BITFINEX TYPES OF ORDERS

Date of update: 16.08.2023

CScalp uses different types of orders for making trades. In this article we will look at all types of orders, using an example of Bitfinex Exchange.

Limit Order

The most popular type of order is a limit order.

A limit order is one of the main types of order. This type of order determines the price and amount that the trader is going to buy or sell.

Buying limit order is placed below the current market price on Bitfinex. In order to sell – above current market price. This type of order will be displayed in the order book. It will be fulfilled when the other side of the trade sends a counter-order. The trader sends his offer to the exchange and waits for someone to sell/buy from you.

Advantages: execution of the order at the price set by the trader.

Disadvantages: there is no guarantee of the execution of order execution. The order may remain unfulfilled if there are more favorable offers on the market. If the volume of the counter order is insufficient, the order may be partially executed.

Professional traders use limit orders in most cases. Scalpers mostly trade “limits”.

Important: Disconnecting the Internet connection or closing CScalp does not affect limit orders on Bitfinex. They will remain and will be executed, because they are placed on the exchange’s servers.

The screenshot shows two limit orders for EUR USD with an amount of 1. In the sellers ‘ zone (the red zone), a “limit” is set for selling. At the bottom of the “glass” there is a “limit” for the buying,

If you place an order in the sellers ‘ zone to buy, the trader immediately makes a buying trade at the best selling price. If you place a limit order in the buyers ‘ zone, the trade will be executed at the best selling price.

Market order

A market order is the simplest and at the same time the most dangerous type of order. For both beginners and experienced traders.

A market order is a type of order that is instantly executed at the best current price.

The execution of a market order occurs instantly if there is a supply and demand in the order book queue. This type of order is advantageous when you need to urgently open or close a trade.

IF you place a market order, the trader cannot determine the trade price in advance. A trade of this type of order will occur at the current price, which changes in a second.

Advantages: guaranteed execution if there are orders in the order book.

Disadvantages: slippage.

Slippage is a situation when the order execution price does not coincide with the price set by the trader.

Usually, slippage occurs if you use a large amount of order. In the process of execution, a market order is executed at several prices at once, “taking” the best orders in the order book. Rare and dangerous type of slippage occurs in a volatile market, when the order book contains “voids” because of “whales of market”.

If you place market orders on Bitfinex, then you should learn the hotkeys:

- close at market;

- Buy/sell at market price;

- Reverse the position.

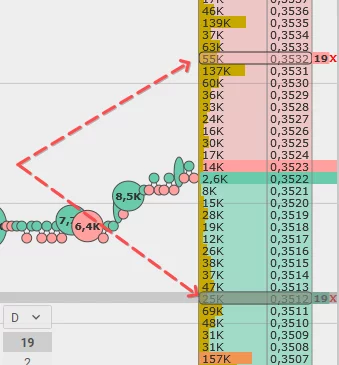

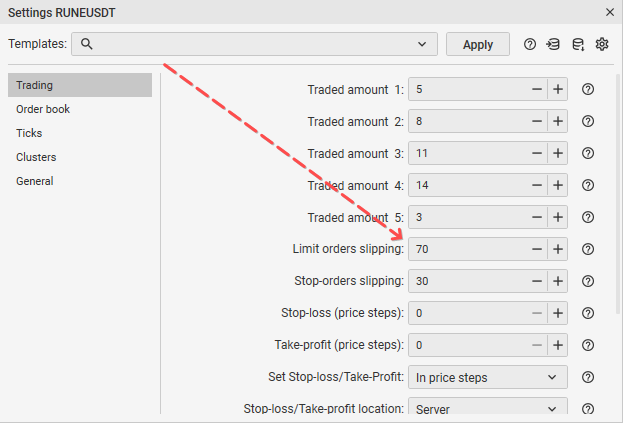

Limit orders slipping is the important thing for these hotkeys. It is specified in the decimal pricing option. The parameter value can be changed in the tickers settings. The value is 0, which means that the order will be sent to the edge of the order book.

Note: The market bid for Bitfinex exits the limit bid in an “artificial” way. If you place a market order – Instead of placing a market order, CSalp places a limit order. Visually, there is no difference – the trade will be executed instantly.

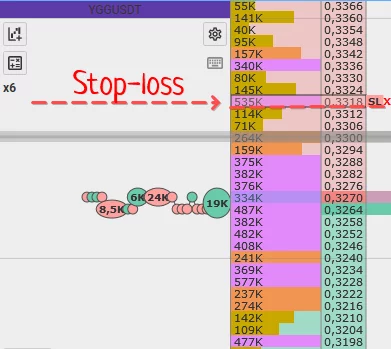

Stop-loss

Stop-loss is a type of order that is issued to automatically close a trade when the specified level is reached to limit losses.

To set stop-loss to Bitfinex, open the position. This type of order is located only on the terminal’s side.

How it works: sending a limit order. When the trader’s position is long, the limit order will be sent in short to the buyers zone. There will be a close at the buyer’s best price. And vice versa, if the trader has a position opened in short.

Important: if the connection with Bitfinex is broken or the terminal is closed, CScalp stop loss will be removed.

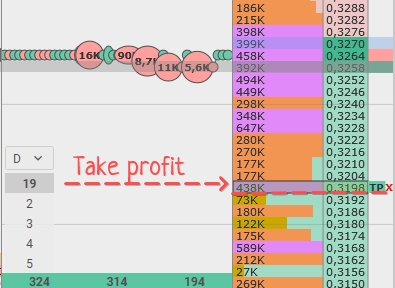

Take-profit

Take-Profit limit order can be a useful tool to lock in profit at specified price levels and related to the opened position.

Take-profit is a type of protective order that is issued to automatically close a trade when the specified level is reached to fix the trader’s profit.

To place a take-profit on Bitfinex, you must open the position. This type of order is located only on the terminal’s side.

How it works: sending a closing limit order. When the trader is in a long position, the limit order will be sent to the short in the buyers ‘ zone. There will be a closing at the best price of the buyer. And vice versa, if the trader has a position open in short.

Important: if the connection with Bitfinex is broken or the terminal is closed, CScalp take-profit will be removed.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT