How to Configure the Order Book in the CScalp Terminal

Date of update: 14.08.2024

We have prepared a guide on configuring the order book in the CScalp trading terminal. In this article, we examine the main settings of the order book and provide universal values for some parameters to help you set it up and start trading.

Attention! This article is for informational purposes only and does not contain recommendations or calls to action.

The review has been prepared by the CScalp terminal team. You can get CScalp by leaving your e-mail in the form below.GET FOR FREE

By clicking the ‘Get for Free’ button, you agree to the ‘Privacy Policy‘

Order Book Settings in the “Trading” Tab

In the “Trading” tab, traders are primarily interested in settings related to order slipping, setting Stop-Loss and Take-Profit, average price calculation, and profit display. Let’s examine parameter settings suitable for most coins and order books.

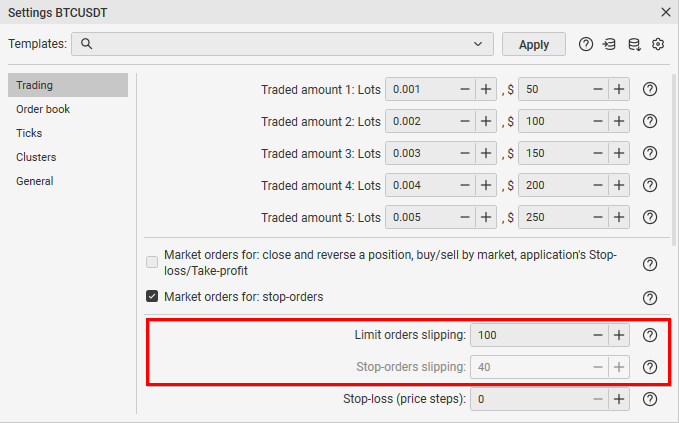

Orders Slipping

The orders slipping parameter determines how far from the spread (in price steps) a limit order without a specific price will be placed. In such cases, CScalp creates market orders from limit orders.

Attention! The orders slipping parameter is independent of the order book scaling.

Orders slipping is important for traders who trade level breakouts. Correct settings minimize slippage and avoid errors when entering breakouts or closing SL/TP.

Let’s consider a common mistake as an example. Suppose, in a highly volatile market, the price can jump 70 points. If the orders slipping from stop orders is set at 50 points, the limit order will be placed 50 points above the triggering price, and it will not open in the desired direction.

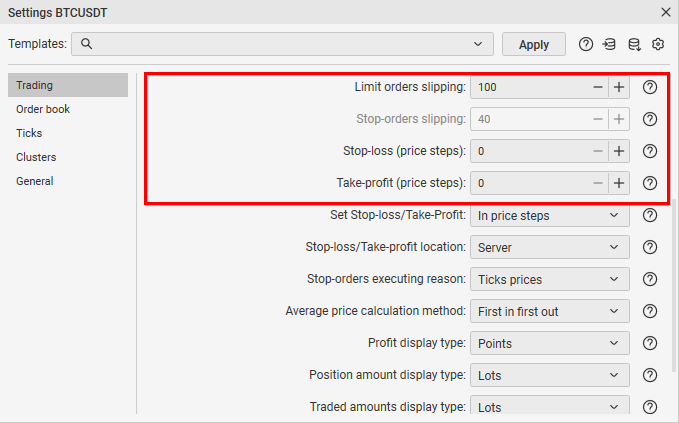

Setting Stop-Loss and Take-Profit

CScalp automatically sets SL/TP orders for an open position if the parameter value is greater than “0“. Stops are set at a specified parameter distance (in points/percent) from the position. If the parameter value is “0“, automatic SL/TP placement is disabled. This parameter is needed for traders collecting the spread and those who prefer to close positions all at once rather than in parts.

It’s important to configure the Stop-Loss/Take-Profit location on the “Server” or in the “Application“:

- With the “Application” parameter, the terminal will “remember” SL/TP and place them on the exchange when the order condition is met. The downside is that if the connection with the exchange is lost, the order will not be executed.

- With the “Server” parameter, the terminal immediately sends SL/TP to the exchange server. The order is executed independently of the terminal.

Attention! Stop-Loss/Take-Profit location on the “Server” is available only for Binance and Bybit exchanges.

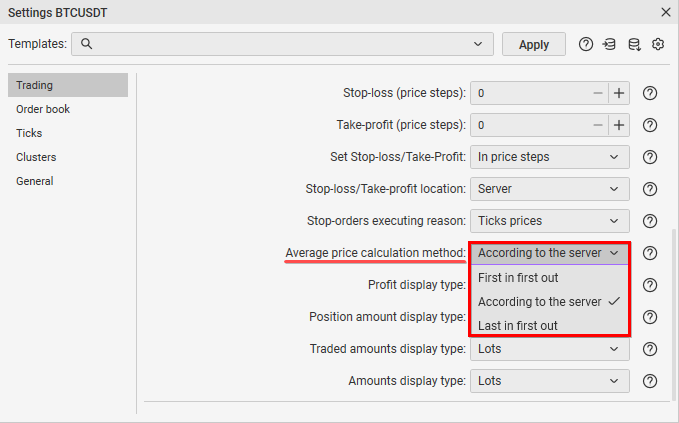

Average Price Calculation

When making multiple trades on a trading instrument, a trader may encounter a situation where the entry point displayed in the terminal differs from the entry point on the exchange.

We recommend using the “According to the Server” parameter – D. The “F” parameter assumes that trades are closed in the order they were opened. “L” assumes that the last opened trade is closed first.

Profit Display

In cryptocurrency trading, profit display in percentages is often used. This is convenient for calculating PnL and proper risk management.

Order Book Settings in the “Order Book” Tab

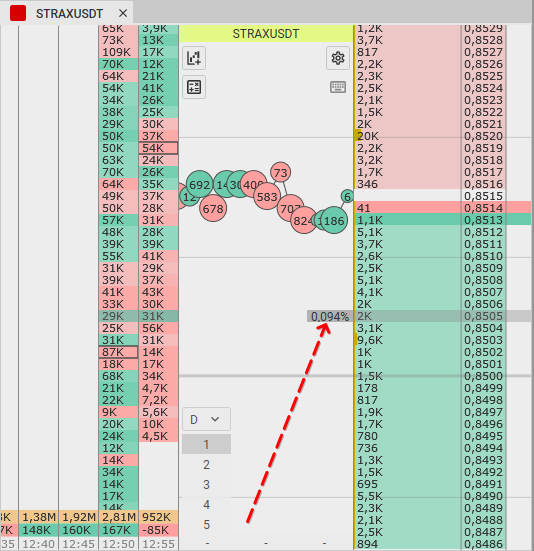

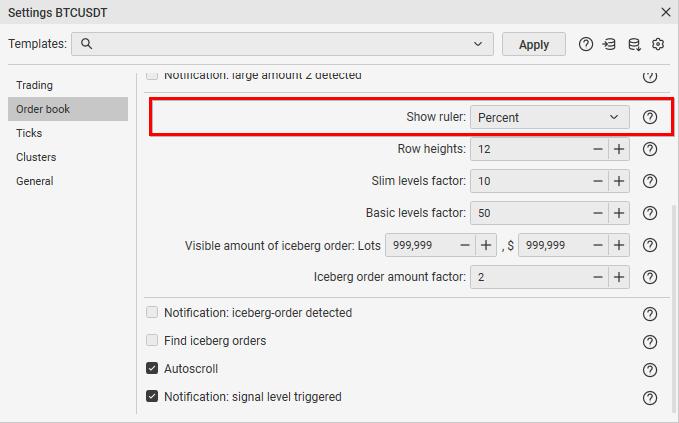

Show Ruler

When you hover the cursor over a price in the order book, a ruler appears, showing the percentage change from the nearest best price.

The display can be set in percentages or points. For crypto exchanges, percentage calculation is traditionally used, so we also set the ruler in percentages. Traders need the ruler to understand at what distance to place limit orders or stops to close positions.

Settings in the “Ticks” Tab

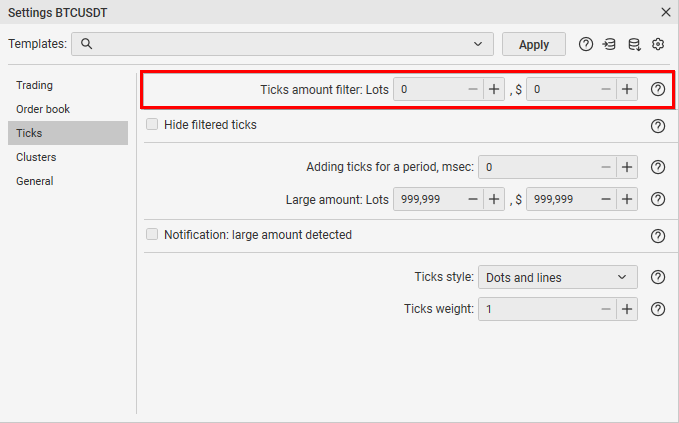

Ticks Amount

The Ticks Amount parameter regulates the information displayed in the trade tape. It is similar to a filter for the volume of trades shown. In most cases, the value is set to “0” – making it more likely to see small purchases/sales typical of bots in the trade tape.

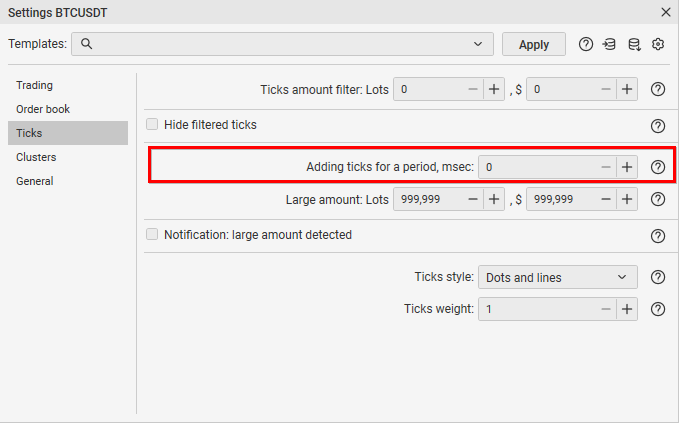

Adding Ticks for a Period

The “Adding Ticks for a Period” parameter sums up ticks passing through the trades tape for a specified period in milliseconds. We recommend setting the parameter to “0” as it will be easier to spot a bot in the trades tape.

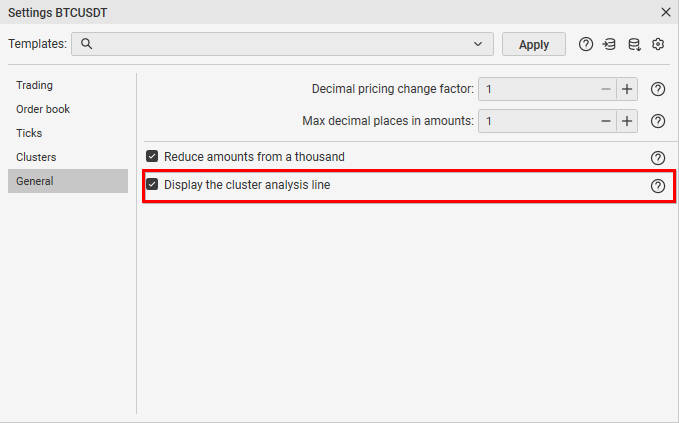

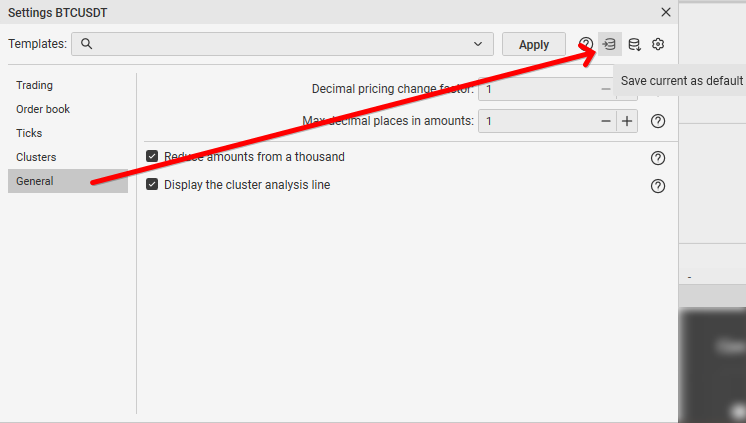

How to Set the Order Book in the “General” Tab

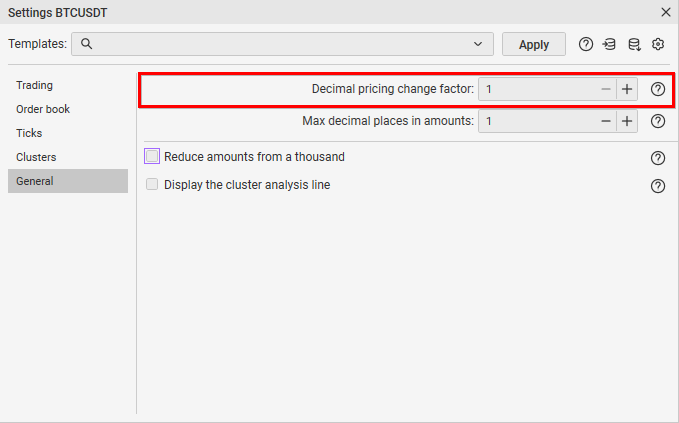

Decimal Pricing Change Factor

The “Decimal Pricing Change Factor” parameter affects the order book scaling step. For larger steps (buttons “+” and “—” above the order book), the value is multiplied by ten. You can also use the “H” hotkey and scroll the mouse wheel over the order book to scale.

We recommend setting this parameter to “1” – this will allow for more precise scaling settings for comfortable work with the order book.

For more details on scaling, read our article: “How to Scale the Order Book in CScalp.”

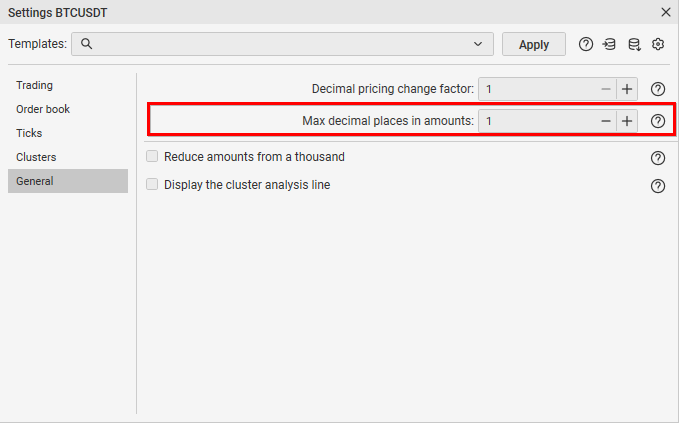

Max Decimal Places in Amounts

This parameter allows you to adjust the number of decimal places in amounts. The default value is “4”, with a minimum of “0” and a maximum of “8“. For comfortable trading, “0” is often set – visually reducing the order book width.

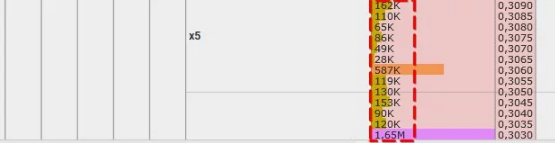

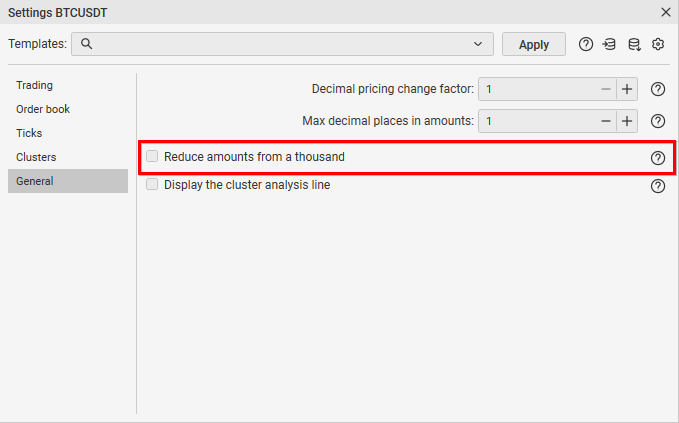

Reduce Amounts from a Thousand

The “Reduce Amounts from a Thousand” parameter removes zeros from volume values. This way, we can visually shorten large numbers when displaying volumes. 1,000 = 1K. 1,000,000 = 1M.

We recommend enabling this parameter by default for all coins.

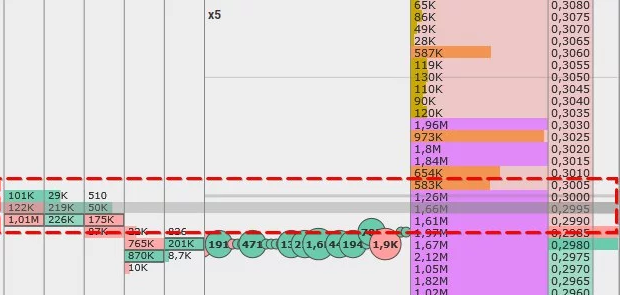

Display the Cluster Analysis Line

The “Display the Cluster Analysis Line” parameter is responsible for displaying a line from the order book to the cluster.

Traders can make mistakes due to fatigue and distraction. This parameter helps correctly understand at what price in the clusters the desired volume is located. We recommend enabling the cluster analysis line by default for all coins.

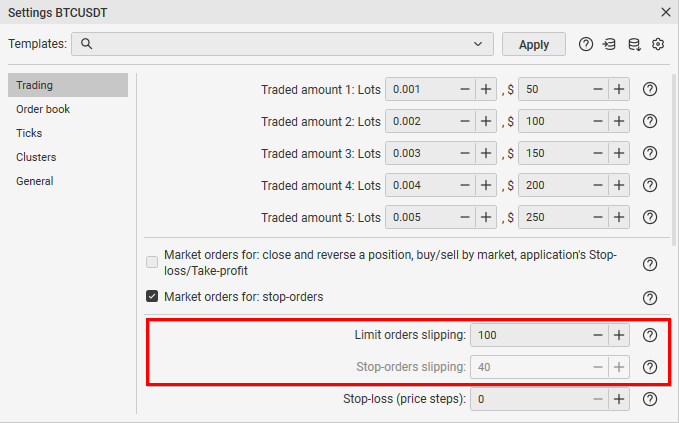

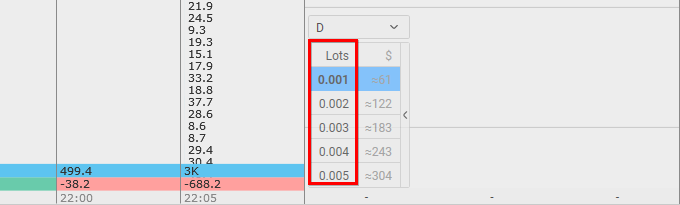

How to Input the Traded Amount in $ (USD)

CScalp has implemented the ability to use the traded amounts in $ (USD). Switch between lots and $ by clicking the left mouse button in the traded amounts settings window. Here you can also view the traded amount in lots and $.

Trading in $ is independent of the instrument’s current price. The number of lots placed depends on the price at which we place the order and is equivalent to the amount in $.

Attention! This feature is available only for Binance and Bybit exchanges.

If you enter traded amounts in dollars and save these parameters as default, they will be applied when adding a new order book. This is convenient for traders trading the same amount in $ – no need to spend time recalculating traded amounts in lots.

Attention! Currently, it is recommended to use traded amounts in dollars when opening positions. Closing is better done in lots to avoid misunderstandings with position leftovers. You can also close position leftovers with “Alt.”

Attention! Traded amounts in the order book settings will not change, and a new order book will open with trading in $.

Creating a Default Template

To save all settings as a template for new order books, click “Save Current as Default” in the order book settings.

CScalp Order Book Configuration – Conclusion

We have covered the main settings of the CScalp order book, which can be used as a basic template for working with most trading instruments. However, there is no universal formula in trading. Order books will need to be “tweaked” for each trader. The final settings depend on your characteristics, market phase, coin volatility, and other parameters.

Join the CScalp Trading Community

Join our official trader's chat. Here you can communicate with other scalpers, find trading soulmates and discuss the market. We also have an exclusive chat for crypto traders!

Don't forget to subscribe to our official CScalp news channel, use trading signals and get to know our bot.

If you have any questions, just contact our platform's support via Telegram at @CScalp_support_bot. We will respond in a matter of seconds.

You can also visit our Discord channel and subscribe to the CScalp TV YouTube channel.

JOIN OUR CHAT