Binance KYC Process: The Power of Complete Identity Verification

In the ever-evolving landscape of cryptocurrency exchanges, Binance stands as a mainstay. With millions of users and a wide array of tradable assets, it has redefined the financial industry. However, as the cryptocurrency market continues to expand, so do concerns about anonymity, fraud, and financial crime. To address these challenges, Binance has implemented a robust Know Your Customer (KYC) process that ensures complete identity verification. This article delves into the significance of KYC in cryptocurrency trading, explores its role in maintaining the integrity of financial institutions, examines its impact on decentralization and blockchain, and discusses how Binance utilizes technology to safeguard user data and comply with regulations.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What is KYC? Understanding the Basics of Know Your Customer Processes

KYC, or “Know Your Customer,” is a fundamental process within the financial industry aimed at verifying the identities of individuals and entities using financial services. The concept of KYC is not exclusive to the cryptocurrency realm; it has long been a cornerstone of traditional financial institutions, including banks, credit unions, and investment firms.

The primary objective of KYC is to establish a comprehensive understanding of customers, ensuring they are genuinely who they claim to be while gaining insights into their financial behavior and history. KYC is instrumental in mitigating various risks, such as fraud, money laundering, identity theft, and terrorist financing. Here’s a closer look at the key components of KYC:

Identity Verification

The core of Binance KYC involves verifying the identity of customers. To achieve this, users must provide a range of personal information, including full name, date of birth, residential address, and, in some cases, contact details like email addresses and phone numbers. This information is cross-referenced with official documents and databases to confirm the customer’s identity.

Document Verification

As part of Binance KYC, customers are often required to submit official identification documents, such as passports, driver’s licenses, or national identification cards. These documents serve as tangible proof of identity and are subjected to scrutiny to ensure they are legitimate and unaltered.

Risk Assessment

KYC processes also involve assessing the risk associated with each customer. This assessment takes into consideration various factors, such as the customer’s financial history, transaction patterns, and geographic location. High-risk customers, including those with complex or suspicious financial activities, may undergo more rigorous KYC procedures.

Ongoing Monitoring

KYC is not a one-time event but an ongoing process. Financial institutions and cryptocurrency exchanges continually monitor customer accounts for any unusual or suspicious activity. Further investigation and due diligence are conducted if discrepancies or red flags emerge during this monitoring.

Binance KYC Regulations: Safeguarding the Crypto Ecosystem

Adherence to local and international financial regulations is a crucial driver behind Binance KYC processes. Governments and regulatory authorities worldwide mandate the implementation of KYC to combat financial crimes, uphold transparency, and ensure the integrity of the financial system.

Protection of Customer Data

Reputable institutions take data privacy and security seriously during KYC procedures. They employ robust encryption methods and secure storage practices to safeguard customers’ personal information and protect it from unauthorized access or breaches.

Binance

Why KYC Matters in the Cryptocurrency Industry?

As cryptocurrencies gained popularity, KYC processes were introduced in crypto exchanges to address the unique challenges posed by digital assets. The decentralized and pseudonymous nature of cryptocurrencies made them an attractive option for illicit activities. KYC in crypto exchanges aims to strike a balance between privacy and security by verifying the identities of users while allowing them to participate in the digital economy.

KYC is a critical mechanism in both traditional finance and the cryptocurrency industry. It serves as a bulwark against financial crimes, ensures compliance with regulatory frameworks, and provides a level of safety and accountability essential for the growth and acceptance of financial systems, whether centralized or decentralized.

The Role of KYC in Crypto Exchanges: Protecting Against Financial Crime

As mentioned above, the primary reason KYC is vital in cryptocurrency exchanges is its role in preventing financial crime. Cryptocurrencies offer a degree of anonymity that traditional financial systems do not. While this anonymity can be a boon for privacy-conscious individuals, it also opens the door to illicit activities such as money laundering and fraud.

KYC processes help exchanges like Binance to identify and verify the identities of users, making it significantly harder for criminals to operate within the crypto space. By requiring you to provide personal information, proof of identification, and other credentials, exchanges can build a defense against illegal activities.

KYC and AML (Anti-Money Laundering)

On one hand, KYC is a set of procedures that financial institutions, including cryptocurrency exchanges like Binance, implement to verify the identities of their customers. On the other hand, AML refers to a comprehensive set of regulations, procedures, and tools designed to detect and prevent money laundering, which is the process of making illegally obtained funds appear legitimate.

AML measures are critical for identifying and reporting suspicious activities that may involve the proceeds of criminal activities. By adhering to AML regulations, financial institutions, including cryptocurrency exchanges, play a pivotal role in preventing the flow of illicit funds through the financial system.

The Connection Between KYC and AML

Know Your Costumer and Anti Money Laundering are two interconnected concepts, each serving a distinct yet closely related purpose. While KYC primarily focuses on identifying and verifying customers, AML aims to detect and dissuade financial crime. These processes ensure that cryptocurrency exchanges remain safe, compliant, and trustworthy platforms for users worldwide. As the cryptocurrency space continues to evolve, adherence to KYC and AML regulations will be paramount to its success and sustainability.

Balancing Anonymity and Binance KYC Processes: Evolution of KYC from Traditional Finance to Cryptocurrency Exchanges

The concept of anonymity in the world of cryptocurrencies has been both a blessing and a curse. When Bitcoin, the first cryptocurrency, was introduced in 2009 by an individual or group using the pseudonym Satoshi Nakamoto, it was celebrated for its anonymous nature. This feature allowed traders to transact with a degree of privacy not offered by traditional financial systems. Instead of tying transactions to real-world identities, Bitcoin users operated behind cryptographic addresses.

However, as cryptocurrencies gained popularity and adoption, it became evident that this very feature attracted individuals with nefarious intentions. Illicit activities such as money laundering, drug trafficking, tax evasion, and other forms of financial crime found refuge in the pseudonymous nature of cryptocurrencies. Transactions could be conducted without revealing the true identities of the parties involved, making it challenging for law enforcement agencies to track and apprehend criminals.

The Global Perspective on KYC and Financial Regulations

This growing concern led regulators and governments worldwide to step in. Recognizing the need to prevent cryptocurrencies from becoming a haven for illegal activities, financial authorities started implementing a range of regulations aimed at bringing greater transparency and accountability to the crypto space. These regulations are not meant to stifle innovation, but rather to strike a balance between preserving the privacy and decentralization principles of cryptocurrencies while ensuring they are not exploited for criminal purposes.

Cryptocurrencies are now considered tradable assets, with market capitalizations that rival some of the world’s largest corporations. As they gain widespread adoption, it becomes increasingly important to have safeguards in place. Financial regulations, including robust Know Your Customer (KYC) and Anti-Money Laundering (AML) measures, have become crucial tools to protect the integrity of the financial system and prevent financial crime.

Cryptocurrency exchanges, which act as gateways to the crypto world, have played a pivotal role in this regulatory landscape. Many exchanges have embraced the need for KYC processes, requiring users to provide identification documents such as passports and proof of address. These processes, although viewed by some as invasive of privacy, are designed to ensure that individuals using the exchange are legitimate and not engaging in illegal activities.

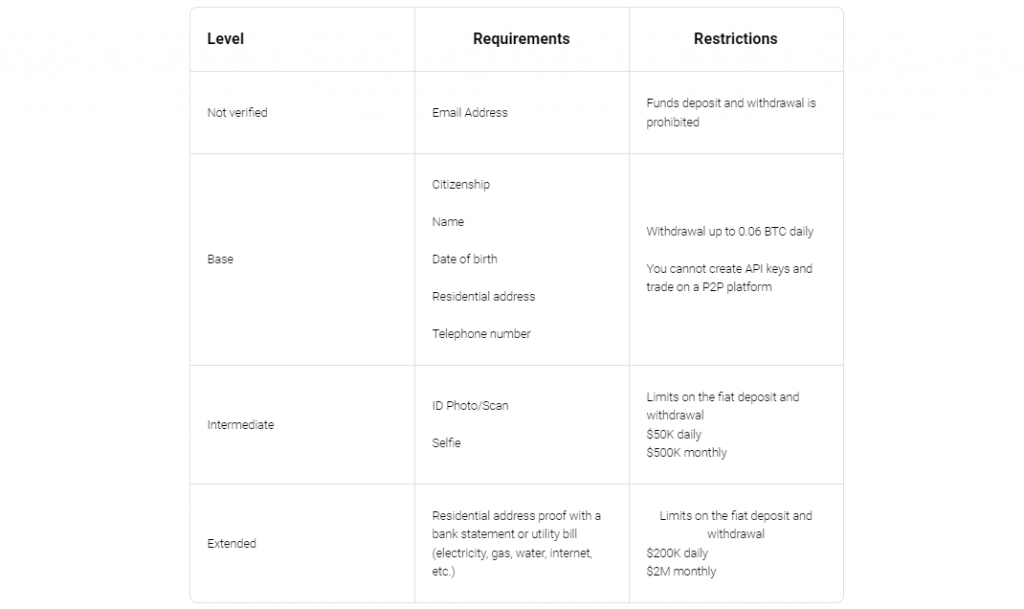

Binance Verification Levels: Exploring Binance Know Your Customer Process

Binance, one of the world’s largest cryptocurrency exchanges, offers various levels of verification to accommodate different types of users and their needs. These levels of verification help ensure security, compliance with regulations, and access to a wide range of features on the platform. Learn step-by-step how to create a Binance account, navigate the Binance KYC process, and start trading cryptocurrencies in our article, “Binance Account: How to Create a Free Account on the Binance Crypto Exchange.”

Let’s explore the different levels of verification available on Binance:

Binance KYC Level 0 – Not Verified

This is the basic level of verification, also known as “Not Verified.” At this level, you have limited access to Binance’s features. You can only withdraw up to a certain amount of cryptocurrency per day (0.06 BTC), which is relatively low compared to higher verification levels. For many users, Level 0 is not enough.

Binance KYC Level 1 – Identity Verification

Level 1 requires you to provide basic personal information, such as your name, date of birth, and address. At this level, you can trade and deposit cryptocurrency without significant limitations. However, withdrawal limits may still be imposed, and some features, like using the Binance Card, may not be accessible.

Binance KYC Level 2 – Intermediate Verification

At Level 2, you must provide more comprehensive information and documents for verification. This typically includes submitting a valid government-issued photo ID, such as a passport or driver’s license. At this level, you can enjoy higher withdrawal limits and can access more features on the platform, including fiat currency deposits and withdrawals.

Binance KYC Level 3 – Advanced Verification

Level 3 is a more advanced level of verification and may require additional documents, such as proof of address or source of funds documentation. At this level, you have significantly higher withdrawal limits and can use most of Binance’s features, including margin trading and OTC (Over-the-Counter) trading.

Binance KYC Level 4 – Corporate Verification

This level is specifically designed for corporate accounts and businesses looking to use Binance for their cryptocurrency needs. Corporate users need to provide extensive documentation, including legal business documents, to verify their identity. Level 4 users can access business-related services and features offered by Binance.

It’s important to note that the exact requirements and features available at each level of verification may vary depending on your jurisdiction and Binance’s policies, which can change over time. In addition, the Binance KYC process can be modified to adapt to evolving regulatory requirements and user needs.

Choosing the appropriate verification level on Binance depends on your trading and withdrawal needs. Most users find Level 2 or Level 3 verification to be sufficient for their cryptocurrency activities. However, if you are a business or a high-volume trader, you may need to consider Level 4 verification for corporate accounts. Always ensure that you provide accurate and up-to-date information during the verification process to comply with Binance KYC policies and regulatory requirements.

The Power of Binance Complete Identity Verification

- Enhanced Security: One of the primary objectives of Binance KYC processes is to enhance security. By requiring you to provide personal information and verify your identity, Binance can create a more secure environment, making it difficult for unauthorized individuals to access accounts or engage in fraudulent activities.

- Compliance with Regulations: Financial regulations vary from one jurisdiction to another, but many countries have imposed strict requirements on cryptocurrency exchanges to prevent illegal activities like money laundering. Binance’s KYC process helps demonstrate its commitment to compliance, reducing the risk of regulatory scrutiny or penalties.

- Fraud Prevention: The Binance KYC process acts as a first line of defense against fraudulent activities. By verifying your identity, Binance can spot and prevent potentially illegal or suspicious transactions. This protects both the exchange and its users from financial losses and reputational damage.

- Protecting Financial Institutions: Binance often partners with traditional financial institutions. Complete identity verification ensures that these financial institutions can confidently engage while adhering to their own compliance requirements.

- Anonymity vs. Identification: While anonymity is a desirable aspect of cryptocurrencies, it must be balanced with the need for identification in the financial world. The Binance KYC process strikes this balance by allowing you to enjoy the benefits of cryptocurrency trading while ensuring your activities are within legal boundaries.

Binance KYC Verification: Step-by-step guide to complete the process

To start trading on Binance, users must first complete the KYC verification process. Here is a step-by-step guide to help you navigate through it:

Binance KYC: How to Pass Verification Level 1

To start trading on Binance, users must first complete the KYC verification process. Here is a step-by-step guide to help you navigate through it:

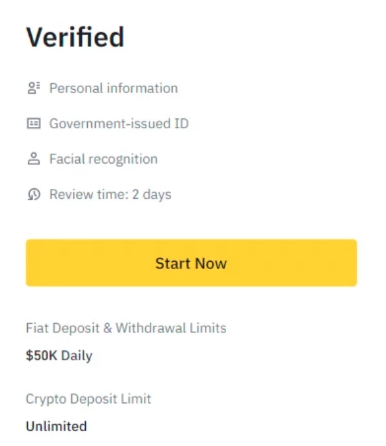

In the “Verified” section, click the “Start now” button.

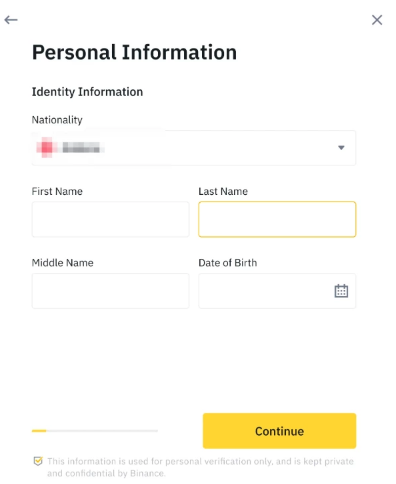

A blank window appears with the fields:

- Nationality;

- First Name;

- Last Name;

- Middle Name;

- Date of birth.

After filling in the fields, click “Continue”.

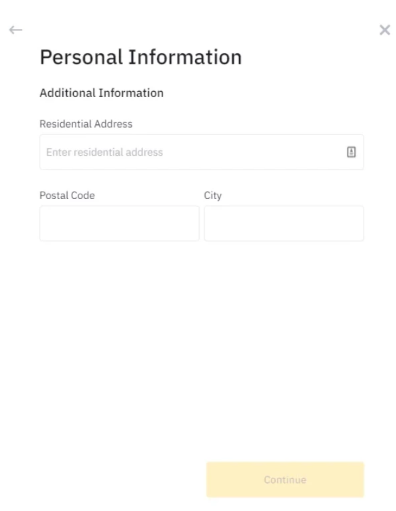

In the next window, specify additional information, and fill in the fields:

- Residential Address;

- Postal code;

- City;

Click “Continue“.

Good job! Basic verification has been passed and access to the funds deposit and withdrawal has been opened. Now you can pass the intermediate verification to remove the remaining restrictions.

Binance KYC: How to Pass Verification Level 2

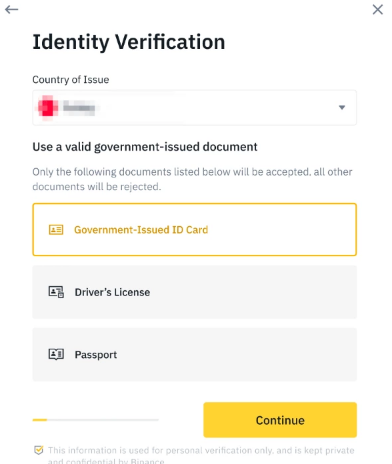

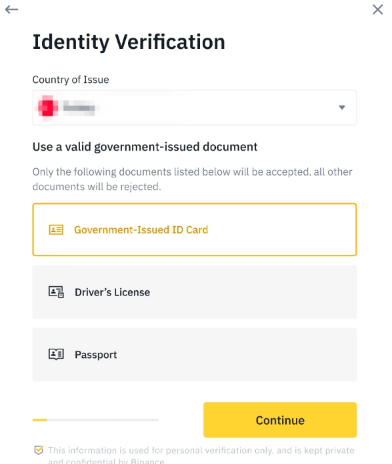

Go to the “Identification” page. In the “Verified” block, click “Start Now“.

A window where you have to indicate the identity document appears. Select the document and the issuing country, then click “Continue“.

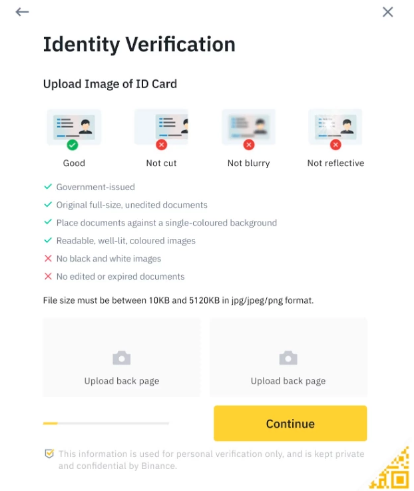

Then, click the “Upload files” button and attach a photo/scan of the documents that meet the requirements of the exchange. After downloading, click “Continue“.

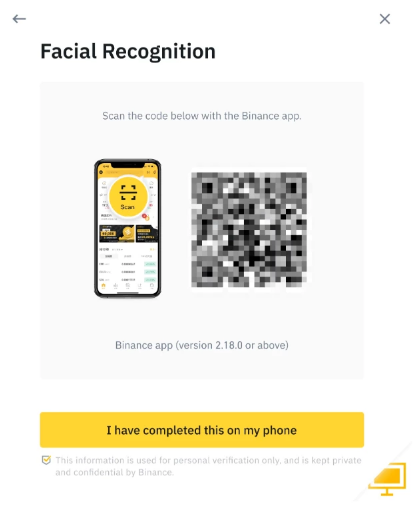

Launch the Binance mobile app and scan the QR code. Then, click “I have completed the process on my phone“.

Done! Your data has been sent for consideration.

Ensuring Data Privacy in the Binance Know Your Customer Process

One of the key measures Binance takes to protect user data is the encryption of data at rest. This means that any sensitive information you provide, including KYC documentation, is stored in an encrypted format. Encryption is the process of converting data into a code to prevent unauthorized access. Binance uses advanced encryption algorithms to ensure that even if an unauthorized party gains access to their servers, the data remains unintelligible and useless to them.

By encrypting data at rest, Binance adds a significant layer of security, making it extremely challenging for any malicious actor to access or decipher user information stored on their servers. This practice aligns with industry best practices for data security.

Binance KYC: End-to-End Encryption for Data in Transit

Not only does Binance protect user data while it is at rest, but it also ensures the security of data in transit. When you interact with the Binance platform, whether it’s accessing your accounts, making trades, or submitting KYC documents, the data transmitted between your devices and Binance’s servers is secured using end-to-end encryption.

End-to-end encryption means that the data is encrypted on your device and can only be decrypted by the recipient’s server, which in this case is Binance. This encryption method ensures that even if intercepted during transmission, the data remains protected and confidential.

User Control Over Personal Information

One of the essential aspects of data security and privacy is user control. Binance firmly believes that you should have control over your personal information. Through encryption and security measures, Binance ensures that only you have access to your personal data. This means that even within the exchange, only you can decrypt and access your KYC information, making it virtually impossible for anyone else, including Binance staff, to access or misuse this sensitive information.

A Guarantee of Data Privacy

Binance’s commitment to protecting your data extends beyond technological measures. The exchange also adheres to strict privacy policies and regulations to ensure that your information is handled with care and in compliance with legal requirements. They are dedicated to maintaining the highest ethical standards when it comes to data privacy.

Is KYC mandatory for all cryptocurrency exchanges?

KYC processes are not universal across all exchanges, but many reputable exchanges, including Binance, have implemented them to ensure compliance and security.

Does complete identity verification compromise my privacy?

KYC processes are designed to strike a balance between privacy and security. Exchanges like Binance prioritize data privacy and employ strict measures to protect users’ personal information.

How long does the KYC verification process take on Binance?

CThe verification process duration can vary but is typically completed within a few hours to a few days, depending on the volume of submissions.

Why is email often required during KYC?

Email is used for communication purposes and to send important notifications to users. It is also a means for users to recover their accounts if they forget their login credentials.

Is Binance KYC mandatory?

Yes, KYC is mandatory on Binance for certain activities. To trade and use various services on the platform, you are required to complete identity verification.

What documents are needed for Binance KYC?

Binance typically requires government-issued identification, such as a passport or driver’s license, as well as proof of address.

Can I maintain anonymity on Binance?

While Binance offers a degree of anonymity for basic trading, certain features and higher trading limits require completing the full KYC verification process.

What are the consequences of not complying with KYC regulations?

Failure to comply with KYC regulations can result in restricted access to certain features on the platform or the freezing of your account.

Binance KYC – Conclusion

Due to the ever-evolving security demands associated with cryptocurrency exchanges, the importance of Know Your Customer (KYC) processes cannot be overstated. Binance, a global leader in the industry, has demonstrated the power of complete identity verification in safeguarding the digital financial ecosystem. This article has explored the multifaceted significance of Binance KYC, from its role in combating financial crime and ensuring regulatory compliance to its impact on the delicate balance between anonymity and accountability in the realm of cryptocurrencies.

As cryptocurrencies continue to gain mainstream acceptance, KYC processes serve as a cornerstone, providing a shield against illicit activities and fostering trust between users, exchanges, and financial institutions. Binance's commitment to data privacy, encryption, and user control further solidifies its role as a pioneer in ensuring the security and integrity of the crypto space.

In a world where digital finance is rapidly evolving, Binance KYC remains an essential tool for building a safer, more transparent, and accountable financial future.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT