How to Place Stop Orders in CScalp

Date of update: 09.04.2024

We have prepared instructions on working with stop orders in the CScalp trading terminal. Learn what stop orders are and what kinds are implemented in the platform. We also show how to place and configure stop orders.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.

What Are Stop Orders?

Stop orders are orders that automatically trigger at a specified price but are not tied to a position, like Stop-Loss and Take-Profit.

It’s important to differentiate stop orders from limit orders. Limit orders are executed immediately or enter the order book, while stop orders “hang” on the exchange server until a transaction occurs at the order price. Once the transaction occurs, the stop order becomes a limit order and is executed.

The advantage of stop orders is that they allow you to “reserve” a price level in advance, regardless of whether this level is above or below the market price. Also, stop orders are not visible to other market participants in the order book until they are triggered.

A buy limit order can only be placed below the market price and a sell limit order above. A Buy Stop can be set above the market (in the sellers’ zone), and a Sell Stop below the market (in the buyers’ zone).

Thus, stop orders simplify trading and allow orders to be spread out at interesting prices without monitoring the order book 24/7. Stop orders in CScalp are available for connections to Binance and Bybit.

For a step-by-step guide on how to use Stop-Loss and Take-Profit orders, check out our article: “How to Set Stop-Loss and Take-Profit in CScalp“.

Types of Stop Orders in CScalp

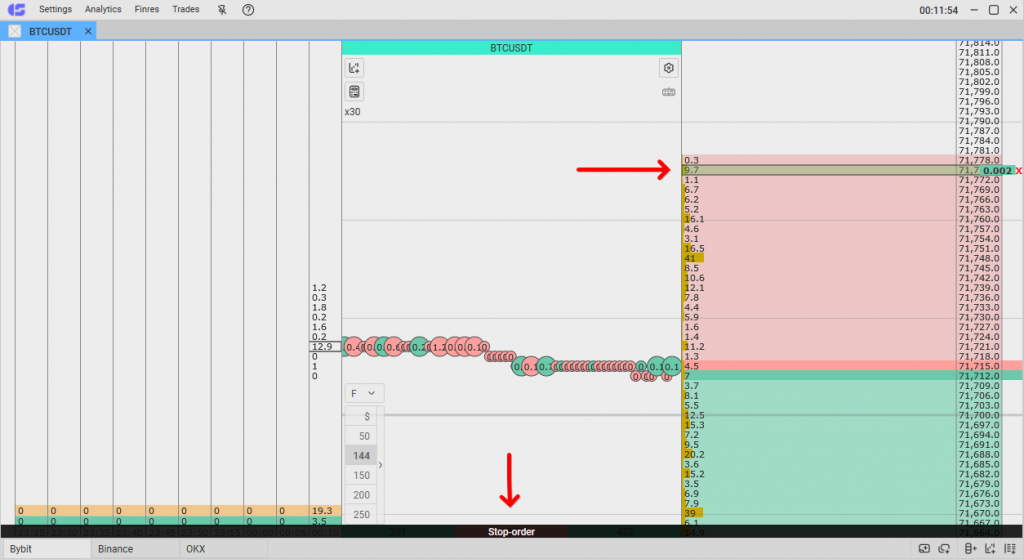

Buy Stop

The Buy Stop order is placed in the sellers’ zone (red zone). When the market price rises to the price specified by the trader in the Buy Stop order, a limit order to buy is sent to the exchange.

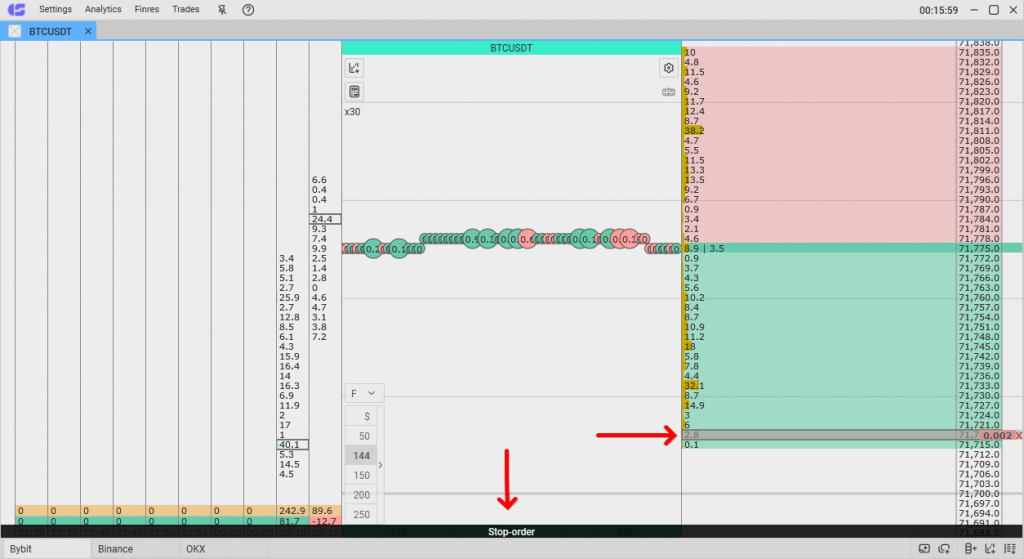

Sell Stop

The Sell Stop order is placed in the buyers’ zone (green zone). When the market price drops to the level specified in the Sell Stop order, a limit order to sell is sent to the exchange.

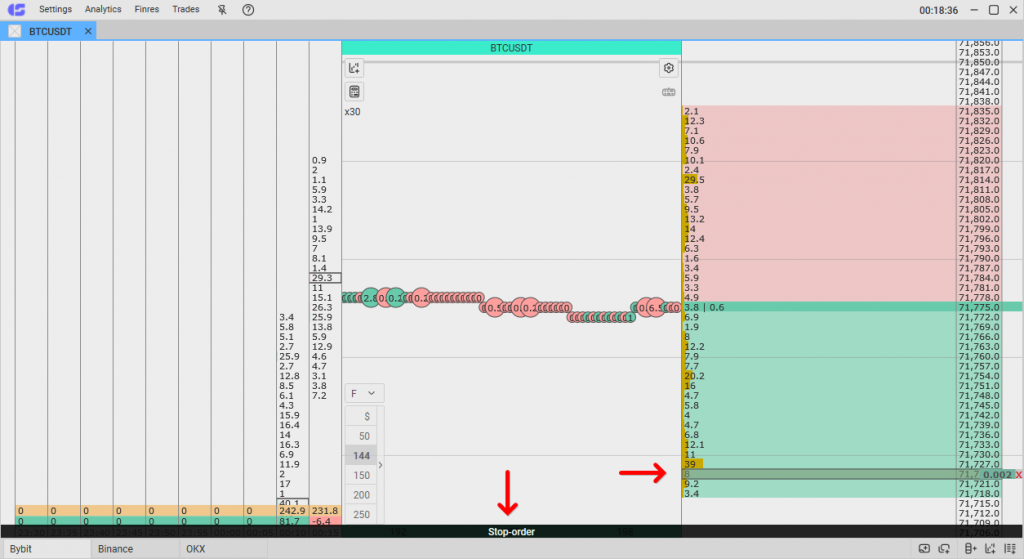

Buy Limit

The Buy Limit order is placed in the buyers’ zone (green zone). A limit buy order is sent to the exchange if the market price drops to the level specified in the order.

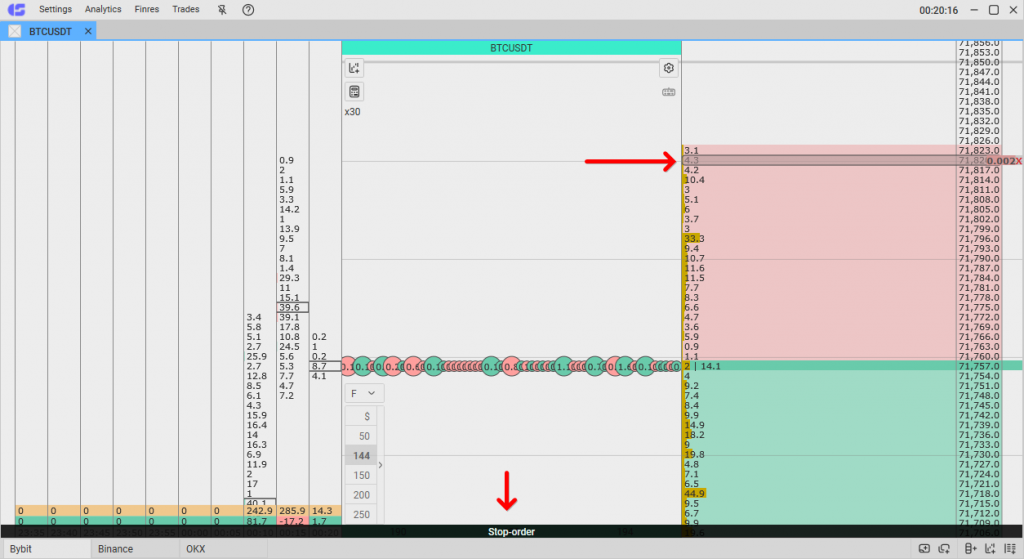

Sell Limit

The Sell Limit order is placed in the sellers’ zone (red zone). If the price rises to the level specified in the order, a limit sell order is sent to the exchange.

How to Place a Stop Order in CScalp

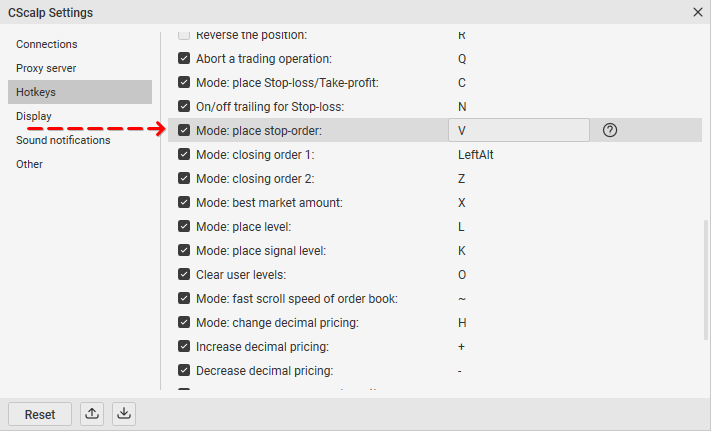

Stop orders are placed using the hotkey “V and clicking on the price level in the order book” in combination. The type of order depends on which zone the trader clicks and which mouse button is used – left (LMB) or right mouse button (RMB). “V” is the default button, which can be changed in the settings.

When the “V” key is pressed, a “Stop-order” notification will appear at the bottom of the screen. The hotkey will work if the cursor is placed over the order book.

How to Place a Buy Stop Order

To place a Buy Stop order, select the traded amount, hover over the desired price in the sellers’ zone, hold “V” and make LMB click. The stop order will be set at the specified price level.

If you make an LMB click in the sellers’ zone without holding “V“,the terminal will create a market buy order (technically, it is a limit order at the best current price).

How to Place a Sell Stop Order

To place a Sell Stop order, select the traded amount, hover the cursor over the desired price in the buyers’ zone, hold “V” and perform RMB click. The stop order will be set at the specified price level.

If you make RMB click in the buyers’ zone without holding the “V” key, the terminal will create a market sell order (a limit order at the best current price).

How to Place a Buy Limit Order

To place a Buy Limit order, hover the cursor over the desired price in the buyers’ zone, hold “V” and make LMB click on the price. The stop order will be set at the specified price level.

If you perform LMB click in the buyers’ zone without holding the hotkey, the terminal will create a limit buy order.

How to Place a Sell Limit Order

To place a Sell Limit stop order, hover the cursor over the price level in the sellers’ zone, hold “V” and perform RMB click on the price. The stop order will be set at the specified price level.

If you make RMB click in the sellers’ zone without holding the hotkey, the terminal will create a limit buy order.

How to Configure Stop Orders

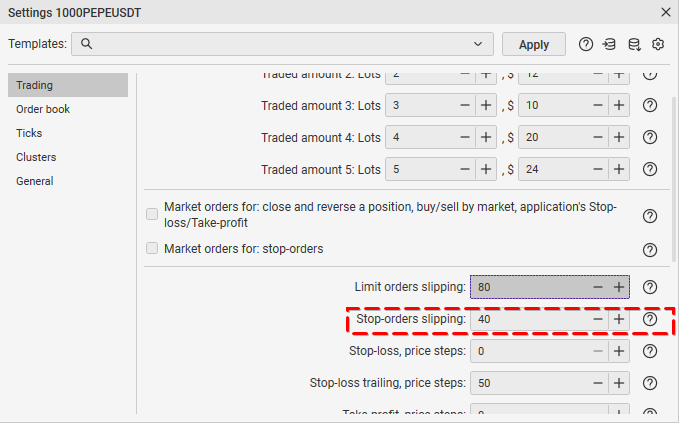

When a stop order activates, it converts into a limit order and is sent to the exchange. The price at which the limit order is set depends on the “Stop-orders slipping” setting.

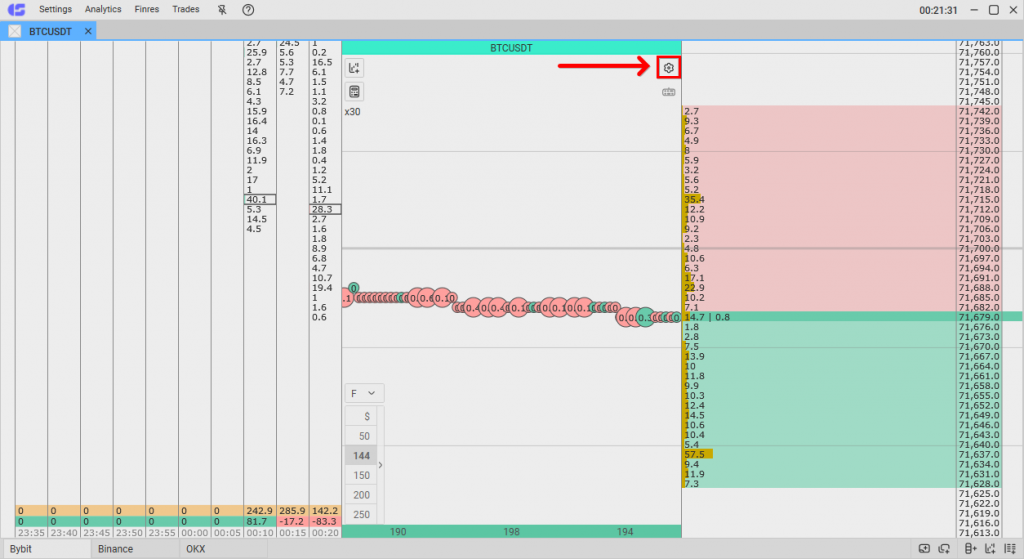

To configure this setting, go to the instrument settings. Click on the gear icon to the left of the order book.

In the settings window, select the “Trading” tab. By default, the “Stop-orders slipping” line is set to “0.” With this parameter, limit orders are placed at the best available price. Essentially, the order is sent to the market.

You can set parameters in price steps. Suppose the price step for the selected instrument is 10 cents, and you set the value of “1” (one step).

Thus, you have set the instruction that limit orders should be placed at the price at which you set the stop order or within ten cents. If you placed a stop order at $10.50, then the limit order could be placed in the range of $10.40 – $10.60.

Stop Orders Hotkey Settings

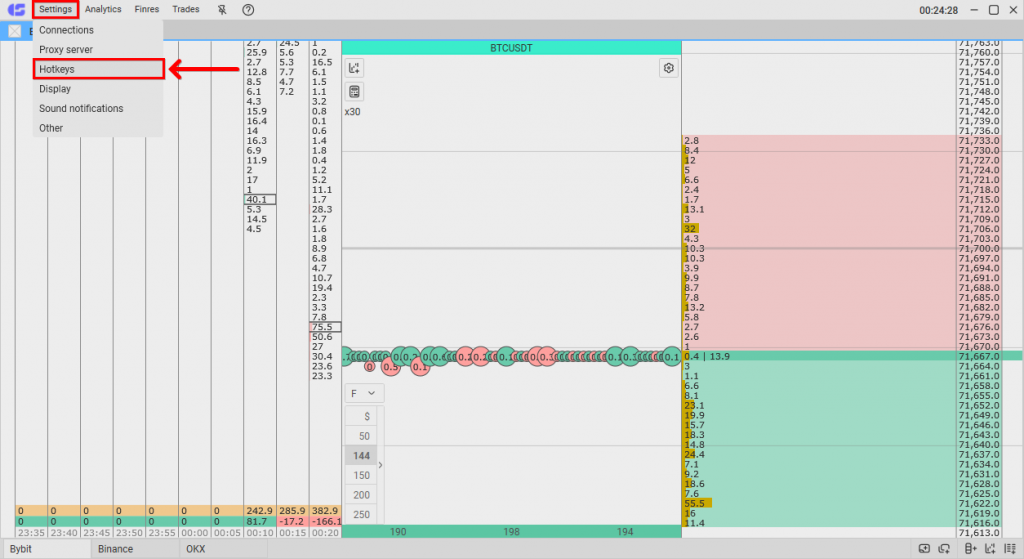

CScalp users can set which hotkey will activate the stop order mode. By default, it is “V“. To change the key, open the “Settings” menu at the top and go to the “Hotkeys” section.

Find the “Mode: place stop-order” parameter. Click on the letter indicated as the hotkey.

In the field that appears, enter the new key. Close the settings. The hotkey should now be updated. Note that only a “free” key can be assigned

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT