BITMEX TYPES OF ORDERS

Date of update: 16.08.2023

Limit, market and some stop orders are used to trade on BitMEX through CScalp. In this article we will review the orders which are implemented in the CScalp terminal, so there is BitMEX exchange market as an example of using such types of order.

Limit order

The most popular type of order is a limit order.

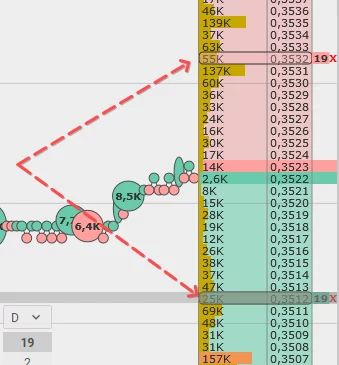

A Limit Order — is an order that you place on the order book with a specific buying or selling limit price.

Typically, BitMEX’s buying order is set below the current market price. Selling orders are above the current market price. This type of order is displayed in the order book. It will be executed and your order becomes the current market price, best market price.

Advantages: execution of the order at the price set by the trader.

Disadvantages: there is no guarantee of the execution of order execution. The order may remain unfulfilled if there are more favorable offers on the market. If the volume of the counter order is insufficient, the order may be partially executed.

Professional traders use limit orders in most cases. Scalpers mostly trade “limits”.

Important: Disconnecting the Internet connection or closing CScalp does not affect limit orders on BitMEX. They will remain and will be executed, if they are placed on the exchange’s servers.

For example, there are two placed limit orders ETH/USDT sized 1. Sell-limit order is placed on the top of the order’s book in the sellers’ zone (the red zone). Buy-limit order is placed in the bottom of the order’s book in the buyers’ zone (the green zone).

If we place a buy-limit order in the sellers’ zone, this order will be fulfilled. You will buy it at the best price. The order is considered to be filled if the price which is placed in the limit order has already been requested at the market.

Market order

Market order — is the simplest order but also one of the most unsafe for the newcomers, not only on BitMEX exchange but on the market at all.

A market order is a type of bid where the purchase is at the price of demand (Ask) and the sell is at the price of supply (Bid).

The execution of a market order will be instantaneous if there is demand and supply in the order book’s queue. That’s why a market order is a good thing to open or close a position.

The Market order ensures the trade, however, a trader won’t be able to forecast the current price of the trade execution. The market order will be completed at the best price, but such price can be changed for a split second.

Advantages: The market order is executed securely (If the order book contains trading orders).

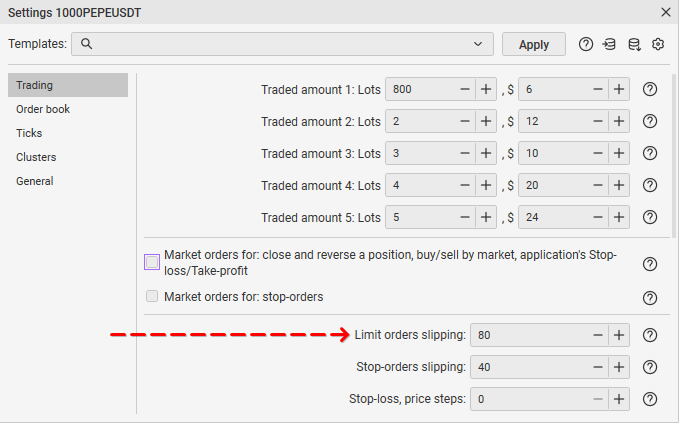

Disadvantages: the main disadvantage is slippage.

Slippage is a situation when a trade is executed at a less favorable price relative to the best price in the order book at the time of placing the order.

The slippage most frequently happens, when a trader works with a big amount of volume. In this case the market order will be completed at different prices executing the best prices in the order book. The slippage the lowest overall happens on the volatile market, when orders book’s been set up the empty trade spots by the major traders.

Hot Keys for BitMEX market orders:

Close Position at market;

Buy/Sell at market; (default hotkeys: T – buy at market, Y – sell at market);

Reverse the position.

Limit order slipping is the important thing for these hotkeys. It is specified in the decimal pricing option. The parameter value can be changed in the tickers settings. The value is 0, which means that the order will be sent to the edge of the order book.

The value is 0 by default this means order will be sent to the edge of the order book.

Note: The market bid for BitMEX exits the limit bid in an “artificial” way. If you place a market order – Instead of placing a market order, CScalp places a limit order. Visually, there is no difference – the trade will be executed instantly.

Stop-loss

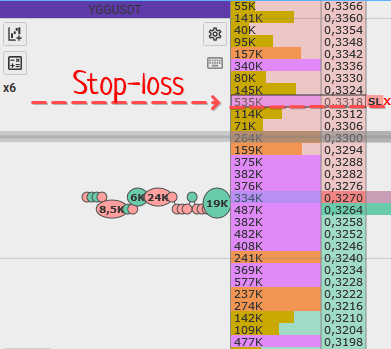

Stop-loss is the type of order that minimizes loss if the price of the instrument starts to move in a loss direction.

Stop-loss can be placed only under the condition of the currently opened position. Stop-loss can be placed on the market exchange servers as well as in the CScalp terminal.

How it works: sending of a limit order for closing. If the trader is in a long position, the limit order will be sent to the short in the area of buyers. The trade will be closed at the best price of the buyer. It also works vica versa, if the trader has a short position.

Pay attention: Stop-loss placed in CScalp terminal will be taken off in case of the connection problems or terminal’s shut down. Stop-loss opened in the market servers will be activated and is ready to be executed even in case of the connection problems or terminal’s shut down. Pay attention please! If the trader wants to leave a workplace and keep the position open, you would be better to use the market exchange stop-loss.

Take-profit

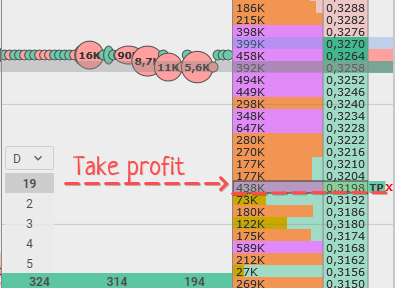

Take-Profit limit order can be a useful tool to lock in profit at specified price levels and related to the opened position.

Take-profit can be placed if you have a current open position. Take-profit may be placed on the market serves as well as in CScalp Terminal. The position of the order depends on the settings. Take-Profit is placed in the CScalp terminal by default.

How it works: sending of a limit order for closing. If the trader is in the long position, the limit order will be sent to the short in the area of buyers. The trade will be closed at the best price of the buyer. It also works vica versa, if the trader has a short position.

Pay attention: Take-profit placed in CScalp terminal will be taken off in case of the connection problems or terminal’s shut down. Stop-loss opened in the market servers will be activated and is ready to be executed even in case of the connection problems or terminal’s shut down. Pay attention please! If the trader wants to leave a workplace and keep the position open, you would be better to use the market exchange Take-profit.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT