges without needing to cycle through tabs.

With CScalp, scalpers can easily operate multiple accounts and subaccounts of a cryptocurrency exchange and switch between them effortlessly. The also offers market analysis, charting, and drawing tools for a better understanding of the market in real-time.

CScalp features include:

- Order book – this allows traders to trade multiple instruments at once while placing limit orders in one click.

- Clusters – allow traders to stay up to date with market dynamics.

- Statistics – direct access to trading history while also maintaining control over profit and loss without affecting other trading activities.

- Market trades history – this shows market orders in real-time, enabling traders to be informed about all the trades made in by other players.

- Risk management – Stop-loss and Take-profit orders are available for better risk management.

- Charts – customizable and moveable charts enable traders to observe price dynamics with ease and convenience.

CScalp is only available on Windows x64; there is no mobile version available.

Where to Learn Scalping Crypto?

In order to scalp efficiently one needs to have a sound knowledge of technical analysis, and trading strategies and to be able to apply those in practice. It is by no means easy to learn, but once you have got the hang of it, the results will impress.

On the CScalp official website, there are comprehensive scalping courses for both beginner traders as well as practicing, more experienced, scalpers. There are free courses on the CScalp YouTube channel dedicated to scalping on Binance. Also, make sure to check out a mini-course called “Breakout trading strategy”, designed for traders who have completed the basic course.

In addition, you can learn about trading from live streams on our channel. Watching live trading is more useful than the edited cuts because you can see both profitable and losing deals, and learn from the streamer’s mistakes. For regular scalping and day trading live streams, check out the CScalp YouTube channel.

Conclusion: What are the Pros and Cons of Scalping?

Scalping can be an impressive trading strategy if used right. However, as much as it holds benefits, it comes with certain challenges, too.

Pros

- You can start with a small deposit and even multiply it within a single trading session.

- Low risks are involved as scalpers normally use only smaller-position sizes.

- Easier than other trading strategies, because smaller price movements occur more frequently than larger ones.

- While it may seem overwhelming at first, scalping is actually easy to apply once you get the hang of it because it’s based on market behaviours that are almost entirely predictable.

Cons

- Limited by liquidity. Each scalper has his own limit on trading volume, above which scalping turns into position trading.

- The ‘cost’ of scalping is a lot higher than that of other types of trading. It can even turn into a loss because of the sheer number of deals and the heavy fees they entail.

- Scalping can, and almost certainly will be, emotionally overwhelming. Keeping a cold head is paramount in this field.

- The profit for each trade is usually tiny, so to make tangible gains, you either need to have a large capital, or execute tens, if not hundreds, of deals a day.

Who is scalping for?

Like other types of strategies, scalping has its pros and cons. To be sure that this strategy is right for you, you need to have answered 3 questions:

- Do you have the time to learn?

- Do you understand that scalping is a craft, not a hobby?

- Do you really enjoy trading in general and does scalping seem fun?

If you answered “no” to at least one of the questions above, you’d better not waste your time trying to learn scalping.

If your answer is “yes” to all three questions, then go ahead and learn the basics, then apply them in practice, make a few trades, earn and/or lost a few bucks, and develop your own practical knowledge of scalping. Also, make sure to come back to CScalp for new scalping techniques, live streams, and just a good time.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT