How the Trade Tape Works in CScalp

Date of update: 01.03.2024

We have prepared an article on how the trade tape works in the CScalp trading terminal. Learn what the trade tape is and how it can be used to analyze the market. We also show how to set up the trade tape.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Is the Trade Tape

The trade tape (prints, ticks) is a tool for tracking transactions made with a trading instrument (stocks, cryptocurrencies, futures) in real-time. It is one of the key analytical tools in scalping and intraday trading.

The tape shows the current activity of the instrument, the balance of sellers and buyers, and order volumes. With ticks, you can assess the direction of the market at the moment, and recognize the beginning and end of periods of increased activity and price movements.

How the Trade Tape Works

The trade tape is essentially the market’s news feed. When news comes out, we see it in the news summary. The same applies to market transactions. When an order is executed, it appears in the tape.

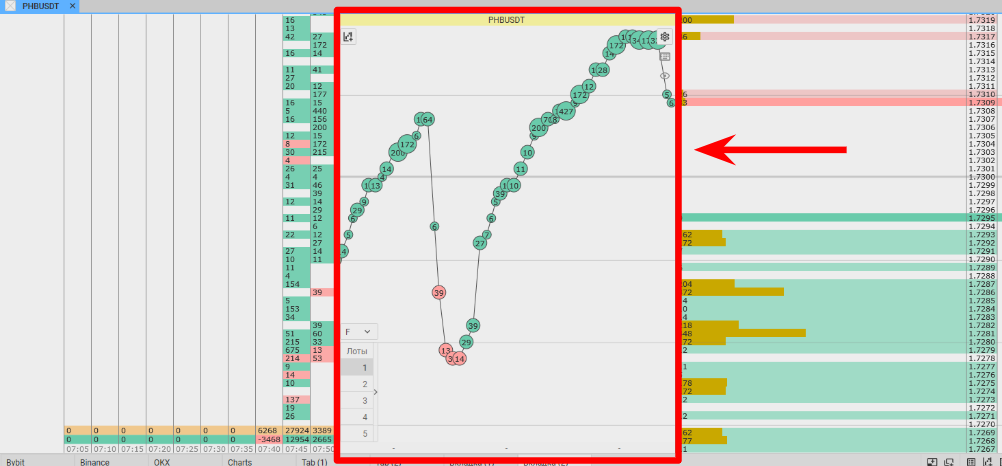

In the tape, we see when transactions are made with the instrument and their volume. Suppose there is an order for 5,000 lots in the order book. While the order is in the book, nothing happens in the tape. The order can be executed or canceled. When someone buys these 5,000 lots, the order “leaves” the book, and a circle (tick) with a volume of 5,000 appears in the trade tape. Thus, the tape shows that a limit order was executed in the order book. The tape also displays data on executed market orders. Tape reading allows you to feel the market and be the first to know about the premises for price movement.

The Tape and Market Orders

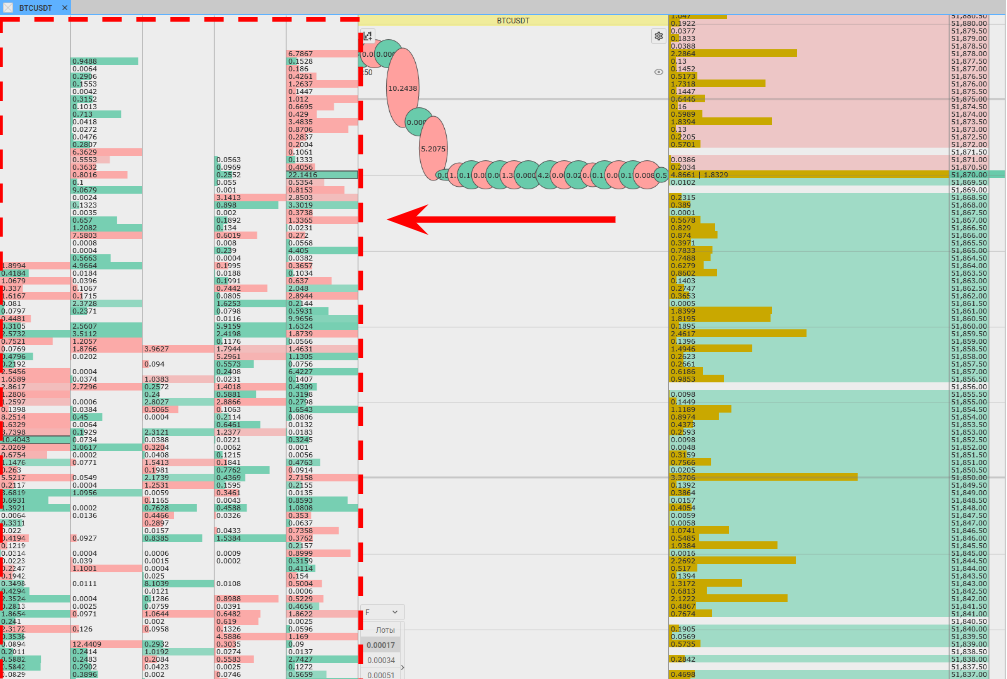

The exchange’s order book “collects” only limit orders. In the trade tape, we can track market orders that are executed instantly (if there is liquidity in the market), so they do not enter the order book. Therefore, the trade tape complements the analysis of the exchange order book. If a large participant begins to buy up density with market orders, we will see that in the tape.

Trade Tape in CScalp

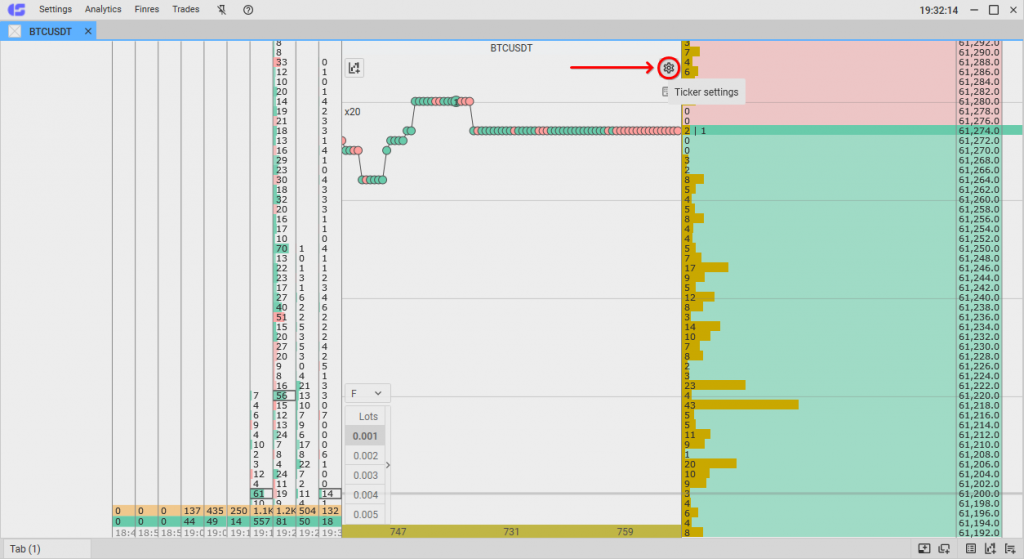

The trade tape in CScalp shows transactions as circles. Red circles represent sell orders, while green ones are buy orders.

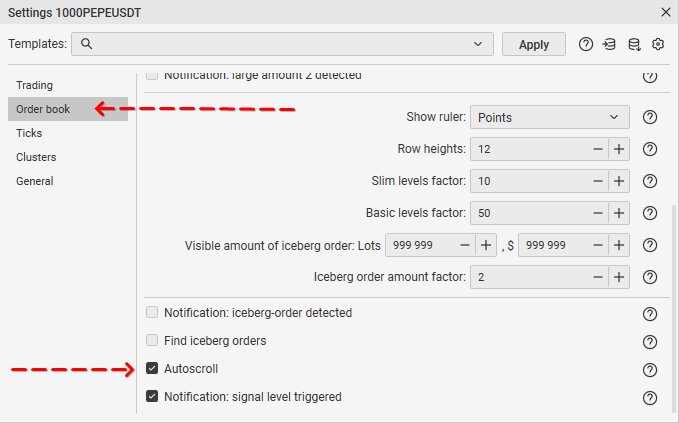

Ticks always follow the bid/ask price. To keep the tape focused, enable auto-scrolling. Click on the gear icon in the instrument’s order book, go to the “Order Book” tab, and activate the “Autoscroll” option. The active field of the order book and the trade tape will now visually “follow” the bid/ask price.

The trade tape is configured for each instrument separately. The terminal remembers user settings. You do not need to set up the trade tape after restarting CScalp.

How to Analyze the Ticks/Prints

Imagine that trade tape is a “microscope.” It allows for analyzing the movement of “particles” of the market: transactions. When analyzing the tape, traders pay attention to the following characteristics:

- Overall activity: Is the tape filled with orders, are prints passing consistently?

- Tape dynamics: Acceleration approaching price levels may herald large movements from them. Slowing down or lack of changes indicates weak activity or its absence.

- Tick/Print volumes: If working with large movements, prints in the tape should contain large volumes.

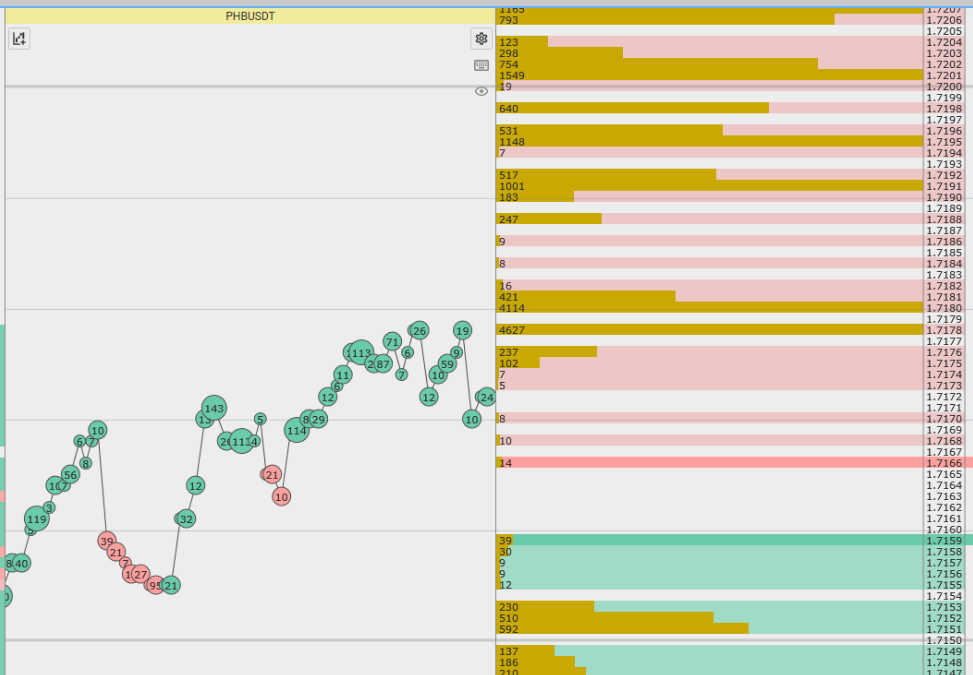

- The ratio of buyers and sellers: It is an important aspect when approaching key levels. Before breaking through the level upwards, look for increased activity from buyers. When breaking down, look for sellers. If one side dominates, it may indicate an upcoming strong movement.

Subsequently, executed volumes should “settle” in clusters.

Cluster readings are compared with densities in the order book for additional confirmation of entry and exit points. Learn more: How Clusters Work in CScalp

Trade Tape Reading Example

Let’s look into a hypothetical example of using the trade tape. Suppose we noticed a large density in the exchange’s order book that has been there for several days. The price has not yet approached it, but patterns on the chart indicate the possibility.

For example, a bullish triangle formed approaching the density. There are increased volumes at key points of the pattern. We assume that after exiting the triangle, there will be an impulse that will push the price towards the density.

When the price approaches the density, look at the trade tape in CScalp. Suppose orders with large volumes start “rushing” through the tape. Orders pass quickly, tick volumes are noticeably above average. The tape becomes “stretched,” meaning that ticks are placed close to each other. The price begins to fluctuate with a clear tendency to increase slowly. We observe a predominance of green prints (buyers). The tape lets us know that the market has come into movement and there is a possible upward movement.

The opposite situation is when the tape is “dry.” Ticks pass slowly and they are of average or small sizes. Activity is not high or not above usual. In this case, one can conclude that strong price movements should not be expected, even if other factors seem convincing.

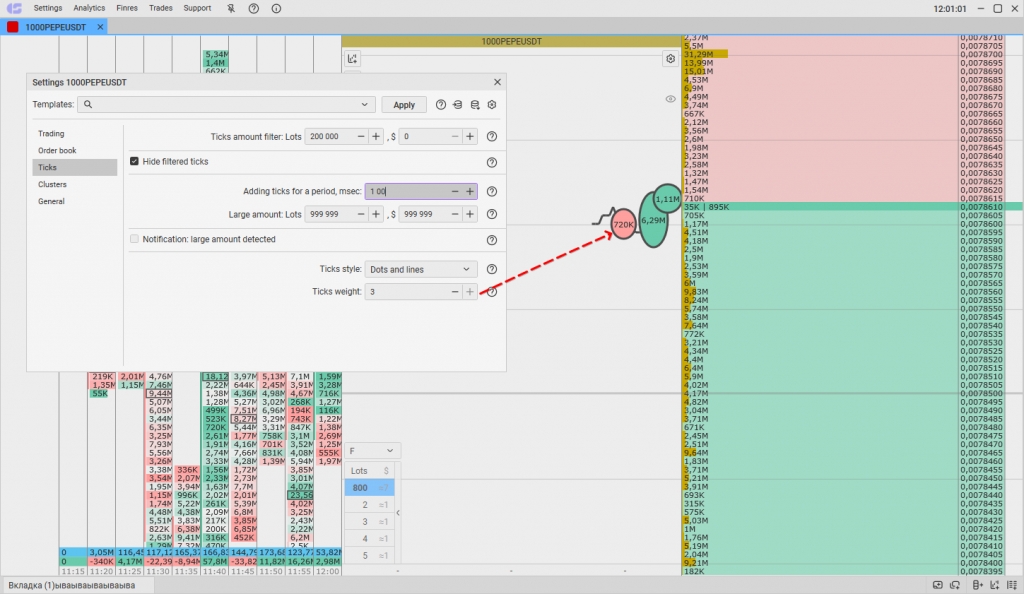

How to Set Up the Trade Tape in CScalp

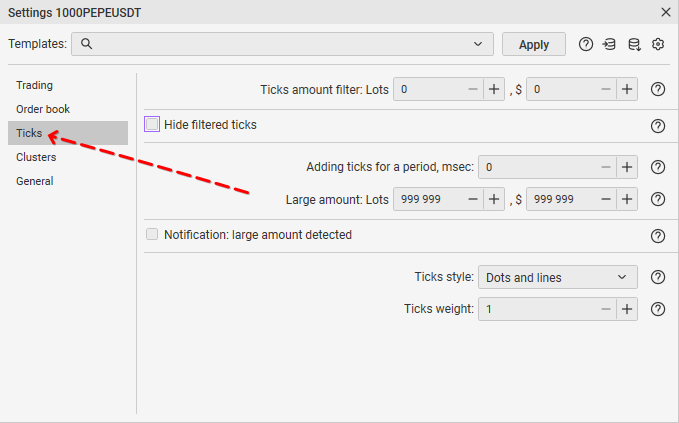

The trade tape in the CScalp terminal can be customized in terms of display style, size, volumes, and other print criteria. To access the print settings, click on the gear icon in the instrument’s order book.

Then navigate to the “Ticks” tab.

We remind you that the trade tape is configured separately for each trading instrument. The terminal “remembers” user settings.

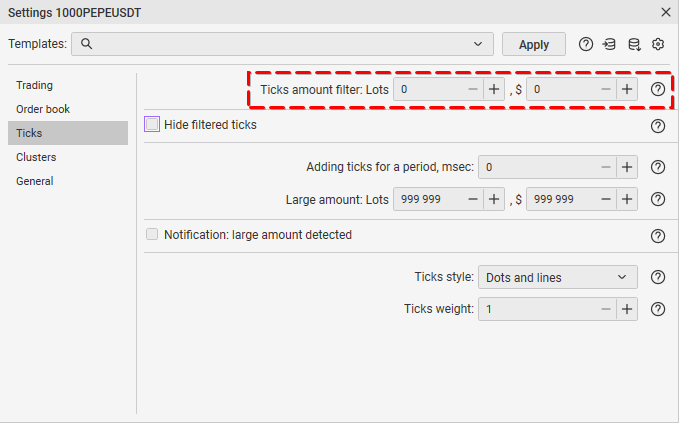

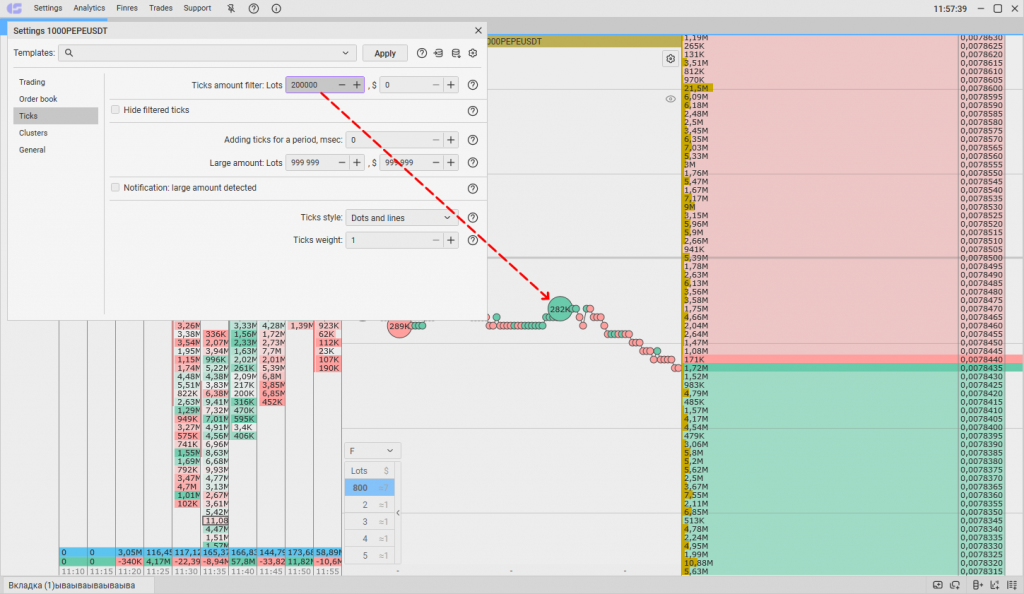

Ticks Amount Filter

This setting serves to filter the “noise” in the market. It allows displaying the volume that exceeds a certain value. The volumes below will not be displayed, just the direction of the transaction (buy/sell).

For example, you expect market news with subsequently increased volatility on the instrument. Then set the “Ticks amount filter” value at a level above average densities in the order book. Suppose, for the instrument BTCUSDT, densities start from a volume of 5 BTC. Then set the ticks amount filter to “5”. The trade tape will highlight only ticks with a volume of 5 BTC and more.

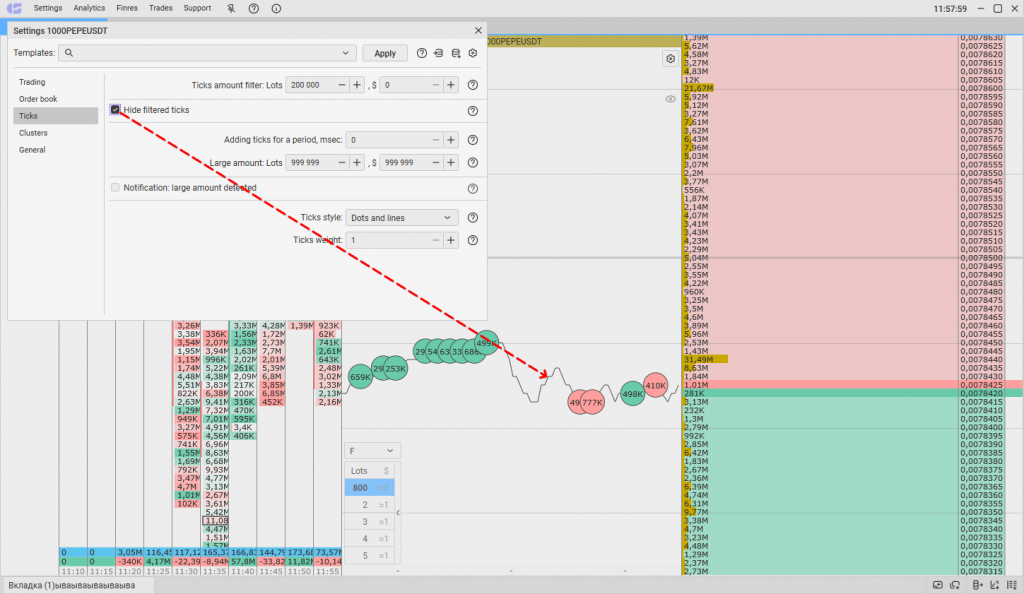

Hide Filtered Ticks

The setting simplifies the visual perception of the trade tape. If small transactions do not affect the price dynamics of the instrument (or distract), they can be removed. This allows you to focus on more significant ticks. Instead of hidden prints, you will see a continuous line.

The setting can be useful when tracking iceberg orders. Without small ticks, it’s easier to recognize large transactions that may indicate the presence of hidden orders in the order book.

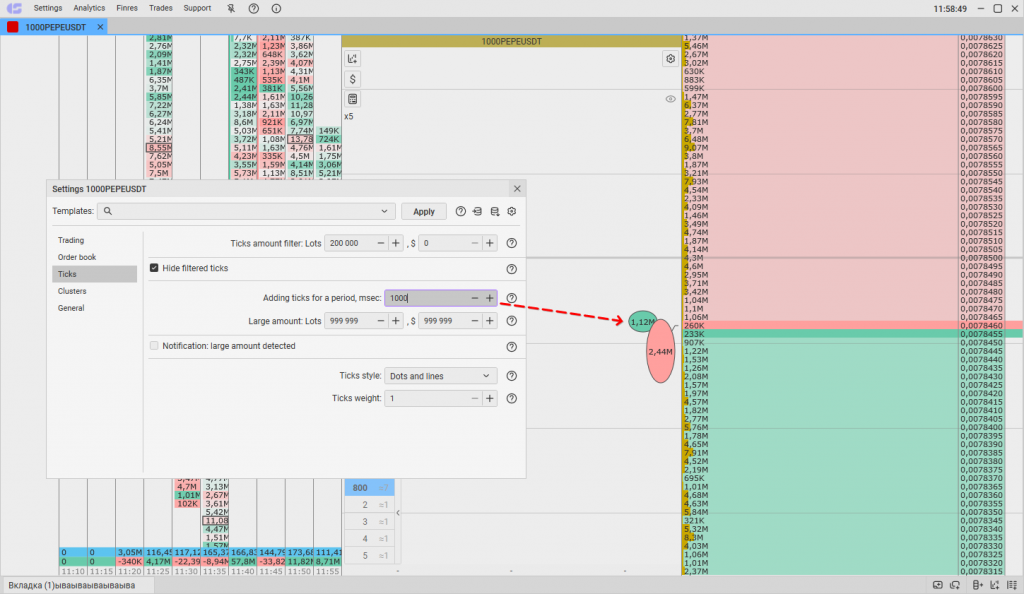

Adding Ticks for a Period, msec

The setting allows aggregating ticks over a specified time interval in milliseconds (1 second = 1000 milliseconds). The setting is useful for instruments where many small orders are executed every second.

For example, during periods of increased activity, transactions in the tape can pass very often, especially with small volumes. Choose an optimal value in milliseconds for aggregating deals. The tape will aggregate small orders over a specified period into one large order.

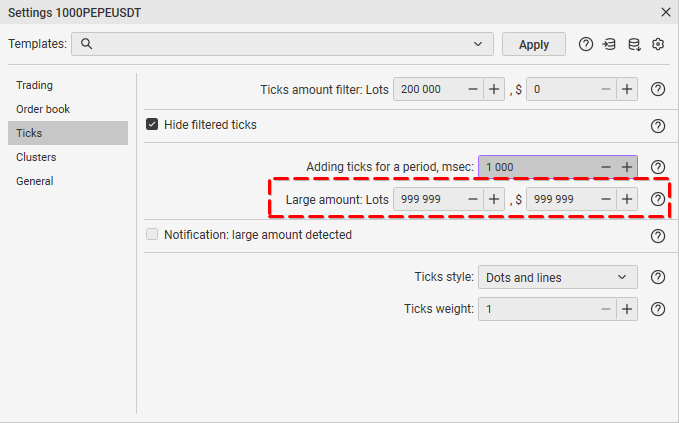

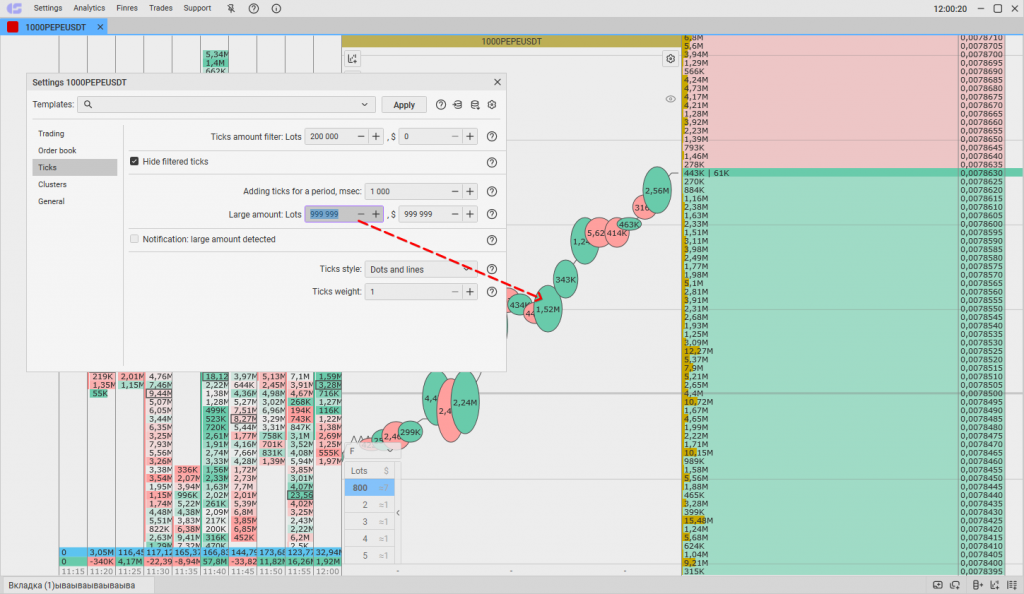

Large Amount

Set the minimum value of a large order in the trade tape. The specific value depends on the instrument and market situation. Set a value that will be considered a large volume of a ticker in the base asset.

This setting works only for a single entire tick with the specified volume. Suppose we set a criterion for a large volume from 1 BTC. A tick with a total volume of 4 BTC passes through the tape. However, this does not mean that the notification will be triggered. For the total tick to be counted as a large volume, it must contain at least one whole order for the specified amount (1 BTC) inside. If individual ticks within the total are less than the specified setting, the large volume will not be counted.

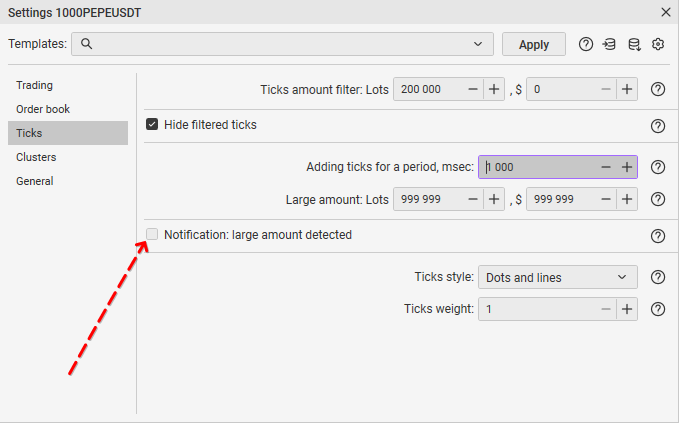

Notification: Large Amount Detected

The setting allows sending a sound alert if a single tick with a large volume passes through the trade tape.

The setting is useful if you expect a large movement from whales. For example, in the BTCUSDT order book, the average density starts from 10 BTC. You expect that the density will be “eaten” in parts of at least 1 BTC. Set the value to 1. As soon as a single entire print of 1 BTC passes through the tape, a sound alarm will be triggered.

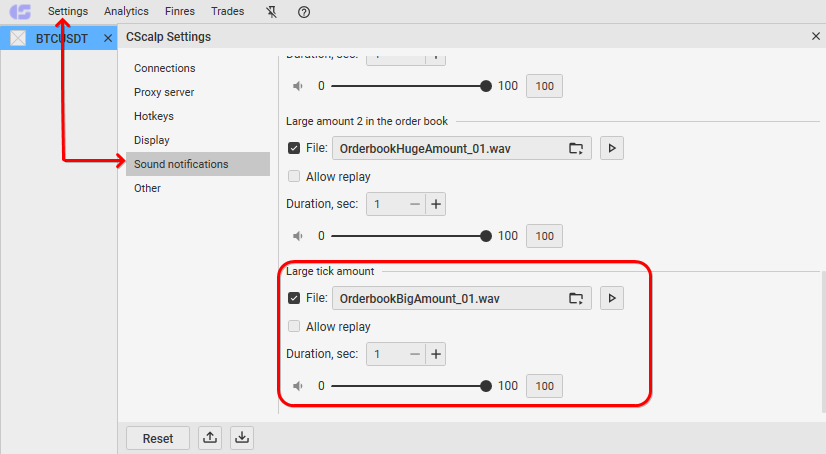

To receive notifications, you have to also activate the option in the general settings of CScalp’s sound notifications. You can add a custom sound file for the alarm.

Ticks Style and Weight

This setting allows hiding or displaying volume circles and the line connecting them.

The setting of line weight (thickness) affects the framing of the circles. It “enhances” the readability of ticks, but may distract from other analysis tools.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT