ORDER TYPES FOR BYBIT

Date of update: 16.08.2023

To trade by Bybit through the CScalp, limit, market and some stop orders are used. We have prepared a detailed instruction in which we examined the features of each order type.

Limit order

The most popular type of order is a limit order. In stock slang, traders call it the “limit”.

A limit order is an order to buy or sell a certain number of lots at a price not more/less than specified by the trader.

At a suitable price, a limit order for Bybit is executed immediately. Otherwise, it goes to the general orders queue (order book). The set limits are anonymous, but their price and volume are visible to all market participants.

The order book should receive a counter order to execute the limit. The counter order price must not be less than the one set in the limit order. If it is less, the limit will be executed partially. You can remove a limit order at any time before its execution.

Advantages: the limit order is executed being not less than the set price.

Disadvantages: the execution of a limit order is not guaranteed. A limit order is passive. If there are more profitable offers on the market, it may be executed partially or not at all.

Most professional traders use only limit orders. We recommend that beginners use limits together with stop orders to reduce losses.

Important! The CScalp sends limit orders to Bybit: they are placed on the exchange’s servers. If the connection is lost or the terminal is closed, the set orders will remain active and can be executed.

For example, two limit orders for BTCUSDT with a volume of 0.001. A limit order for sale is placed at the top of the order book in the trader zone (red zone). The one for purchase is in the buyer zone (green zone).

A limit order can be set by clicking on the desired price with the left mouse button (buy) or the right mouse button (sell).

A limit order sent to the trader zone will be executed immediately at the best market price. This is due to the fact that the price set in the limit has already been offered by the market. In the buyer zone, the limit order will be executed at the best purchase price.

Important! CScalp features the simultaneous cancelation of limit orders on Bybit. Hotkeys to simultaneously cancel all orders (by default):

“Space“: Cancels exchange orders throughout the entire application.

“F“: Cancels exchange orders in one order book.

Market order

A market order is the simplest and at the same time the most dangerous type of order both for beginners and experienced traders

A market order is an order to buy or sell a certain number of exchange instrument lots at the best price.

At a high level of supply and demand, the market order is executed immediately. This is convenient when you need to urgently open or close a position.

The market order guarantees the transaction. Although, a trader can’t determine the price of a deal himself. The market order is executed at the best price, which can change in an instant.

Advantages: a market order is executed immediately (at a high level of supply and demand).

Disadvantages: high risk of slippage.

Slippage is a situation when a trade is executed at a less favorable price relative to the best price in the order book at the time of placing the order.

The slippage usually occurs when trading in large volumes. The market order is executed at several prices, “devouring” the best orders in the order book. A rarer and more dangerous slippage takes place in a volatile market, when empty spaces form in the order book due to major participants.

To place market orders on Bybit, you can use the hotkeys:

1. close a position on the market;

2. buy/sell at market value

(by default, the keys are: T – buy at market value, Y – sell at market value);

3. reversal of the position at market value.

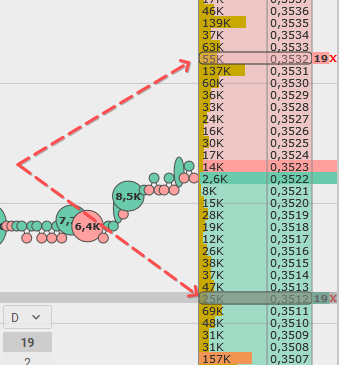

For these hotkeys, the casting range is important. This parameter is specified in the tool price increment. You can change the parameter value through the tool settings (as shown in the screenshot). The default value is 0 – the order is sent to the end of the order book.

NB: In the CScalp, a market order for Bybit is “artificially” created from a limit order. When a trader places a market order, the CScalp sends a limit order of the same direction to the end of the order book (this function can be changed in the casting range settings). Visually, the trader will not notice the difference, the transaction will occur immediately.

Stop-order

Stop orders (conditional orders) are orders executed under certain conditions. The conditions usually are the completion of a transaction or the shift of the order queue to a certain price.

In the CScalp, when trading on Bybit, you can only set position closing (linked) order.

Position closing stop orders are familiar to Stop-Loss and Take-Profit traders. There is no volume parameter in the linked orders, since they are set in the volume of the open position. This is convenient because you do not have to spend time setting the volume. If 17 lots are open, Stop-Loss or Take-Profit will close 15 lots and reset the position.

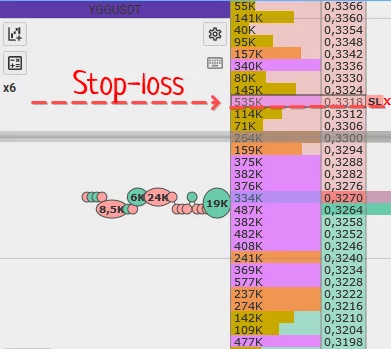

Stop-loss

Stop-Loss is an order with a price level at which the transaction will automatically close, fixing the minimum loss for the trader. The principle of operation is similar to the emergency brake.

Stop-Loss can be set only if there is an open position. In the CScalp, when trading on Bybit, Stop-Loss is set only in the terminal. When a stop order is executed, the CScalp closes the position with a limit order and sends it to the end of the order book. This usually leads to an instant position closure.

To set the Stop-Loss, point the cursor at the order book and hold down the C button (the default). The message “Stop-Loss/Take-Profit” will appear at the bottom of the order book. This means that you have enabled the SL/TP installation mode. Left-click on the price at which the order to position closing will be executed.

Important! When trading on Bybit, Stop-Loss is removed when the connection is lost or the is CScalp closed.

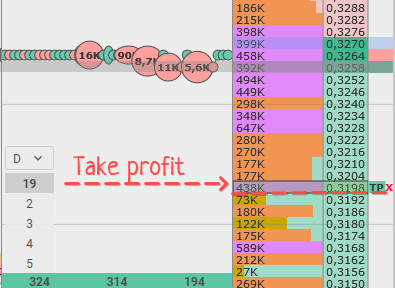

Take-profit

Take-Profit is an order with a price level at which the transaction will be automatically closed, fixing the profit received for the trader.

Take-Profit can be set only if there is an open position. In the CScalp, when trading on Bybit, Take-Profit is set in the terminal. When Take-Profit is executed, the CScalp will automatically close the limit order position and send it to the end of the order book. This normally leads to an instant position closure.

To set Take-Profit, point the cursor at the order book and hold down the C button (the default). The message “Stop-Loss/Take-Profit” will appear at the bottom of the order book. This means that you have enabled the SL/TP installation mode. Left-click on the price at which the order to position closing will be executed.

Important! When trading with Bybit, Take-Profit is removed when the connection is lost or the CScalp is closed.

Limit stop-orders

Not related to the position Binance stop-orders (limit stop-orders) divided into 4 types:

- buy-stop buying order placed in the seller’s zone (making a buy if the price is going up in specified level);

- sell-stop – selling order placed in the buyer’s zone (making a sell if the price is falling in specified level);

- buy-limit – buying order placed in the buyer’s zone (making a buy if the price is falling in specified level);

- sell-limit – selling order placed in the seller’s zone (making a sell if the price is going up in specified level).

Limit stop-orders are outlined on the market exchange servers and can be fulfilled if occurs under the condition of the specified price. If the orders on the orders book reach the limit stop-order level, but there are not any trade, therefore the limit stop-orders will not execute.

In order to place a limit stop-order, hover the mouse over the order book and hold down the hotkey V (default). The message “Stop order” will be shown at the bottom of the order book (if you turn on the stop order setting mode). Click on the price using the left or right mouse button, at which the deferred order should be triggered.

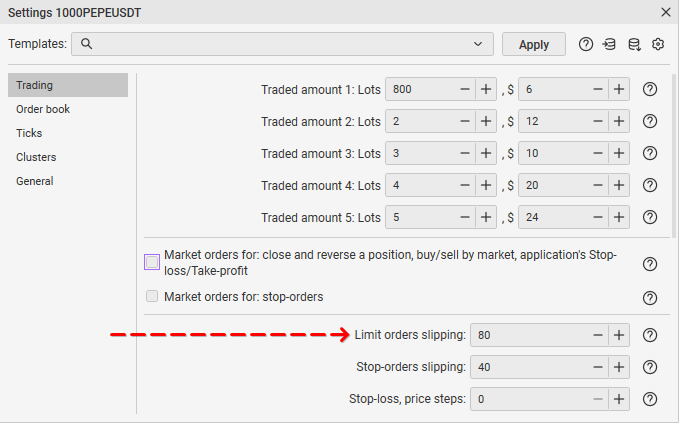

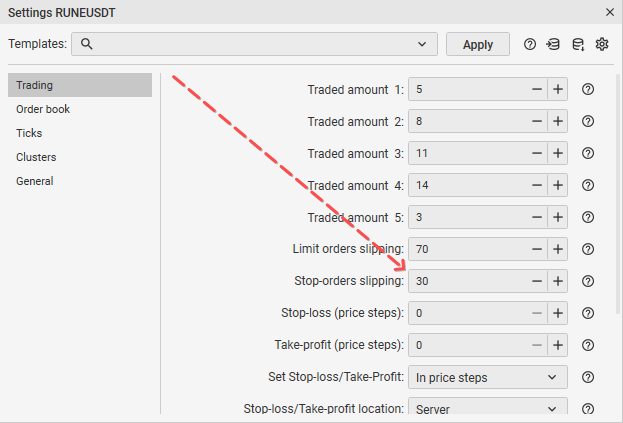

In the implementation, limit stop-order will be transformed to the limit order. These such of orders are implemented by the price of the limit stop-order, with “the limit and stop orders slipping”. Settings of the limit and the stop orders slipping adjusted by default (by 0). This means limit stop-order will be transformed to the limit order and will be implemented as the market order.

Limit and stop orders slipping referred to the step price. That means, if the step price is 1 cent, a limit order will be placed by the “deferred” price plus and 1 cent. Scaling of orders book doesn’t affect this parameter.

Pay attention: In case of any connection problem or quitting CScalp, limit stop-orders will be implemented because they placed on the market exchange servers.

Important! CScalp features the simultaneous cancelation of limit stop-orders on Bybit. Hotkeys to simultaneously cancel all orders (by default):

“RightAlt“: Cancels stop orders throughout the entire application.

“B“: Cancels stop orders in one order book.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT